- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Income from another state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from another state

I live in PA but worked in Mass. and TX. The W-2s from MA and TX are entered in the Federal Section. The PA state return only shows the income from the MA W2. Entering the TX income on the PA gross income form results in an error. PA should be taxing all income, so why isn't the TX W2 transferred to the PA forms?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from another state

You would enter all of your Forms W-2 in the federal section of TurboTax. When you get to the state filings, you should enter your nonresident state returns first because your resident state might give you a credit for any taxes paid in that situation.

All of your income should flow to your state tax return(s).

Also, once you've determined that you need to file a nonresident state return, the first thing you want to do is make sure you've filled out the Personal Info section correctly:

- With your return open, select My Info in the left-hand menu.

- Then, on the "Personal info summary screen", scroll down to "Other State Income", and select "Edit".

- On the screen "Did you make money in any other states?" question, answer "Yes" and make sure your nonresident state(s) are selected from the drop-down.

- Select "Continue" to return to your "Personal info summary".

Click here for information regarding filing multiple state returns.

Click here for additional information on filing when multiple states are involved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from another state

Linda,

Thank you for the reply but that does not solve the problem.

All the W2s are entered into the Federal Section - they were imported

The W2s from MA show up in the PA return. The TX W2 does not and you cannot select TX as a state for nonresident income. TX along with AK, NV, SD, TN and WY are not in that list.

I've completed the MA return and I do get the credit for the MA taxes on the PA return. There were no state taxes taken out for TX since they do not have a state income tax. That income should still flow to the PA return but it does not. The MA return shows the federal AGI that includes the TX income but the PA return only has the income totals for MA.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from another state

First, I would try deleting them (your W-2's) and re-enter them manually.

To delete your Forms W-2 you can:

- Sign into your return

- Click on" Pick up where you left off"

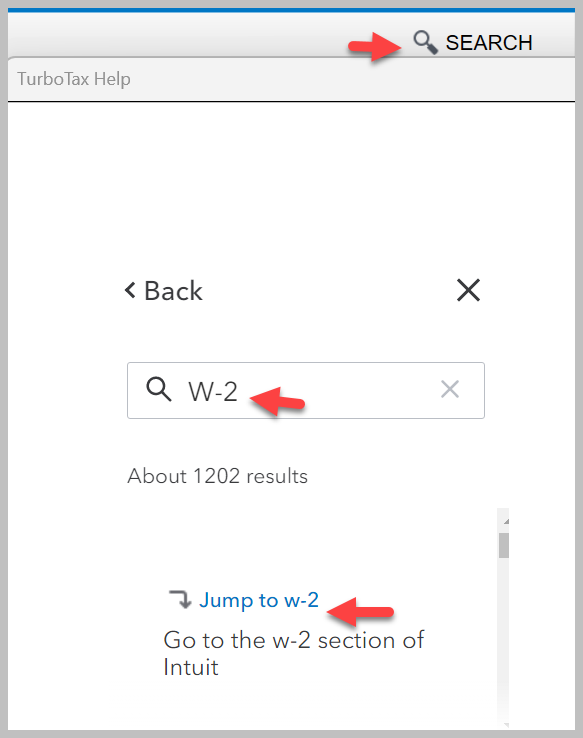

- Click "Search" at the top right of your screen

- In the search box, type "W-2"

- Click on "Jump to W-2" (See screenshots below for additional guidance)

- Click on the garbage can icon next to your Form W-2 you want to delete.

To manually enter your Form W-2 you can:

- Open or continue your return

- Click "Search" at the top right of your screen

- In the search box, type "W-2"

- Click on "Jump to W-2" (See screenshots below for additional guidance)

- Your screen will say "We'll start with your W-2", click the box "Work on my W-2" want to file

- Your screen will say "Let's Start With a Bit of Info From Your W-2" , enter your Employer ID from Box b of your W-2"

- Click on "Continue"

- You can select "Type it myself"

- The next screens will prompt you for the information you see on your W-2.

- Answer all follow-up screens

You would enter all of your Forms W-2 in the federal section of TurboTax. When you get to the state filings, you should enter your nonresident state return (MA) first because your resident state might give you a credit for any taxes paid in that state..

I don't know if you entered your nonresident tax return first but you should complete your nonresident returns first. You may want to try to delete your state tax returns and re-enter again.

The only other thing I can suggest is to try contacting TurboTax Customer Service. They may be able to share your screen to see what is happening. Turbo Tax Customer Service

To search for your Forms W-2:

Click here for information regarding filing multiple state returns.

Click here for additional information on filing when multiple states are involved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

colehabbels

New Member

reneesmith1969

New Member

ajm2281

Returning Member

waynelandry1

Returning Member

Lukas1994

Level 2