- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Incorrect State on 1099-R, then was sent corrected form with zero amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State on 1099-R, then was sent corrected form with zero amount

I took out money from a retirement account in October 2023, and the retirement company initially sent me a 1099-R form with the incorrect state. I had lived in Michigan until April, but moved to Colorado since then and was in Colorado when I took the money out.

I asked them to correct the form to indicate Colorado instead of Michigan, and at first all they changed on the initial 1099-R form was Box 15 (State/Payer’s State No), from MI to CO, without changing anything else.

I called the retirement company about this, since when they send the 1099-R form to us, they also send the money from Box 14 to the state (in my case, the money was sent to Michigan, NOT Colorado), and the edited form would be incorrect and if I submitted the form info as it was, Colorado would wonder where their money is. (I think)

Then the retirement company created a new, CORRECTED 1099-R form, but the only thing on it is that the “CORRECTED” box is checked, and only Box 1, 7, and 15 are filled out.

Box 1 is showing the Gross Distribution as ZERO ($0.00)

Box 15 is showing MICHIGAN.

First question is - is what the retirement company did on this “corrected” form, CORRECT?

Additionally, I saw a post with someone who received a corrected 1099-MISC (which I know is different from a 1099-R), where the gross amount was also zero, and the answer/solution given was to just upload the info on the CORRECTED form.

Would this be the same with the “corrected” 1099-R that I received? Even if it only has 3 boxes filled out?

I tried to enter in the info JUST for the CORRECTED 1099-R form, with 3 boxes filled, and the system didn’t seem to understand what was going on, and the amount that I owe that shows up on top of the screen didn’t change.

Usually we pay the amount we owe (Federal and State) when we file the tax return. So, if just entering the CORRECTED form doesn’t change the numbers at the top to what I really owe, I’m also concerned that if I DON’T enter in the information for the FIRST form that has Box 1, 2a, 4 etc filled out, along with the CORRECTED form, I’d owe more money to Federal/State much later in the year and I’d rather just pay it when I file the tax return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State on 1099-R, then was sent corrected form with zero amount

The IRS instructions for Information returns , including 1099 forms, state that you should prepare a new information return. That may be up to interpretation, but one would assume it would be best to complete all boxes as opposed to just the ones that changed.

The best thing to do would be to prepare a substitute Form 1099-R and enter everything the way it should have been reported, with the distribution in box 1, taxable amount in box 2(a), code in box 7, Michigan in box 15 and the Michigan tax withheld in box 14, any other information that should be on the form as follows:

