- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

I am currently needing an answer to this as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

Column 1 - state abbreviation

Column 2- gross earnings in state in column 1

Column 3 -column 2 divided by federal agi from federal 1040

Column 4-Federal Income Tax x ratio in Column 3

Column 5 - Column 2- column 4=column 5

Column 6 - Column 5 divided by Line 10 of your Louisiana Income Tax return (Louisiana Tax Table Income)

Column 7 - Column 6 x Income Tax on Louisiana return line 11

Column 8 - tax paid to other state (be sure to deduct any refund)

Column 9 - Lesser of column 7 or column 8

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

Would someone please verify which figure from the Mississippi tax return goes in column 2 of the Louisiana R-10606. Is it line 16, Mississippi Adjusted Gross Income? Or is it line 19, Mississippi Taxable Income?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

If you call Turbo Tax one of their experts will answer your question and walk you through exactly how to fill out the form. They did so for me and I filed the form and have not had a response either way from Louisiana.

Good Luck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

2021 is the first time I used TurboTax. I had always used HR Block. In 2020, Form R-10606 for Louisiana was filled in by HR Block's software. I assumed the same is for TurboTax. Not. I just received a request from LA to fill this form in. This form is not intuitive, and I am beyond angry that TurboTax files a Schedule C which uses data from R-10606 but does NOT include the REQUIRED R-10606. I have to call TurboTax because the instructions make no sense to do this manually. I found one worksheet in TurboTax called 'Smart Worksheets from your 2021 Louisiana Tax Form' which appears to contain the information. The problem I have is Columns 8 and 9. I am pretty sure that these two columns in R-10606 come from the 'Smart Worksheet,' which does NOT match the R-10606 instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

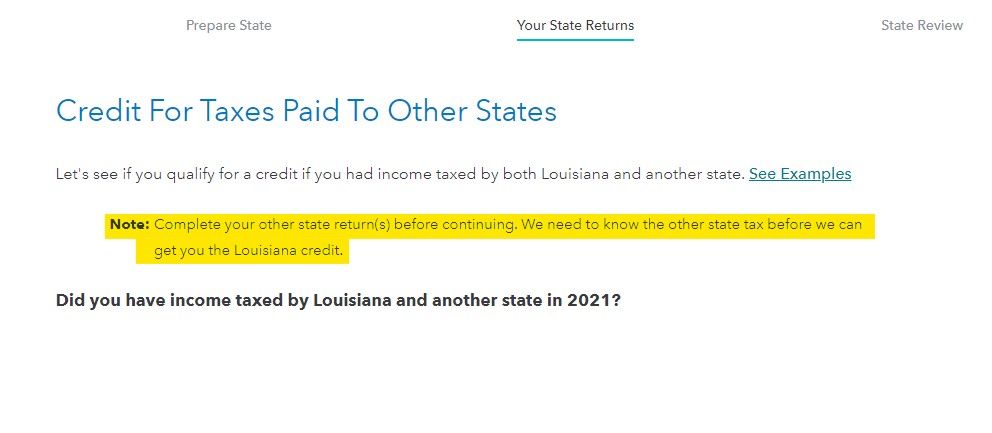

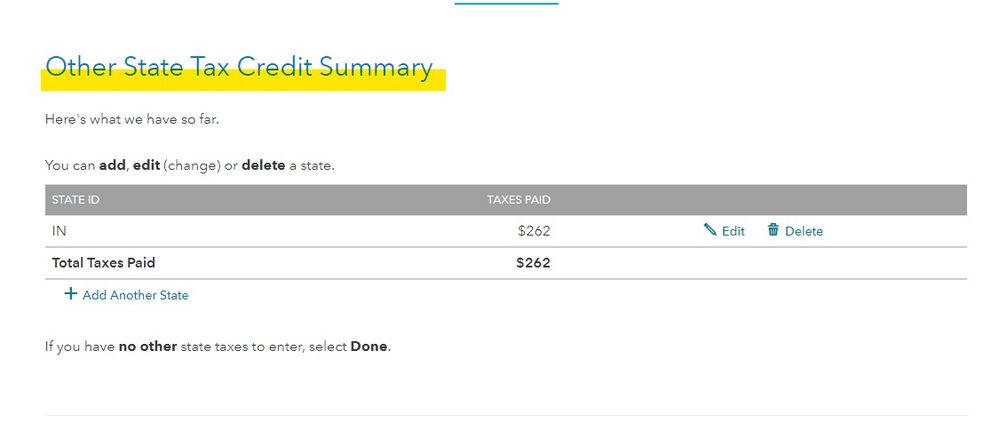

If LA was your resident state then you need to complete all the non resident states before you complete the LA interview ... if you do so the taxes paid should automatically carry properly or you will have the chance to enter the yourself ...

