- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I am a parent cna in Colorado and I know my income is tax exempt but I do not know how to enter that since I have a w-2? Please how and where do I enter this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a parent cna in Colorado and I know my income is tax exempt but I do not know how to enter that since I have a w-2? Please how and where do I enter this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a parent cna in Colorado and I know my income is tax exempt but I do not know how to enter that since I have a w-2? Please how and where do I enter this?

Do you mean you are taking care of your child under a Medicaid Waiver Program? If so, depending on where the numbers are on the form will depend on how you enter it. Click the link below for instructions on how to enter your W-2 from a Medicaid Waiver Program.

How do I enter my tax-exempt Medicaid waiver payments from IHSS in TurboTax?

If you are asking something else, please respond with clarification.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a parent cna in Colorado and I know my income is tax exempt but I do not know how to enter that since I have a w-2? Please how and where do I enter this?

This is an answer I found online from a TurboTax answer -

“If you live with the person you provide care for, the income you earn for providing care services can be excluded from your federal income taxes.

The payments you receive are Difficulty of care payments and can be excluded from taxable income, according to IRS Notice 2014-7.

If you received a form W-2 for these payments, you'll report the form on your tax return. but it will not be part of your taxable income. Here's how:

Enter that form W-2 in TurboTax just like a normal W-2.

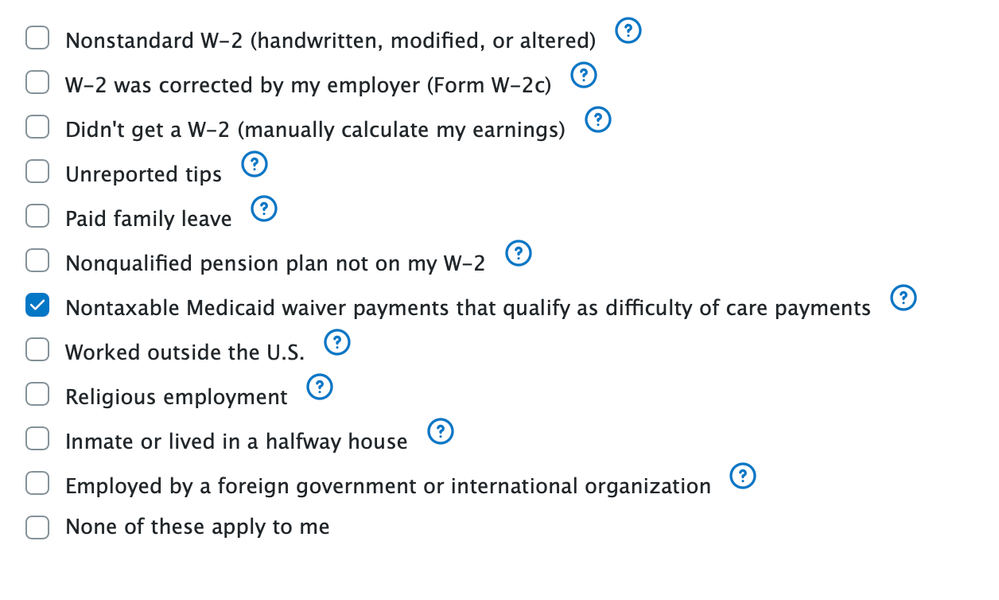

Then in the follow-up interview, when you arrive at the page titled Let's check for uncommon situations, put a checkmark on Nontaxable Medicaid waiver payments that qualify as difficulty of care payments and click Continue. On the next page you can indicate how much of the W-2 amount should be nontaxable, which in your case is All of it.

See attached screenshot.

I guess it won’t share the picture. I tried to find this but I am not having any luck. The date of the post is only last year … does this help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a parent cna in Colorado and I know my income is tax exempt but I do not know how to enter that since I have a w-2? Please how and where do I enter this?

Yes, you found the same situation that @VanessaA was talking about. When you enter your W2, the next screen asks about uncommon situations and you select difficulty of care payments.

Are you able to enter the w2 and continue to the next screen? If you imported the w2, you might need to delete it and type it in manually.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tivo44

Level 2

dan-knifong

New Member

pcld5872

New Member

annarichard05

New Member

user17524181159

Level 1