- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Instead of entering the 1099-MISC on your return, report your gambling winnings directly in the Gambling Winnings section of TurboTax.

On the Wages and Income section of your return, scroll down to Less common income. Click Start or Revisit next to Gambling winnings.

On the next screen, choose Yes.

Choose that you did not receive a W-2G.

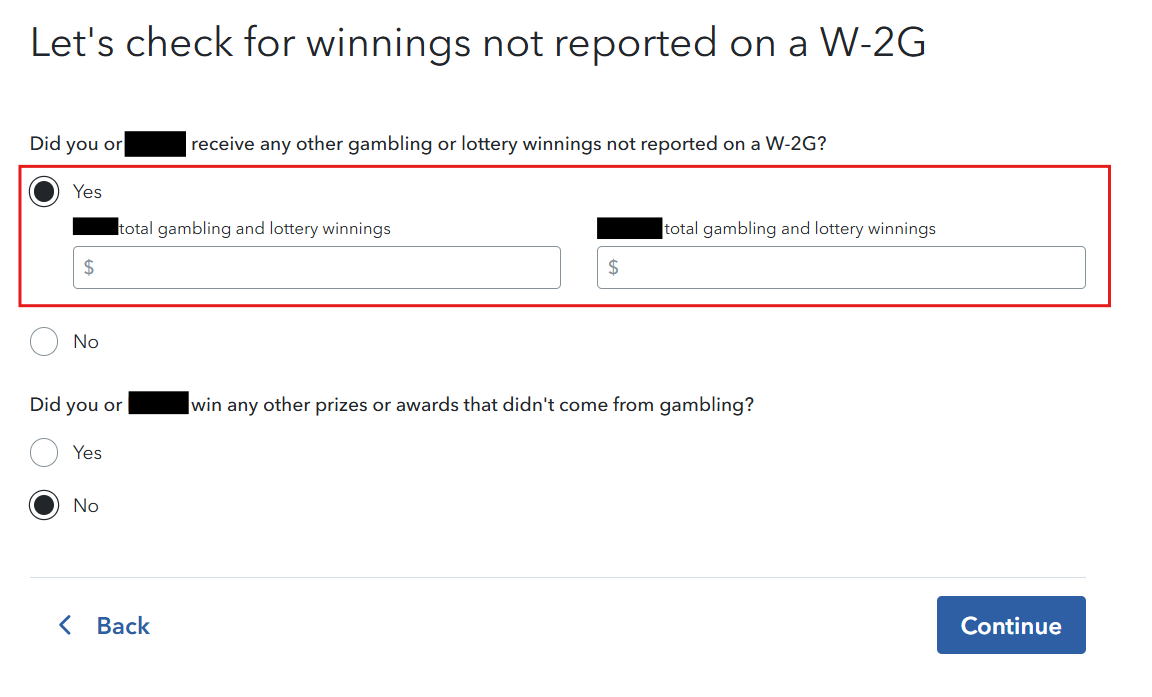

When asked if you received gambling or lottery winnings not reported on a W-2G, select Yes and enter the amount of winnings that you received. This will categorize your income as gambling winnings that can be offset with your gambling losses.

March 15, 2025

2:24 PM