- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to report 1042-S with income code 01 for Resident Alien for tax purposes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1042-S with income code 01 for Resident Alien for tax purposes

I received a 1042-S form from IRS with Income Code 01 (Interest paid by U.S. obligors - general). The form is issued for the interest IRS paid me for my 2015 tax refund which was issued in 2022.

Should I enter this gross income in other income or in interest received section? I did not receive any 1099-INT form.

For the interest already deducted as mentioned in the 1042-S, I will enter as other tax paid not reported on W2 or 1099? Any help is appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1042-S with income code 01 for Resident Alien for tax purposes

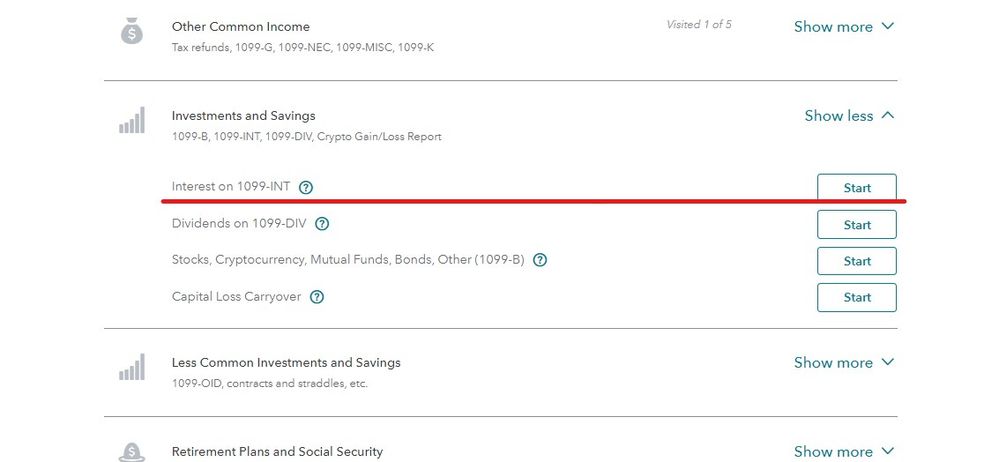

