- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Ok...you could be referring to either box 8 $$ on a 1099-INT form, or box 11 $ $ on a 1099-DIV form.

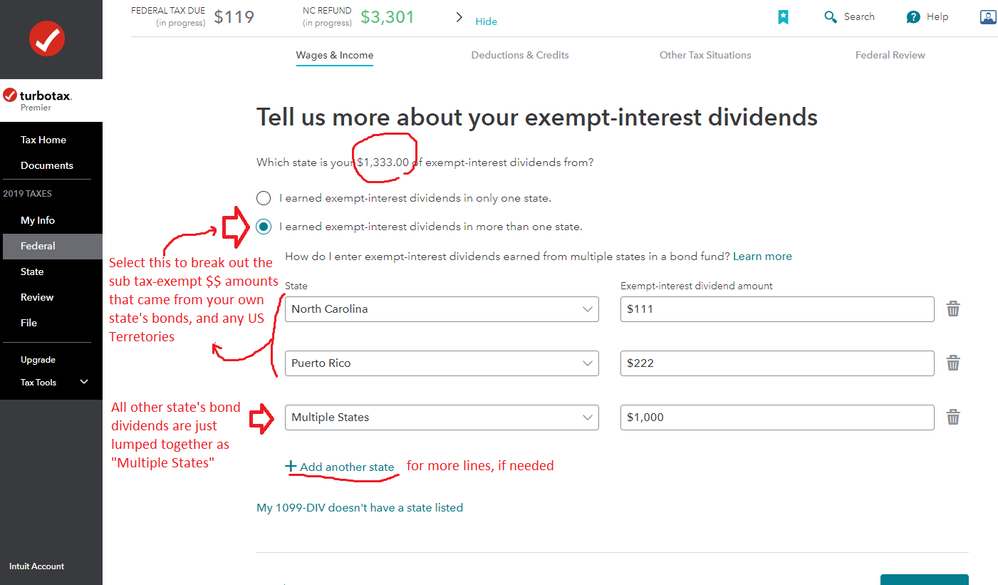

So you enter the value that was indicated by the issuing provider....an which form is appropriate ( 1099-DIV or -INT)....then the follow-up page you can either:

1) Leve it set at the only one state selection at the top, BUT Use the "Multiple States" selection in state selection box (it's at the end of the list of states) and move on....(don't check the box lower down on that page )

OR

2) Same thing as #1, but make the second selection on that page "I earned exempt-interest dividends in more than one state" to do display the boxes to do a break-down, for interest from:

a) your own state's bonds

b) any US territory bonds

c) the remaining total is just "Multiple States"

(example below for NC)

3) BUT if your state is one of the non-income taxiing states (TX, WA FL..etc) then you only do #1, since a breakdown as in #2, is immaterial.

_____________________________