- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I'm looking for my previous tax returns and the chat tells me to go to the left menu and click "Documents". It turns out there is no left menu. tried in Safari and Chrome

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm looking for my previous tax returns and the chat tells me to go to the left menu and click "Documents". It turns out there is no left menu. tried in Safari and Chrome

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm looking for my previous tax returns and the chat tells me to go to the left menu and click "Documents". It turns out there is no left menu. tried in Safari and Chrome

You have to sign onto your 2019 online account using the exact same User ID you used to create the online account.

Close all TurboTax windows on your web browser (including this one). Copy and paste the account recovery website link onto a new web browser window and run the tool.

Use this TurboTax account recovery website to get a list of all the User ID's for an email address. Run the tool against any email addresses you may have used - https://myturbotax.intuit.com/account-recovery

If none of the user ID's received will access your 2019 account, then use the option shown in blue on the account recovery website, "Try something else"

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

To access your prior year tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

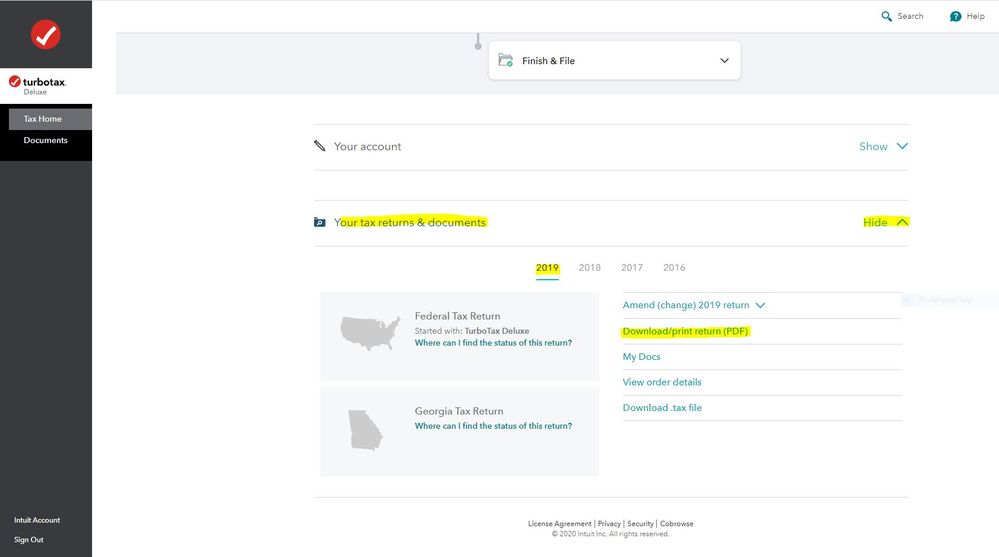

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

OR -

You may have to start a 2020 tax return before the links on the Tax Home web page become available. In that case start the 2020 tax return with the User ID you used for the 2019 return. Once some basic information has been transferred over, Tax Home should be visible on the left column. Click on Tax Home and then the other links will be shown as in this screenshot.

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm looking for my previous tax returns and the chat tells me to go to the left menu and click "Documents". It turns out there is no left menu. tried in Safari and Chrome

Other have reported this problem too..

Assuming you are in the exact-same "Online" tax account you used in prior years.

....you may need to start thru the first steps of preparing your 2020 tax return, just minimal information that the software takes you thru.

Then click on "Tax Home" (NOT Documents) , and then, scroll down the page:

__________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm looking for my previous tax returns and the chat tells me to go to the left menu and click "Documents". It turns out there is no left menu. tried in Safari and Chrome

This is my problem too. However, I have opted for a professional to do my taxes full service this year. I see an icon to "Safely share documents with your expert," how will I access last years tax returns for the expert who is doing my taxes through Turbo tax this year?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

artttom

New Member

user17515633536

New Member

anil

New Member

SydRab5726

New Member

rgrahovec55

New Member