- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I received a 1099 misc for prize winning. I have losses at that casino that exceed the value of the prize. It is not letting me write off the loss. CAN I DEDUCT THIS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099 misc for prize winning. I have losses at that casino that exceed the value of the prize. It is not letting me write off the loss. CAN I DEDUCT THIS?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099 misc for prize winning. I have losses at that casino that exceed the value of the prize. It is not letting me write off the loss. CAN I DEDUCT THIS?

Under current tax law, you can only deduct gambling losses to the extent of winnings reported, and only if you itemize your deductions, unless you are in business as a professional gambler.

If your total itemizable deductions including the gambling losses (limited to winnings) don't total more than your standard deduction, you can't claim any additional amount for the losses and you would be limited to the standard deduction.

This article provides more helpful details on this topic.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099 misc for prize winning. I have losses at that casino that exceed the value of the prize. It is not letting me write off the loss. CAN I DEDUCT THIS?

You didn't really answer the question. Turbo Tax is treating the prize from the 1099 misc separately from gambling. For example, If I have a 1099 Misc for a prize of $1000 and I have W2-G's totaling 10,000. Shouldn't I be able to deduct $11,000 for losses if I have that and more and I am itemizing deductions? TurboTax only allows me to deduct the $10,000 and not the $11,000 that includes the prize of $1,000. Is there a place that I can deduct the prize winning of $1,000 from the 1099 Misc if I have gambling losses much greater? In my state taxes, it allows me to deduct both.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099 misc for prize winning. I have losses at that casino that exceed the value of the prize. It is not letting me write off the loss. CAN I DEDUCT THIS?

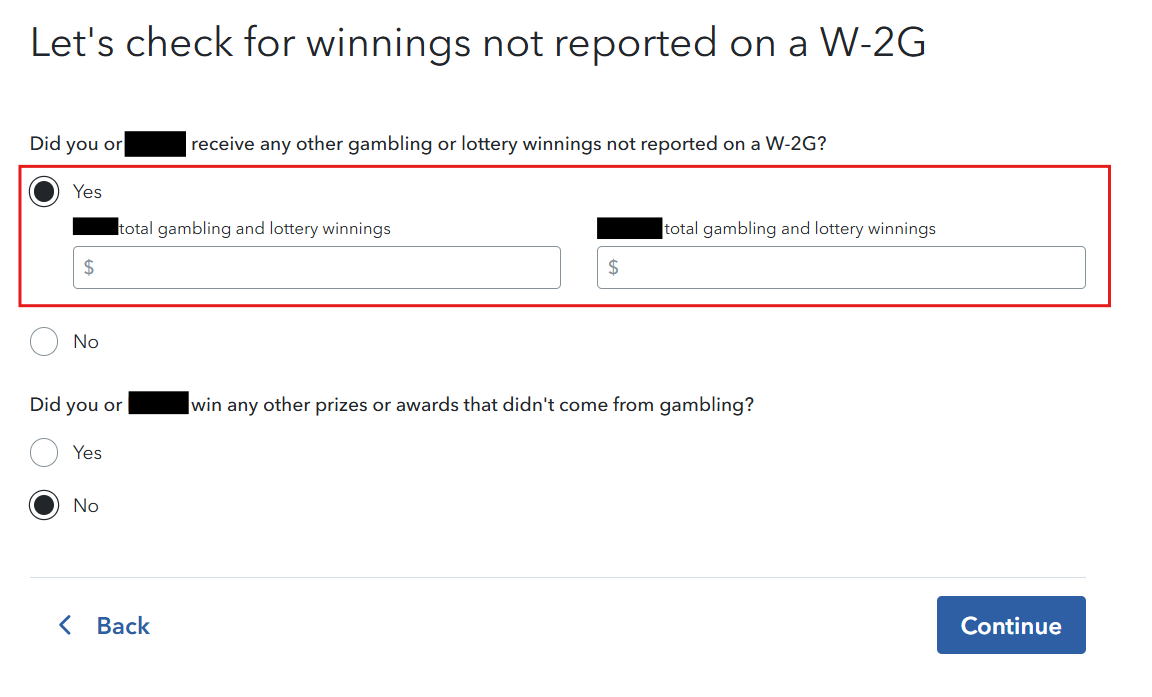

Instead of entering the 1099-MISC on your return, report your gambling winnings directly in the Gambling Winnings section of TurboTax.

On the Wages and Income section of your return, scroll down to Less common income. Click Start or Revisit next to Gambling winnings.

On the next screen, choose Yes.

Choose that you did not receive a W-2G.

When asked if you received gambling or lottery winnings not reported on a W-2G, select Yes and enter the amount of winnings that you received. This will categorize your income as gambling winnings that can be offset with your gambling losses.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

daking214

New Member

jweis1987

New Member

jason805sm

New Member

in Education

manspark7281

New Member

terie1len

New Member