- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- If I have credit card debt that was consolidated, and I received a 1099-C, do I have to report it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have credit card debt that was consolidated, and I received a 1099-C, do I have to report it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have credit card debt that was consolidated, and I received a 1099-C, do I have to report it?

Taxpayers receive a 1099-C form when a debt collector has excused at least $600 of debt. The taxpayer must report the amount of debt forgiven when reporting annual federal taxes on the 1040 form for individuals. Line 21 has the space for other income, and the filer should include the amount of debt forgiven on that line. Debt forgiveness should be reported even if it was below the $600 minimum that triggers a 1099-C form. Exceptions exist in cases of bankruptcy and insolvency. The Internal Revenue Service details the exceptions in Publication 4681.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have credit card debt that was consolidated, and I received a 1099-C, do I have to report it?

Yes, the cancelled debt is income to you.

Let me help you navigate the 1099C

1. Log into your return

2. select Pick Up Where I Left Off

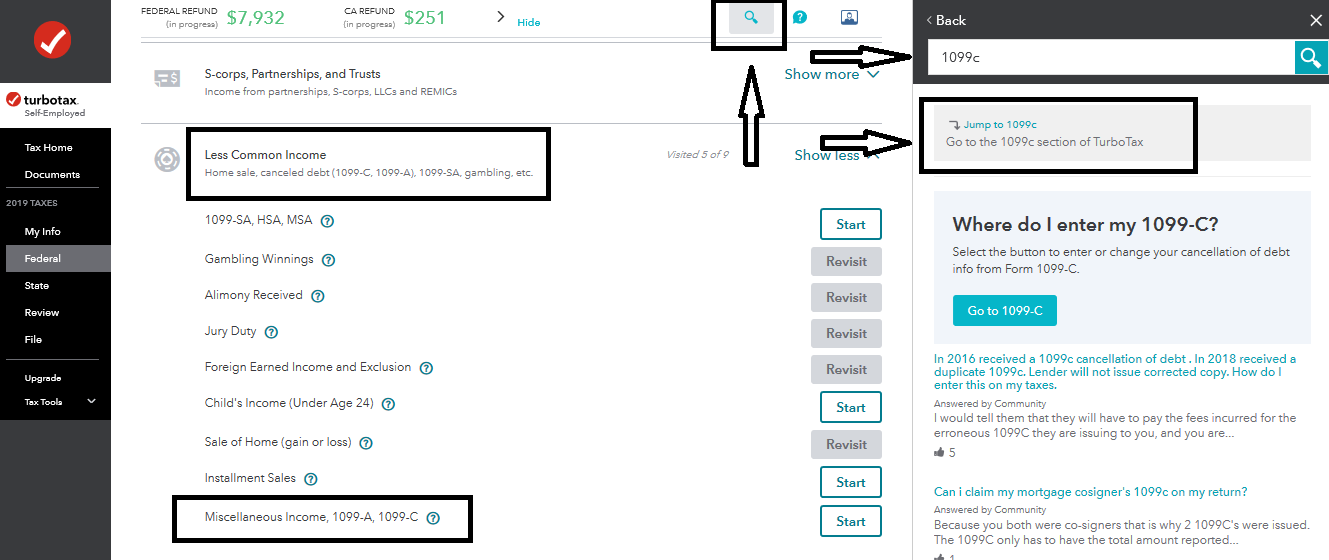

3. In the top right corner, locate the Magnifying glass/search

4. enter the exact words f1099c

5. Enter

6. Select the first entry Jump to 1099c

7. Enter your information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17552925565

Level 1

Aowens6972

New Member

Propeller2127

Returning Member

user17548719818

Level 2

Newby1116

Returning Member