I did a test return ... indicated in the MY INFO that I was an LA resident but earned income in IN so when I got to the state section the IN and the LA returns were waiting for me listed in the order they are to be completed ... so I completed them in the correct order and the program completed the other state credit automatically so if you did not get either of these screens then you did not complete the interview correctly in the order the items are presented :

To get this form filled in correctly I suggest you use the amendment option to get back into the program and review the LA interview again to see if you get either of the screens posted above then you can print the form you need to mail in the PRINT CENTER in the TOOLS section of the menu bar on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

All my taxes were submitted in March 2022. I am only now (July 2022) receiving the request from LA's Dept of Revenue for Form R-10606. I figured out several pieces of information this morning while looking at my LA return + MD return + NJ return. TurboTax's Smart Worksheet calculates the values to input Column 9 in R-10606. Column 8 is easy because this is the tax that I am liable for MD and NJ. Column 9 is calculated by multiplying the ratio (or "%" if one is using Excel) of income earned in Other State with LA Tax Line 11 in form IT-540. However, I have the same issue as the person (the Mississippi question above) who asked about Column 2. It is not clear from the R-10606 instructions which value should be the input. There are THREE possibilities: MD/NJ's Wages and Salary OR Gross Income OR Adjusted Gross Income (based on exemptions for MD or NJ). The LA R-10606 instructions say: "Enter the income taxable to the other state that is taxable to Louisiana." Looking at my R-10606 that HR Block's software filled out in 2020, the software entered the amount for Wages and Salaries, which to me, is incorrect. If I were to take a guess, shouldn't the amount be the Gross Income? I'm calling TurboTax tomorrow (Monday) when they open.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

I am still quite angry that I spent the weekend doing something that the TurboTax software should have completed for me. This is a serious bug that TurboTax should fix. The form is required for the State of LA. It's not a new thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

Since yours is the only post on the subject I have seen in 10 years on this forum I think this may be just your issue ... if it was a systemic issue there would have been hundreds of posts. I was able to do a test return and had no issues as evidenced by the screen shots posted.

Glitches like these are fixed quickly and if you had already filed TT sends out email alerts to those affected with instructions on how to correct the issue ... the company is quite on top of things like these.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

I completed MD and NJ first. I submitted them. Then I completed LA, and I did a test run like you did. Then I submitted it. I keep my TT software updated. Thus, as far as I know, I completed my state taxes the same way you did, but I do not have a final Form R-10606 at any point. I ran the software update again yesterday. I ran the software again. Same result: No Form R-10606.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

I do not have a Louisiana Form R-10606 either, and this is for another year later for TurboTax. I did not notice last year that TT did not generate, and had to manually create one months later when contacted by LA. This year I searched before filing and no form in TT. I guess I'll go to the LA DOR website and muddle through. Really disappointed that TT does not generate this form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

TurboTax does not support Louisiana Form R-10606.

Please check the link below for instructions on how to file form R-10606:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help with my Louisiana Return. I am having to file a Form R-10606 with Louisiana. I need help with that.

I had always used HR Block software for my Louisiana taxes. In 2021, I purchased Turbo Tax for the first time, and assumed that Form R-10606 was filled out for me. HR Block's software included R-10606. The state audited my return and I had to fill out Form R-10606 in July to comply. I forgot about this, and purchased TT again for 2022. I'll have to remember to use HR Block next year. Form R-10606 is not straightforward, and the instructions at the state is not intuitive. I do not understand why HR Block includes an algorithm to fill out a specific state form but Turbo Tax (more expensive software and touts itself as the best tax software) does not?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wilsonbrokl

New Member

annarichard05

New Member

cferna007afer

New Member

Solsti

New Member

Vijontillman

New Member