- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I have home and Business turbo tax - The instruction - ju...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

While following the TurboTax interviews, our questions will lead you to most every form you might need to enter for your taxes. For example, your W-2 form is one of the first forms you’ll have a chance to enter (or import).

However, if you have a form you wish to enter directly into TurboTax, there are several easy ways to go directly to the area for that form. Lets use your W-2 form as an example:

Form 1099-MISC

Most people get a Form 1099-MISC in the mail when they do contract or freelance work and make over $600. The 1099-MISC also reports miscellaneous income that you might get from other things, like prize or award money, rent payments, and more.

As its name implies, this form is used to report miscellaneous income – that is, income that doesn't "belong" on a different form, like employee wages on a W-2 or interest earnings on a 1099-INT. Form 1099-MISC is often used to report income for work you performed outside of employment, or as the IRS calls it, self-employment income.

Although form 1099-MISC can be used for any kind of miscellaneous income, it is typically used to report these types of income:

- Payments of $600 or more for services performed by persons not treated as an employee (a non-employee, independent contractor, freelancer, or the self-employed).

- Prizes or awards ($600 or more)

- Rent payments

- Royalty payments ($10 or more)

- State and federal tax withheld for any of the activities reportable on the form.

- Substitute dividend and tax-exempt interest reportable by brokers ($10 or more).

- Payments to a physician, physicians' corporation or other supplier of health and medical services, issued mainly by medical assistance programs or health and accident insurance plans ($600 or more).

- Payments to fishing boat crew members coming from sale of catch.

- Crop insurance proceeds.

Note: It's important to remember that you still need to report all of your income even if you did not receive a 1099-MISC.

In TurboTax Deluxe, Premier, or Home and Business, jump directly to the Form 1099-MISC entry screen:

- Enter 1099-misc in the TurboTax search box (with or without the dash) and press the Enter key.

- You'll jump to the Did you get a 1099-MISC? screen, click Yes.

- On the Let's enter the info from your 1099-MISC screen, copy the information from your form into TurboTax.

- Then click Continue and finish by describing your income in the following interview screens.

Remember, all income should be included on your tax return. When you get a form, such as Form 1099-MISC, the IRS also gets a copy to match with your tax return.

Depending on your miscellaneous income and any related expenses, you may need to upgrade to a TurboTax edition with the Schedule C form and coaching you need.

TurboTax Deluxe and Premier editions support 1099-MISC income with limited expenses:

- Standard vehicle mileage,

- Phone expenses, and

- Miscellaneous expenses up to $100.

TurboTax Home and Business edition supports additional expenses beyond those listed, and is designed for small businesses including sole proprietors, consultants, and the self-employed using a Schedule C with both income and expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

While following the TurboTax interviews, our questions will lead you to most every form you might need to enter for your taxes. For example, your W-2 form is one of the first forms you’ll have a chance to enter (or import).

However, if you have a form you wish to enter directly into TurboTax, there are several easy ways to go directly to the area for that form. Lets use your W-2 form as an example:

Form 1099-MISC

Most people get a Form 1099-MISC in the mail when they do contract or freelance work and make over $600. The 1099-MISC also reports miscellaneous income that you might get from other things, like prize or award money, rent payments, and more.

As its name implies, this form is used to report miscellaneous income – that is, income that doesn't "belong" on a different form, like employee wages on a W-2 or interest earnings on a 1099-INT. Form 1099-MISC is often used to report income for work you performed outside of employment, or as the IRS calls it, self-employment income.

Although form 1099-MISC can be used for any kind of miscellaneous income, it is typically used to report these types of income:

- Payments of $600 or more for services performed by persons not treated as an employee (a non-employee, independent contractor, freelancer, or the self-employed).

- Prizes or awards ($600 or more)

- Rent payments

- Royalty payments ($10 or more)

- State and federal tax withheld for any of the activities reportable on the form.

- Substitute dividend and tax-exempt interest reportable by brokers ($10 or more).

- Payments to a physician, physicians' corporation or other supplier of health and medical services, issued mainly by medical assistance programs or health and accident insurance plans ($600 or more).

- Payments to fishing boat crew members coming from sale of catch.

- Crop insurance proceeds.

Note: It's important to remember that you still need to report all of your income even if you did not receive a 1099-MISC.

In TurboTax Deluxe, Premier, or Home and Business, jump directly to the Form 1099-MISC entry screen:

- Enter 1099-misc in the TurboTax search box (with or without the dash) and press the Enter key.

