- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I entered exempt interest dividends for more than one state every way possible and the software keeps telling me it needs to be reviewed. How do I enter this correctly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered exempt interest dividends for more than one state every way possible and the software keeps telling me it needs to be reviewed. How do I enter this correctly?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered exempt interest dividends for more than one state every way possible and the software keeps telling me it needs to be reviewed. How do I enter this correctly?

@vinjmp13 Ahhhh crap....

1) IF you only have box 11 $$ on a 1099-DIV form, you probably have to have at least a zero entered into box 1a....then it takes clears the "Review" issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered exempt interest dividends for more than one state every way possible and the software keeps telling me it needs to be reviewed. How do I enter this correctly?

Ok...you could be referring to either box 8 $$ on a 1099-INT form, or box 11 $ $ on a 1099-DIV form.

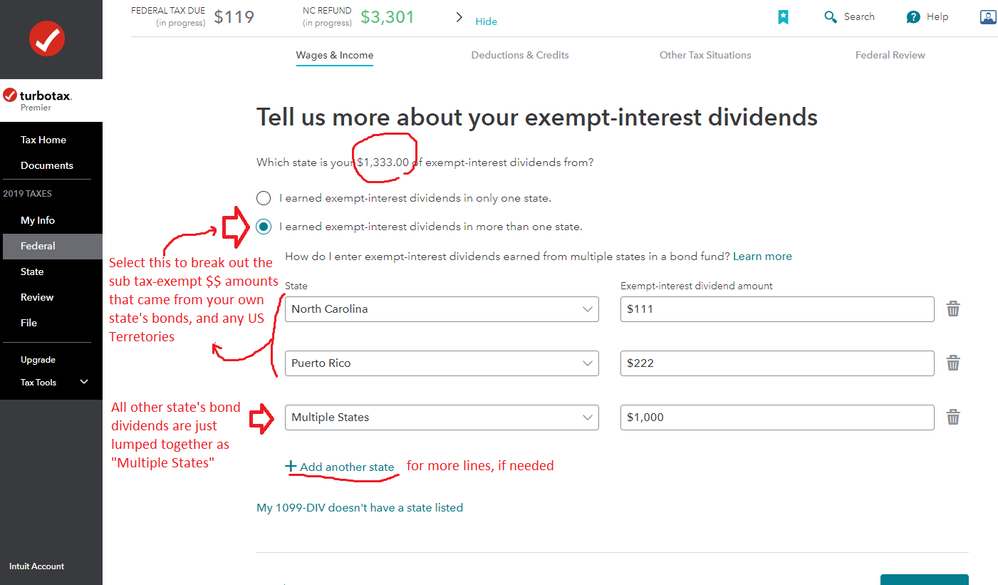

So you enter the value that was indicated by the issuing provider....an which form is appropriate ( 1099-DIV or -INT)....then the follow-up page you can either:

1) Leve it set at the only one state selection at the top, BUT Use the "Multiple States" selection in state selection box (it's at the end of the list of states) and move on....(don't check the box lower down on that page )

OR

2) Same thing as #1, but make the second selection on that page "I earned exempt-interest dividends in more than one state" to do display the boxes to do a break-down, for interest from:

a) your own state's bonds

b) any US territory bonds

c) the remaining total is just "Multiple States"

(example below for NC)

3) BUT if your state is one of the non-income taxiing states (TX, WA FL..etc) then you only do #1, since a breakdown as in #2, is immaterial.

_____________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered exempt interest dividends for more than one state every way possible and the software keeps telling me it needs to be reviewed. How do I enter this correctly?

@vinjmp13 Ahhhh crap....

1) IF you only have box 11 $$ on a 1099-DIV form, you probably have to have at least a zero entered into box 1a....then it takes clears the "Review" issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered exempt interest dividends for more than one state every way possible and the software keeps telling me it needs to be reviewed. How do I enter this correctly?

Entering the zero worked. Thanks for your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ericasteven2017

New Member

RandlePink

Level 2

Dan S9

Level 1

starkyfubbs

Level 4

judiesinbox

New Member