- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

Form 8826 is not supported by TurboTax. The tax data from the Form 8826 is entered in the TurboTax program using the general business credit Form 3800 Part III Line 1e. You will have to print and mail the tax return and attach the Form 8826 to the mailed return.

IRS Form 8826 - https://www.irs.gov/pub/irs-pdf/f8826.pdf

Enter 8826, disabled access credit in the Search box located in the upper right of the program screen. Click on Jump to 8826, disabled access credit

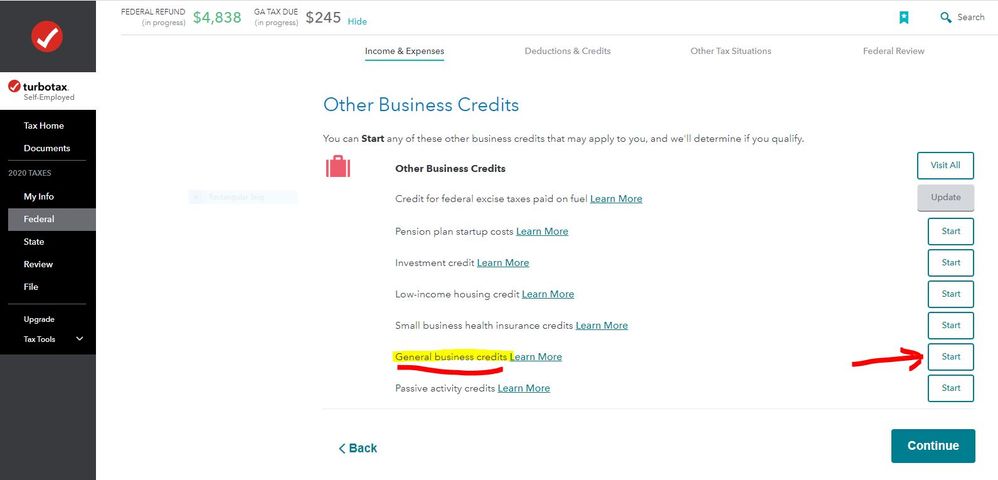

On the screen Other Business Credits, on General business credits, click the start button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

For the federal, any time you have to attach a form that is not supported for e-filing you will have to print and mail the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

I need to use the 8826. Is there a way to manipulate the software so that the right amount of tax due or refund is calculated? How does it work if I just attach the paper 8826 to get the credit? Doesn't this lower the taxable income? I really need to take advantage of this credit this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

@benokaela wrote:

I need to use the 8826. Is there a way to manipulate the software so that the right amount of tax due or refund is calculated? How does it work if I just attach the paper 8826 to get the credit? Doesn't this lower the taxable income? I really need to take advantage of this credit this year.

As stated in the answer above -

The tax data from the Form 8826 is entered in the TurboTax program using the general business credit Form 3800 Part III Line 1e. You will have to print and mail the tax return and attach the Form 8826 to the mailed return.

IRS Form 8826 - https://www.irs.gov/pub/irs-pdf/f8826.pdf

Enter 8826, disabled access credit in the Search box located in the upper right of the program screen. Click on Jump to 8826, disabled access credit

On the screen Other Business Credits, on General business credits, click the start button

Report the amount from the Form 8826 Line 8 on Form 3800, Part III, line 1e

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

I've been looking for that "other business credit" page so that I can enter it, but I just can't find it even with the "search." I just get threads that I see here but no link to 3800. I tried searching manually through the "business credit" section, too. It just stated that I don't have the form and that's it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

I found it! I'll assume this is 3800.

Other Credits under Business

I was looking under Personal for some odd reason.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

@benokaela wrote:

I've been looking for that "other business credit" page so that I can enter it, but I just can't find it even with the "search." I just get threads that I see here but no link to 3800. I tried searching manually through the "business credit" section, too. It just stated that I don't have the form and that's it.

Enter 8826, disabled access credit in the Search box located in the upper right of the program screen. Click on Jump to 8826, disabled access credit

On the screen Other Business Credits, on General business credits, click the start button

Did you land on this screen after clicking on Jump to 8826, disabled access credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have TT self-employed. I need form 8826 for disability access credit. How do I e-file without the form? Do I have to send in my taxes via paper?

Yes, I found it. Thank you so much! I had to manually go in and find it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17577067935

Level 1

blrhoden

New Member

gocatt19731

New Member

queencleopatra2279

New Member

thereseozi

Level 2