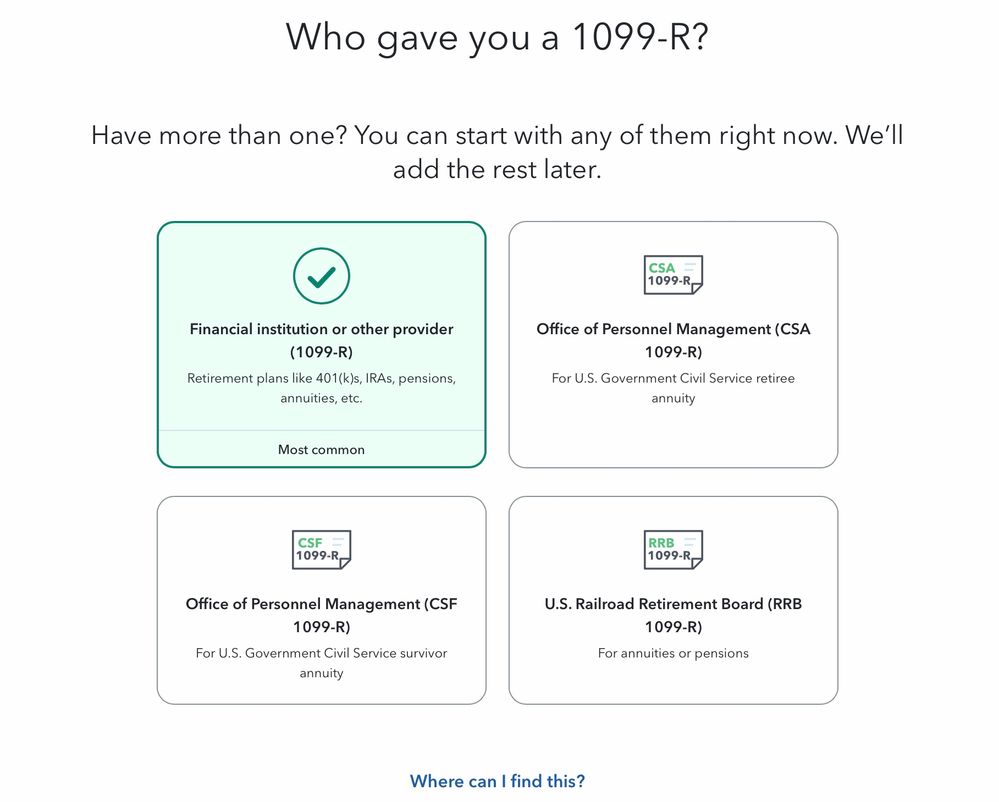

- Go to the personal income section of TurboTax

- Find the Retirement Plans and Social Security menu option

- Start or Update IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Choose Add Another 1099-R

- Choose I'll type it in myself

- On the screen that says Tell Us Which 1099-R You Have choose I need to prepare a Substitute 1099-R

You will complete a Form 1099-R entry using all of the correct information from your Form 1099-R. You will be given the option to complete Form 4852, on which you can explain why you are issuing the substitute Form 1099-R.

On your Colorado return, the pension income should be picked up from the box 1 entry on the 1099-R form, but you will have to verify that before you file the Colorado return. The pension income should be reported on the Colorado return since that is the state you lived in when you received it.

For Michigan, you need to back out the pension income as it isn't taxable there, but you need the box 15 and 14 populated for Michigan to get credit for the taxes paid in. Look for an option when you work through the Michigan return to indicate that the pension income isn't taxable there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State on 1099-R, then was sent corrected form with zero amount

