- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi there,

Thank you for your response,

I'm still having an issue understanding what to do here. I have a similar situation where I received a 1099-NEC with a higher amount than what I received, the difference is close to $ 10,000.

The employer is ignoring my request to have this corrected.

I'm trying to follow your instructions but I don't understand where I should be inputting the negative amount.

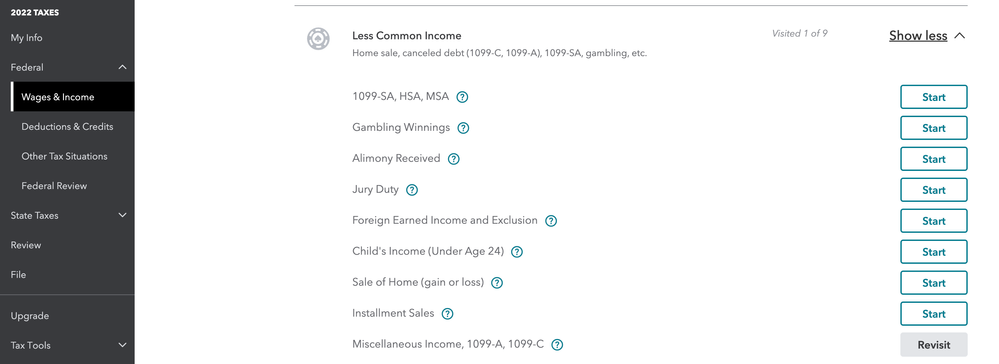

then:

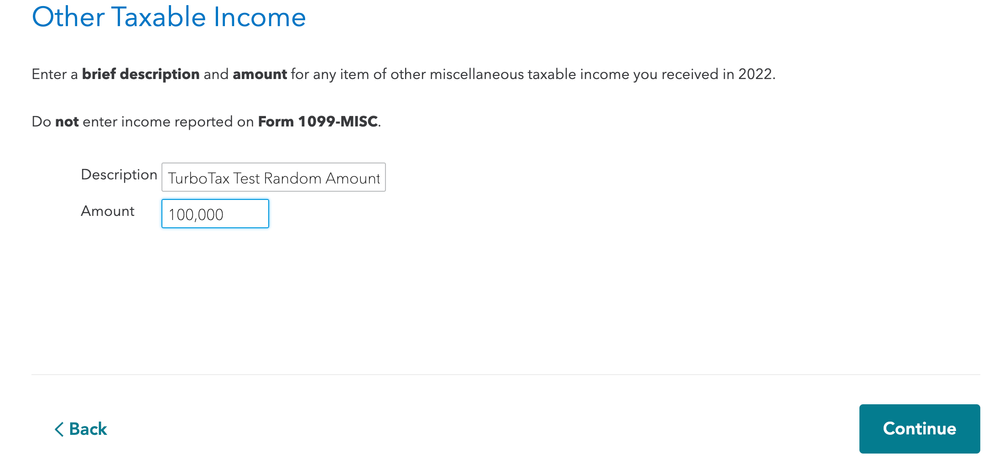

I enter the amount:

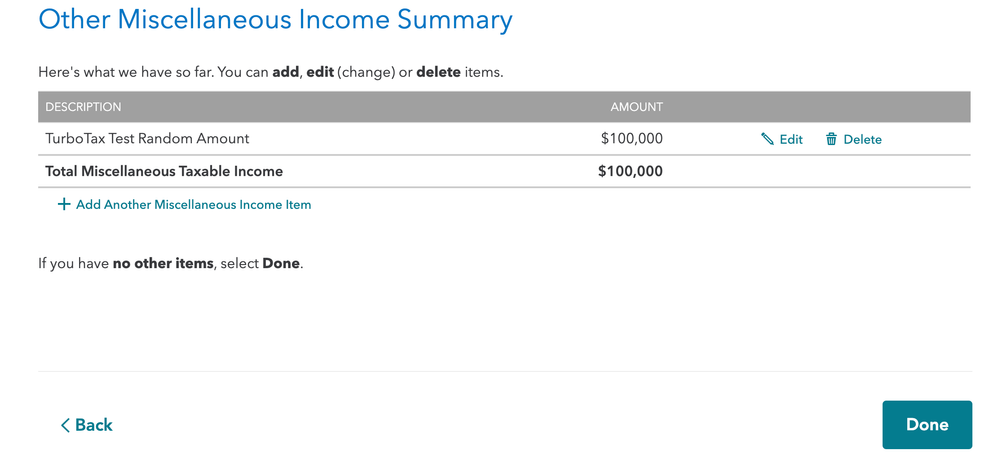

And this is it. I don't see anywhere where to correct the amount to reflect the actual money that I received.

Say if I received $ 100,000 in 1099-NEC, I used your instructions to enter it as Other Less Common Income, but there is no field to enter the negative amount to correct the difference.

As well you mentioned, an explanation, would this mean sending a letter, hence filling by mail rather than filing electronically?

@ColeenD3 wrote:You can enter the 1099-NEC as other income and back it out again with an explanation that it is incorrect.

Thank you