- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I am a resident alien but my wife and child are non resident aliens and do not have SSN/ITIN. I am filing tax as "married but filing separately". NRA is not valid for SSN

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident alien but my wife and child are non resident aliens and do not have SSN/ITIN. I am filing tax as "married but filing separately". NRA is not valid for SSN

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident alien but my wife and child are non resident aliens and do not have SSN/ITIN. I am filing tax as "married but filing separately". NRA is not valid for SSN

If they do not have an SSN or ITIN and you choose to file Married Filing Separate ,you can enter spouses name and DOB and then on the next screen you can select "xxx is a non resident alien or dual status spouse" Make sure you put a check mark in the box that says My spouse is a Non-Resident alien in the My info section. When you get to the end and try to transmit the return, ignore the e-file errors regarding your NRA spouse and select transmit your return. If that does not work you will need to print and mail your return and write NRA (Non Resident Alien) in the space for her SSN.

Even though your wife and child are Non-Resident Aliens it is still possible for you to file a joint return. The benefit to this would be if your wife does not have other income, then you would have a standard deduction of $29,200 instead of $14,600 which means your taxable income would decrease by an additional $14,600. You may also be able to claim the the$500 Other Dependent Credit.

If your spouse chooses to be treated as an US resident for tax purposes, and you want to file as Married Filing Joint and claim your child as a dependent, you can apply for an ITIN when you file your return. You would need to include their income FROM ALL SOURCES WORLDWIDE (not just what they earned in the US) on your return as well and they would be taxed on it. If you choose filing jointly, you will need to print and mail your return along with the W-7 which is an application for an ITIN and any other required documents to the address in the instructions

How should I file my taxes if my spouse is a nonresident alien?

Claiming a Non-Citizen Spouse and Children on Your Taxes

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident alien but my wife and child are non resident aliens and do not have SSN/ITIN. I am filing tax as "married but filing separately". NRA is not valid for SSN