- You'll jump to the Did you get a 1099-MISC? screen, click Yes.

- On the Let's enter the info from your 1099-MISC screen, copy the information from your form into TurboTax.

- Then click Continue and finish by describing your income in the following interview screens.

Remember, all income should be included on your tax return. When you get a form, such as Form 1099-MISC, the IRS also gets a copy to match with your tax return.

Depending on your miscellaneous income and any related expenses, you may need to upgrade to a TurboTax edition with the Schedule C form and coaching you need.

TurboTax Deluxe and Premier editions support 1099-MISC income with limited expenses:

- Standard vehicle mileage,

- Phone expenses, and

- Miscellaneous expenses up to $100.

TurboTax Home and Business edition supports additional expenses beyond those listed, and is designed for small businesses including sole proprietors, consultants, and the self-employed using a Schedule C with both income and expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

I have the same question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

Also have that question. Did you guys figure it out? Can we only use one or the other? I am confused, thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

You have to enter all your income on the same tax return. Both W2 and 1099 income. You can enter W2 into all versions.

1099Misc is usually for self employment income. You can enter Self Employment Income into Online Deluxe or Premier but if you have any expenses you will have to upgrade to the Self Employed version.

How to enter income from Self Employment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

Found it in the "personal" section 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

Is schedule C part of Tubo Tax Home and Business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

@wmgadsden1 wrote:

Is schedule C part of Tubo Tax Home and Business

Yes, Schedule C is included in the TurboTax Home & Business edition.

Go to this TurboTax website for a list of all the Form and Schedules included in the CD/Download editions - https://turbotax.intuit.com/personal-taxes/irs-forms/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

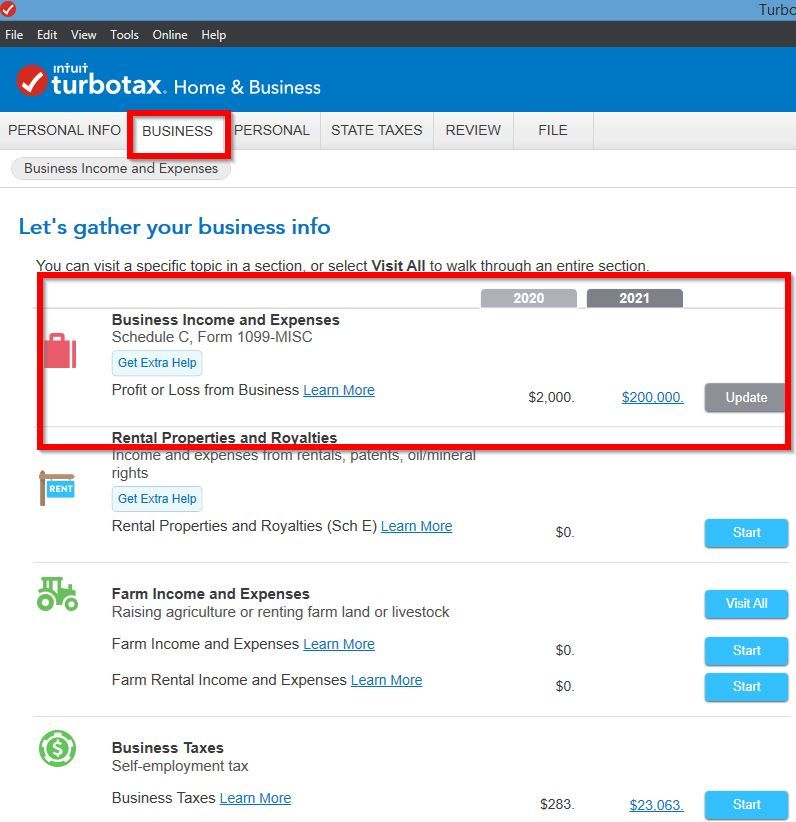

In Home & Business Desktop program schedule C is under the Business tab at the top. I have H&B for Windows. I can make you screen shots. Like this one. Go to the Business Tab, continue a screen or two and pick I'll Choose what I work on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

i need to enter taxes for year 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

am filling jointly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a W2 and a 1099 MISC. How do I enter both?

i have w2 and my ssi filling jointly

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CCCD

New Member

pdunamis

New Member

joe-kyrox

New Member

RyanK

Level 2

soccerdad720

Level 2