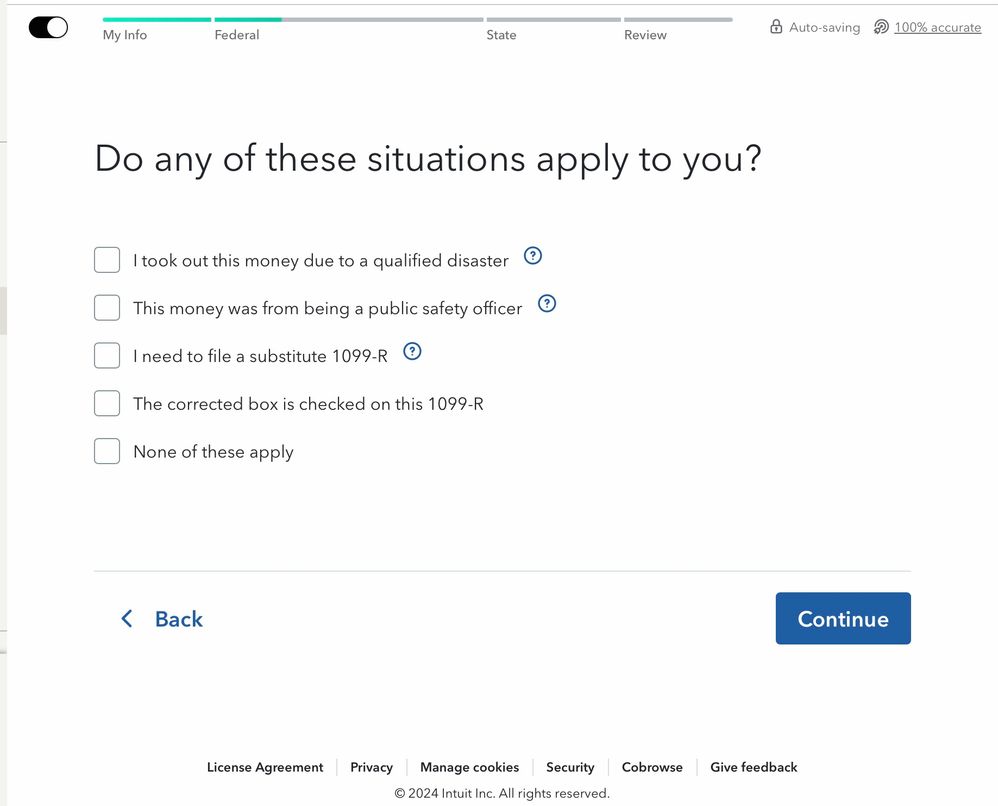

I don’t see the option for number 6 in your message (“On the screen that says Tell Us Which 1099-R You Have choose I need to prepare a Substitute 1099-R”)

this is what I have on my screen until I get to number 5:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State on 1099-R, then was sent corrected form with zero amount

Okay I found the screen to select a substitute 099-R, it was after I entered in the information for the original 1099-R (that doesn’t have the corrected box checked). I’m still trying to process everything you mentioned in your post and may have follow up questions afterwards.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State on 1099-R, then was sent corrected form with zero amount

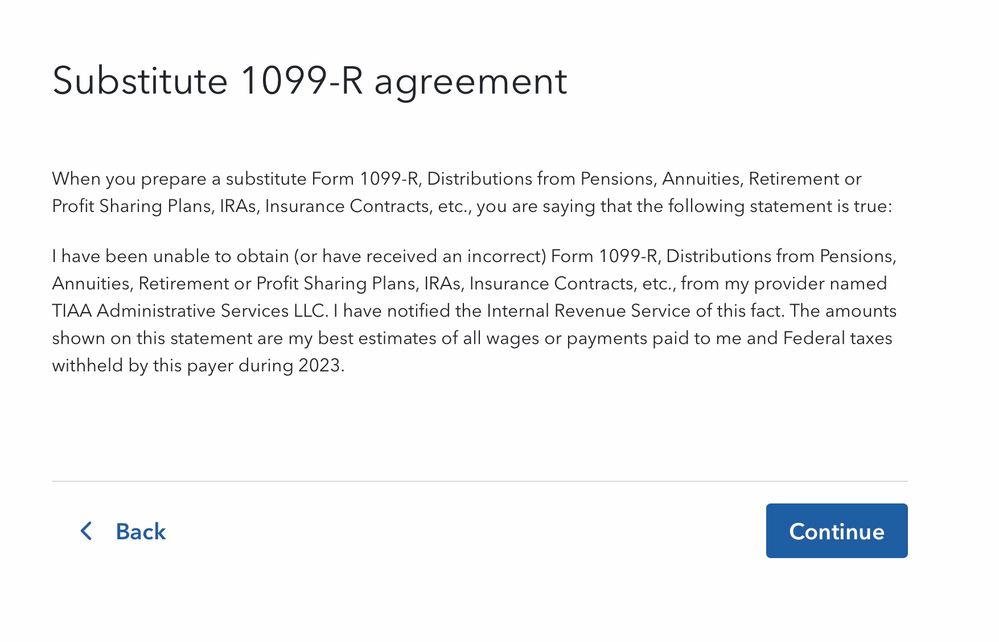

I tried to select the checkbox for Substitute 1099-R, but the following screen showed me this:

I don’t agree to this as the retirement company DID provide a corrected 1099-R form, even though it only has 3 boxes filled out. How can I proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State on 1099-R, then was sent corrected form with zero amount

Not sure what the payor was trying to do with the corrected 1099 - but they probably shouldn't have done anything.

As for your filing, you need to allocate your income based upon where you lived when your received the income. (I assume that you don't have any non-resident income from Michigan, e.g. a rental property). And then you just have to claim the state withholding on the Michigan return. Yes, that will likely mean that you get a refund from Michigan and have a balance due to Colorado.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17669592079

Level 1

paulalbertson

New Member

moumourocks

Returning Member

JerryChicago

Level 2

welschboyd

New Member