- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to report 1099-nec incorrectly issued to me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

My former employer, a large healthcare provider that I worked for as a W-2 employee for 2+years issued a 1099-NEC with about $5,000 in compensation. I left the job in July 2021. I am 100% sure I'm only a W-2 employee because I received a W-2 and the amount in box 1 matched my last paycheck. There is no way I had this compensation for additional work after I left their employment.

To make the matter more complicated to resolve, right after I left, they were bought out by a larger healthcare provider and all their HR / backoffice stuff got moved to their new HR department. I was successful in reaching someone in new HR and they gave me the run around and asked I called the IRS. I called the IRS, and they can't be reached, I called HR back and they directed me to payroll. Got someone in payroll and they can't find any record of this 1099-NEC issued to me. With that last result, they agreed I shouldn't had received 1099 income, but also refuse to issue a corrected 1099-NEC with $0.00 on it. Now I'm stuck. Do I report the 1099-NEC as $0.00? If I do, how do I enter a statement in TurboTax to explain that the $0.00 vs. $5K so I don't get audited? Appreciate the community's help so I can finish filing my taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

You can enter the 1099-NEC as other income and back it out again with an explanation that it is incorrect. However, this does not mean the IRS won't contact you. It would be helpful at least to get a letter from HR saying that it was incorrect and that they don't even have a record of sending you the form.

Follow these steps and note in the explanation as much of how you were due no money, they refused to correct and that they can't even find a record of the issuance.

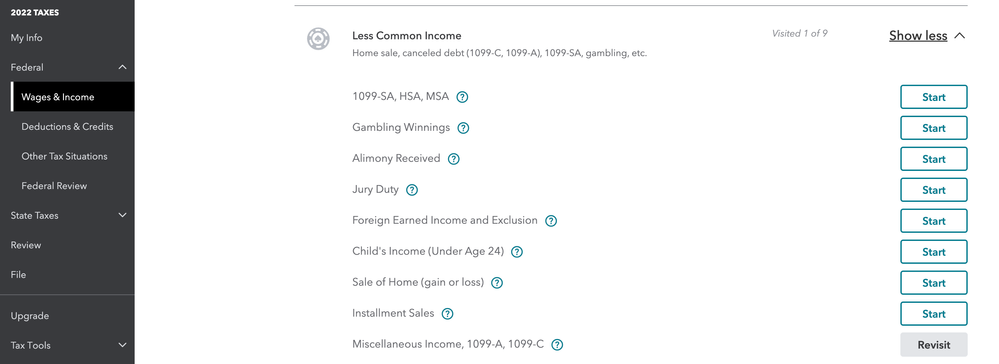

- From the left menu, go to Federal and select the first tab, Wages & Income

- Add more income by scrolling down to the last option, Less Common Income, and Show more

- Scroll down to the last option, Miscellaneous Income, 1099-A, 1099-C and Start

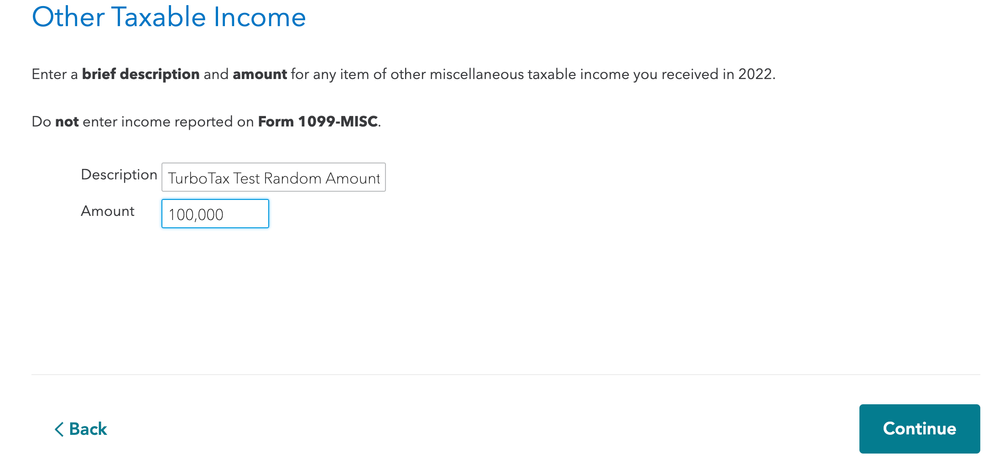

- Choose the last option, Other reportable income and Start and Yes

- Enter the applicable description and amount and Continue

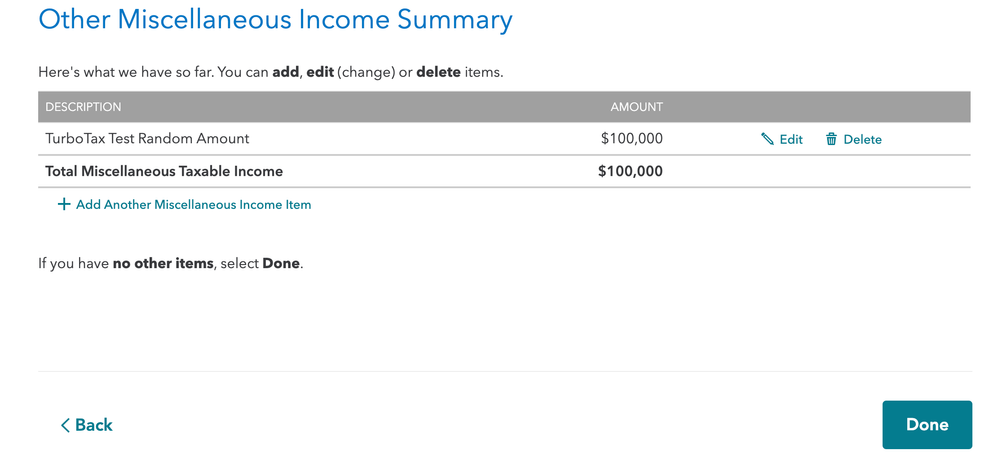

- First, enter Form 1099 as received. It is essential that the full amount be entered.