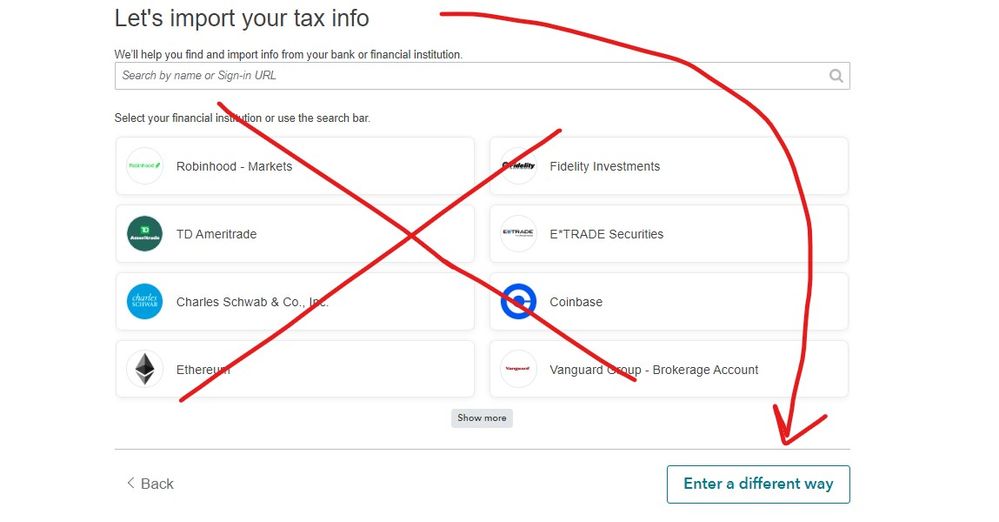

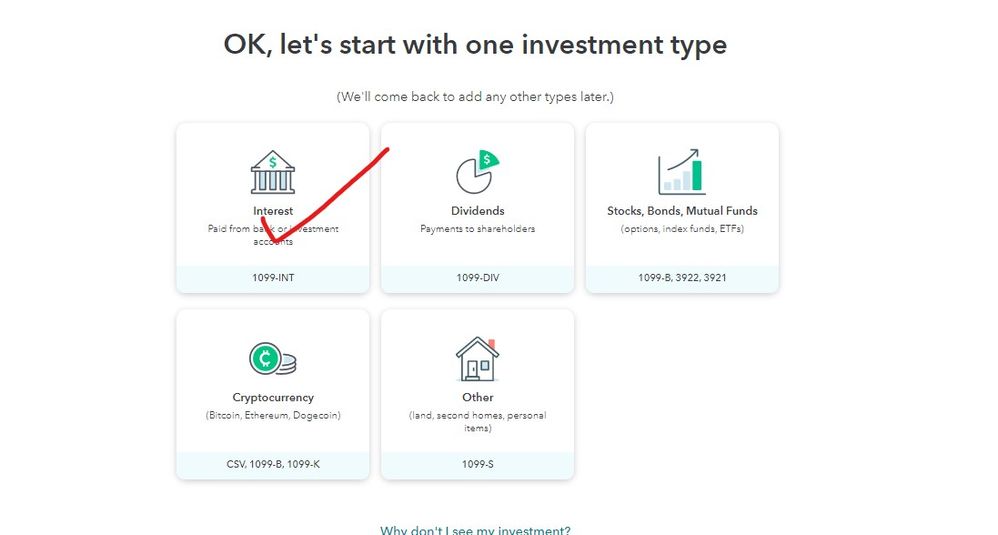

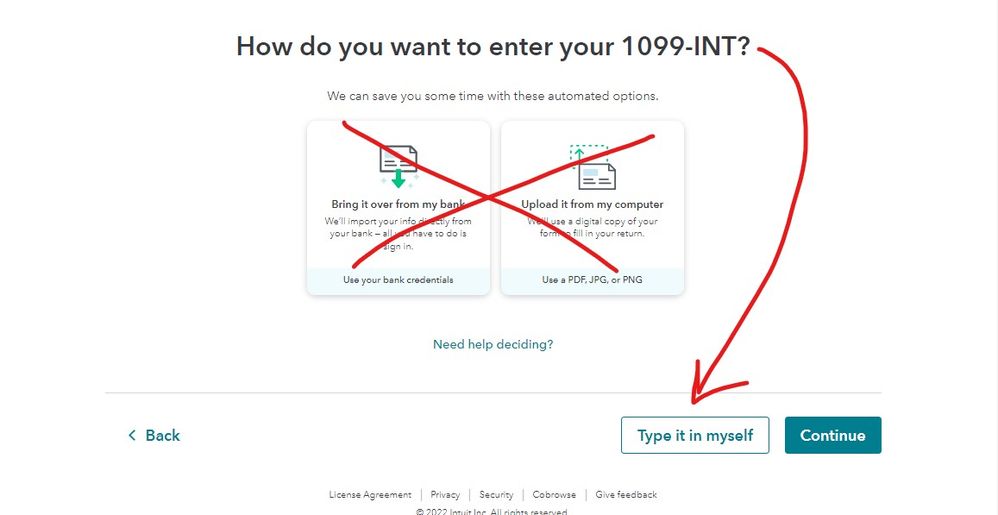

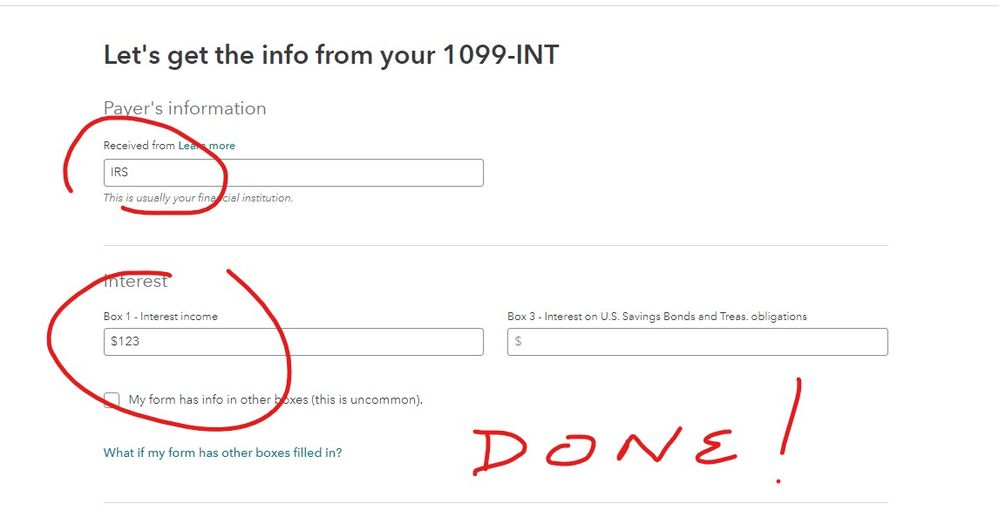

It is simply interest and should be entered as such ... payer is IRS and enter the amount in the interest income section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1042-S with income code 01 for Resident Alien for tax purposes

It is simply interest and should be entered as such ... payer is IRS and enter the amount in the interest income section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report 1042-S with income code 01 for Resident Alien for tax purposes

Thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Katie1996

Level 1

IndependentContractor

New Member

scatkins

Level 2

Danielvaneker93

New Member

Aowens6972

New Member