Hi,

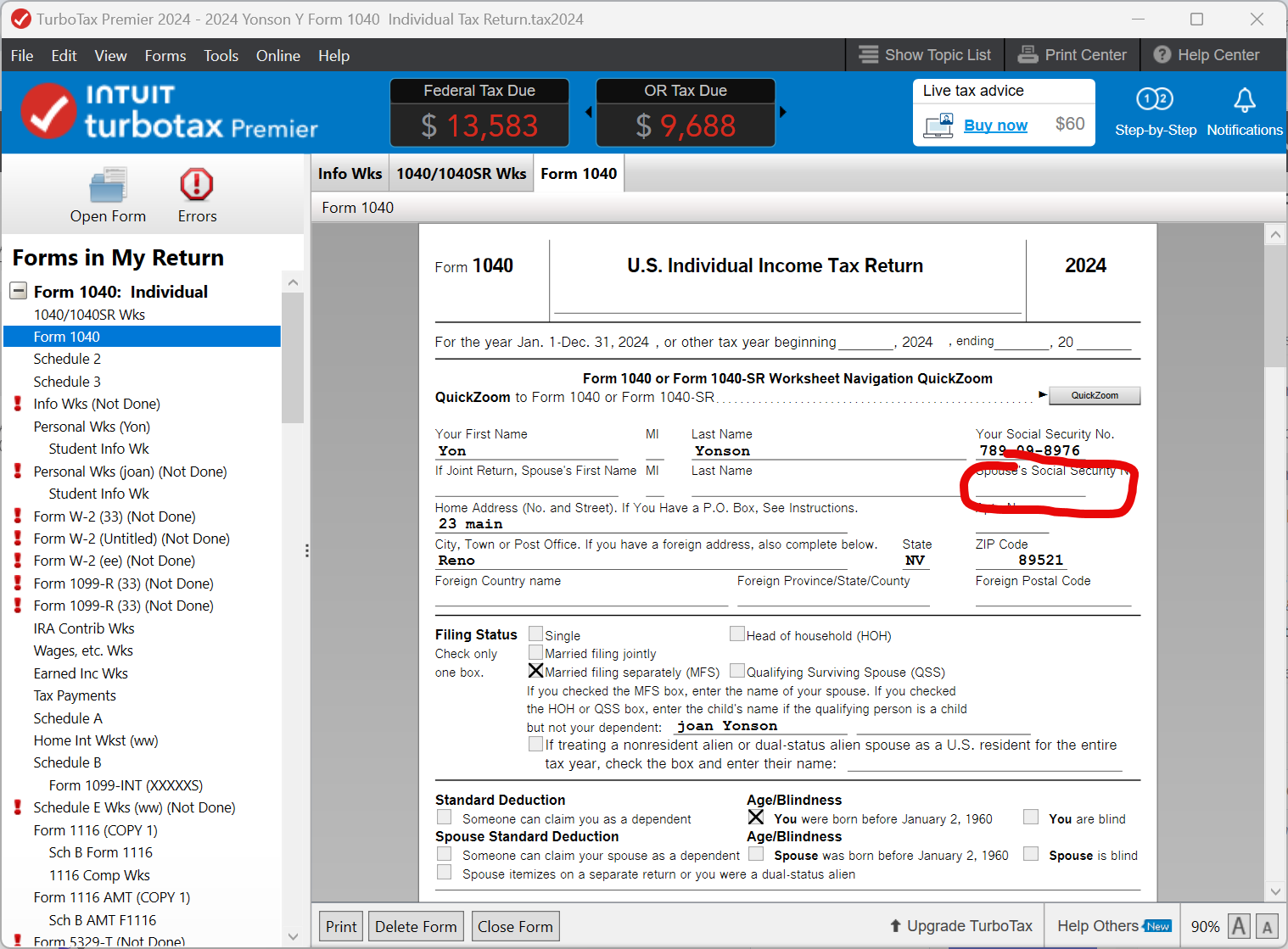

I am in the same situation filing as 'married filing separately' with a non resident alien spouse without a social security number. Turbo did not allow me to e-file so I file by mail. When I printed out the the tax return, I don't see where to enter 'NRA' for my spouse on the form since I married filing separately, I don't see where on the form that asks for this information.

Could you please help? I contacted TurboTax agent with no help.

Thank you!

Thao

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident alien but my wife and child are non resident aliens and do not have SSN/ITIN. I am filing tax as "married but filing separately". NRA is not valid for SSN

You can write this in on the 1040 either in the Box where your wife's social security would normally go. Her name is already listed in the filing status section under married filing separately.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident alien but my wife and child are non resident aliens and do not have SSN/ITIN. I am filing tax as "married but filing separately". NRA is not valid for SSN

This is clearly a remaining UNFIXED Bug in Turbotax. The IRS allows for a NRA spouse to NOT have an SSN, AND allows the US Taxpayer to e-file in this circumstance. This was changed during the 2022 tax year. TurboTax's BUG is to NOT allow you to transmit with a NULL VALUE despite following IRS guidelines to e-file despite NOT having an SSN for your NRA SPOUSE, which when filing Married Filing Separately, and you DO NOT itemize, you can e-file.

This needs to be fixed asap so I can e-file this week. But I suspect my continued pointing out this programatic failure on behalf of Turbotax, will NOT see the light of day. If not, this is the last year I will use the paid version of Turbo Tax, desktop or online. I tried BOTH, and it is clearly a back end issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident alien but my wife and child are non resident aliens and do not have SSN/ITIN. I am filing tax as "married but filing separately". NRA is not valid for SSN

I learned that you can e-file with H&R block in this situation. I am planning to switch to H&R Block next year. I called Turbo Tax but they could not do anything to help. This is a bug in their software and they treated me as I am stupid by telling me that the IRS does not allow to e-file in this situation. I am a software engineer.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dennison-jenna

New Member

Katie1996

Level 1

davel-parr

New Member

shrivatsk

New Member

jackkgan

Level 5