- Next, enter an adjustment as a negative number to reflect the cost of these items and the sales expenses (but not more than the amount You can't produce a loss.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

No. There is not a way to support sending an attachment. just keep the email in the same file you keep your return if the IRS decides to contact you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

You can enter the 1099-NEC as other income and back it out again with an explanation that it is incorrect. However, this does not mean the IRS won't contact you. It would be helpful at least to get a letter from HR saying that it was incorrect and that they don't even have a record of sending you the form.

Follow these steps and note in the explanation as much of how you were due no money, they refused to correct and that they can't even find a record of the issuance.

- From the left menu, go to Federal and select the first tab, Wages & Income

- Add more income by scrolling down to the last option, Less Common Income, and Show more

- Scroll down to the last option, Miscellaneous Income, 1099-A, 1099-C and Start

- Choose the last option, Other reportable income and Start and Yes

- Enter the applicable description and amount and Continue

- First, enter Form 1099 as received. It is essential that the full amount be entered.

- Next, enter an adjustment as a negative number to reflect the cost of these items and the sales expenses (but not more than the amount You can't produce a loss.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

Hi Coleen. Is there a way I can attach a copy of the email from the employer/HR person in TurboTax at the end of the statement? Not sure if TT support attachment functionality.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

No. There is not a way to support sending an attachment. just keep the email in the same file you keep your return if the IRS decides to contact you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

You can attach anything that is printed to a mailed return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

Hi there,

Thank you for your response,

I'm still having an issue understanding what to do here. I have a similar situation where I received a 1099-NEC with a higher amount than what I received, the difference is close to $ 10,000.

The employer is ignoring my request to have this corrected.

I'm trying to follow your instructions but I don't understand where I should be inputting the negative amount.

then:

I enter the amount:

And this is it. I don't see anywhere where to correct the amount to reflect the actual money that I received.

Say if I received $ 100,000 in 1099-NEC, I used your instructions to enter it as Other Less Common Income, but there is no field to enter the negative amount to correct the difference.

As well you mentioned, an explanation, would this mean sending a letter, hence filling by mail rather than filing electronically?

@ColeenD3 wrote:You can enter the 1099-NEC as other income and back it out again with an explanation that it is incorrect.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

@jako You should be filling out Schedule C for self employment income. You could add a Misc Expense for the difference. Did they say why the 1099NEC is too much? Did they reimburse you for something you bought? You would need to use or upgrade to the Self Employed version or Premium version.

Where to enter business expenses

https://ttlc.intuit.com/community/entering-importing/help/where-do-i-enter-my-self-employment-busine...

FYI- If you are getting a 1099NEC you do not have an employer. That is self employment/independent contractor income. When you are self employed you are in business for yourself and the person or company that pays you is your customer or client.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

Thank you.

They first sent me the money on w2 (withholding taxes), then changed that to 1099-NEC and I do not know why they decided to do that, I've been running a business as a self-employed for a while before starting with them, eventually I was employed, and they continue to pay in w2 for the remainder of the year.

I kept a copy of the first pay stub that I received before they made the correction, but now it's not available anymore on GUSTO.

So they made a correction and sent me extra money to compensate for the difference as I would have to pay taxes on that 1099 on my own, but the money sent does not equal the full amount.

The company is stating that they made an overpayment of reimbursement, which is not true, and instead of giving me the money back, they deducted it from the amount they transferred to me in the calculation of the amount when they decided to switch from w2 to 1099, and they did not correct 1099 to reflect that difference.

"Misc Expense" - what type of description should I be using?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

Hi Jako -

First of all, I'm not a tax expert. But this is how I handled it per the advice I got from this community. Per the original thread, I'm a W-2 employee and not filing Schedule C. I used TT 2021 Desktop and not the online version so these below instructions may be different but I'm sure it can be duplicated in the On-line version.

1. I first enter the $5K in Other Income as: Employer name 1099-NEC with a positive number $5,000

2. Then I enter a second entry in Other Income as: "Corrected Erroneous Employer mame 1099-NEC as a negative number -$5.000.

The above enteries will show up in the Schedule 1 Other Income Statement under line 22 a & b (for tax year 2021).

For me, since I don't have other additional income, my Schedule 1 Additional Income and Adjustment to Income Form netted out to $0.00. I think this is important to have as if you got a 1099-NEC, the IRS would probably look for a schedule 1 or schedule c.

They hadn't reached out to me for my information or a copy of the email from the employer stating I shouldn't had received the 1099-NEC. Maybe I got lucky.

Hope this helped.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1099-nec incorrectly issued to me

Hello,

OK thank you for the input.

I finally got a corrected 1099 from my employer, although they have not given me the difference in money they owe me...another battle.

That being said I went to check my IRS Transcript but it does not reflect the changes yet and is still stated as if I received the non-corrected amount.

How long does it take to reflect on the end of the IRS?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sarkarp

Level 1

fam1995

New Member

db621

New Member

Braun7479

Returning Member

champers0306

Level 1