- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I qualify for the $2000 child tax credit so $4000 total But my refund amount still only showing $900 is this correct? Or should it show $4900? Thanks for input.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I qualify for the $2000 child tax credit so $4000 total But my refund amount still only showing $900 is this correct? Or should it show $4900? Thanks for input.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I qualify for the $2000 child tax credit so $4000 total But my refund amount still only showing $900 is this correct? Or should it show $4900? Thanks for input.

We cannot see your tax return. But the child tax credit is used first to apply toward any tax liability that you have. So look on lines 19 and line 28 to see what is there for the child tax credit and the refundable portion which is called the Additional Child Tax Credit.

Look at your 2020 Form 1040 to see the child-related credits you received

PREVIEW 1040

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Child Tax Credit line 19

Credit for Other Dependents line 19

Earned Income Credit line 27

Additional Child Tax Credit line 28

Child and Dependent Care Credit line 31 (from line 13 of Schedule 3)

https://ttlc.intuit.com/questions/1900923-what-is-the-child-tax-credit

https://ttlc.intuit.com/questions/1900643-what-is-the-child-and-dependent-care-credit

https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/use-the-eitc-assistant

Your tax refund will be on line 35a.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I qualify for the $2000 child tax credit so $4000 total But my refund amount still only showing $900 is this correct? Or should it show $4900? Thanks for input.

I have not filed yet. Im referring to turbo saying i have a $900 refund. But i do qualify for $4000 child tax credit. But is turbo supposed to show this amount in my total refund or no? Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I qualify for the $2000 child tax credit so $4000 total But my refund amount still only showing $900 is this correct? Or should it show $4900? Thanks for input.

No. The entire amount of the child tax credit is not automatically part of your refund. Look at the lines on your Form 1040 that show the credit and then "follow the math" on the lines after the additional child tax credit. Your tax refund is on line 35a.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I qualify for the $2000 child tax credit so $4000 total But my refund amount still only showing $900 is this correct? Or should it show $4900? Thanks for input.

Ok I remember it being different in the past is why, thank you for your input.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I qualify for the $2000 child tax credit so $4000 total But my refund amount still only showing $900 is this correct? Or should it show $4900? Thanks for input.

Only the additional child tax credit is refundable----and you do not necessarily get it all as a refund. A tax credit is used first to lower the amount of tax you owe. If you had a tax liability -- tax you owed -- the credit is used first toward what you owed. The amount of the refundable credit that is left over after your liability has been met is refunded to you. No one "gets" the full $2000 per child as a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I qualify for the $2000 child tax credit so $4000 total But my refund amount still only showing $900 is this correct? Or should it show $4900? Thanks for input.

@rebe292599 wrote:

I have not filed yet. Im referring to turbo saying i have a $900 refund. But i do qualify for $4000 child tax credit. But is turbo supposed to show this amount in my total refund or no? Thank you

The "refund meter" is net, after all taxes and credits have been applied.

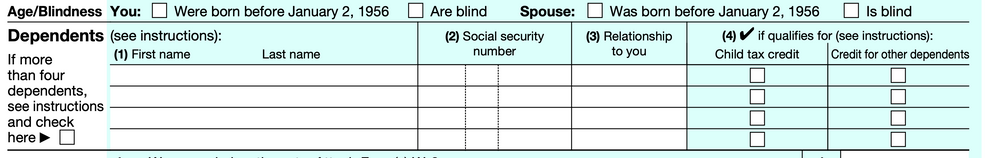

There are some reasons you might not be getting the full $4000 of child tax credit. For example, if your income from working is on the low side. Or, if you indicated the children lived with you less than half the year, or they are age 17 or older. Or, you did not provide a valid social security number. Before you e-file your final return, print a copy and look at the list of dependents on the front page, and see if the "Child tax credit" box is checked, or the "other dependent" box. If "other dependent" is checked, then your children don't qualify based on your situation, you may need to provide more details and we can help you figure it out.

Even if you qualify for the child tax credit, the amount is not guaranteed to be $2000 per child, it depends on your other income, other taxes owed, and how much of your income is from working (instead of prizes, investments or unemployment compensation).

Lastly, it might be that you are getting the full $4000 but you did not have enough other taxes withheld during the year from your wages. One way to get a $4900 refund would have been to get $75 less per week in your take-home pay. Whether you want more money each week or a large lump-sum refund is a matter of preference.

We can't know for sure because we can't see your tax return. Start by printing a copy (without e-filing) and look at the list of dependents and line 19.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jrmarmion

New Member

TheSchulteMeistr

Returning Member

tabmore

New Member

naejay32

New Member

Hope-Smith

New Member