- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I dont understand Cash contributions section at all? Where does one find the AGI (adjusted gross income) limits ? Does it mean you need last years taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I dont understand Cash contributions section at all? Where does one find the AGI (adjusted gross income) limits ? Does it mean you need last years taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I dont understand Cash contributions section at all? Where does one find the AGI (adjusted gross income) limits ? Does it mean you need last years taxes?

Would you please clarify, are you entering cash contributions made for 2022?

Are you trying to carry over contributions from 2021?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I dont understand Cash contributions section at all? Where does one find the AGI (adjusted gross income) limits ? Does it mean you need last years taxes?

If I knew the answer to your reply, I don't think I would be asking the question. That section is confusing, and I was wondering if I could just by-pass it and forgo the donation deduction? There are too many options to choose not understanding it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I dont understand Cash contributions section at all? Where does one find the AGI (adjusted gross income) limits ? Does it mean you need last years taxes?

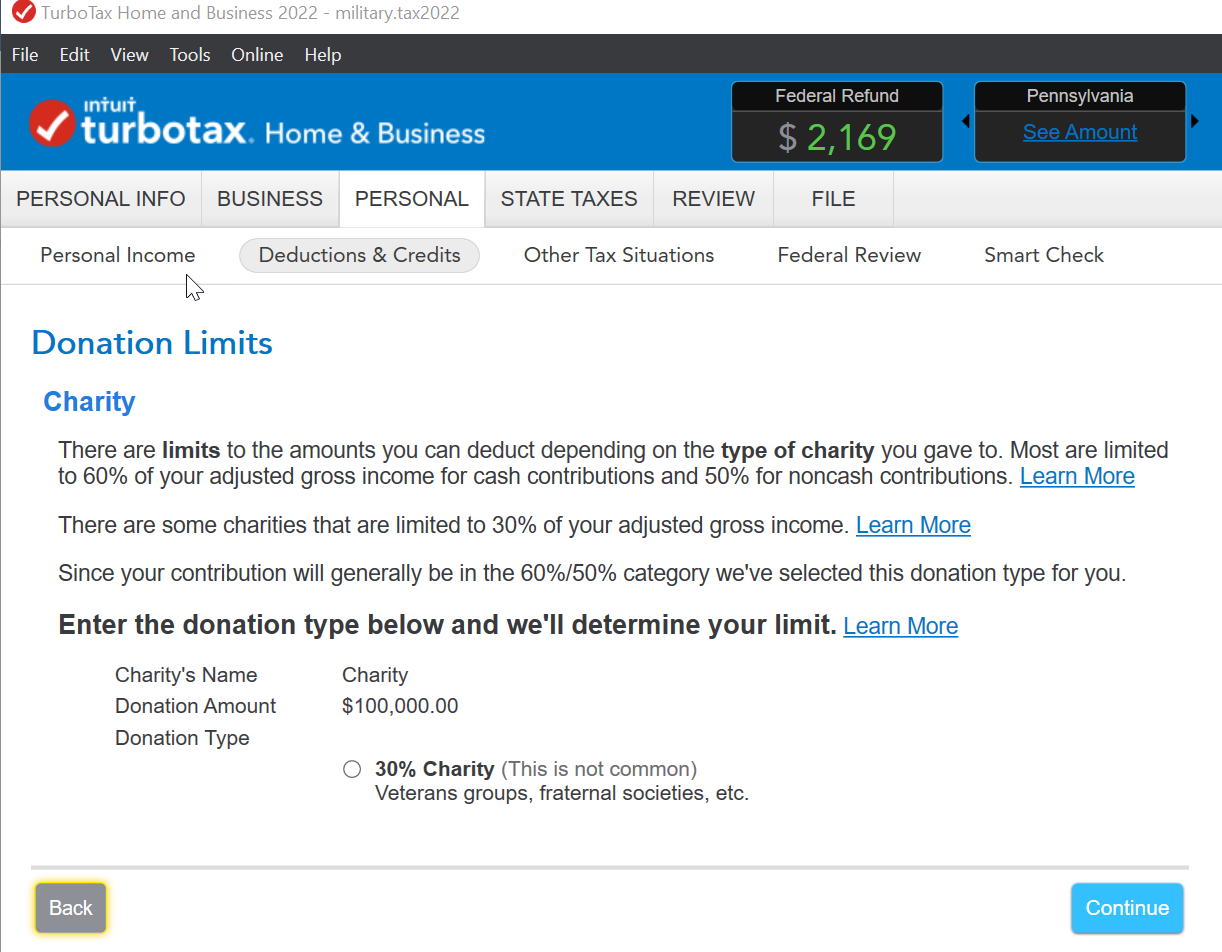

The AGI limit for a 2022 cash contribution is based on 2022 AGI.

If you reach the limit, you will see a donation limits screen where TurboTax will ask you whether you are donating to a 60% charity or 30% charity.

TurboTax will also carry forward any unused charitable contributions from 2021. If you did not use TurboTax, you can enter the amount yourself.

You can carry over any contributions you can't deduct in the current year because they exceed the limits based on your adjusted gross income (AGI). Except for qualified conservation contributions, you may be able to deduct the excess in each of the next 5 years until it is used up, but not beyond that time.

A carryover of a qualified conservation contribution can be carried forward for 15 years.

Contributions you carry over are subject to the same percentage limits in the year to which they are carried.

How To Figure Your Deduction When Limits Apply

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ir63

Level 2

tcondon21

Returning Member

CTinHI

Level 1

simoneporter

New Member

Blue Storm

Returning Member