- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to fill out schedule C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill out schedule C

I work for an employer who pays me via personal check every week, no taxes were taken out. I will not be getting a W2 or 1099. I believe I need to fill out schedule C, but I don't know how to do so in TurboTax. Whenever I search for schedule C it just leads me to topics telling me search for schedule C again. I don't have my employer tax ID either, do I need this? Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill out schedule C

Yes, you are correct, since you provided a service to an individual and they did not consider you an employee or provide you with a W-2, you would be considered self-employed and would need to prepare a Schedule C to report your income and expenses.

In order to complete a Schedule C in TurboTax you will need TurboTax Self-Employed or TurboTax Live Self-Employed to file a Schedule C.

Once you have the correct version of TurboTax you can complete the Schedule C by following these steps:

- Open or continue with your return.

- In the Search box type schedule c.

- Click the “Jump to schedule c” link in.

- Answer Yes to Did you have any self-employment income or expenses?

- Follow the onscreen instructions to enter your Schedule C information.

Please note: An employer tax ID number is not needed for a Schedule C, choose your social security number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill out schedule C

I just upgraded my TurboTax Premier (online download) to Home and Business, would this contain schedule C?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill out schedule C

Actually if you are using the Desktop CD/Download program then all versions have Schedule C, even Deluxe and Basic. You didn't need to upgrade.

You can just type Schedule C into the search bar at the top of your return and it should give you a JUMP TO link to go directly to it.

To add a business or Schedule C….

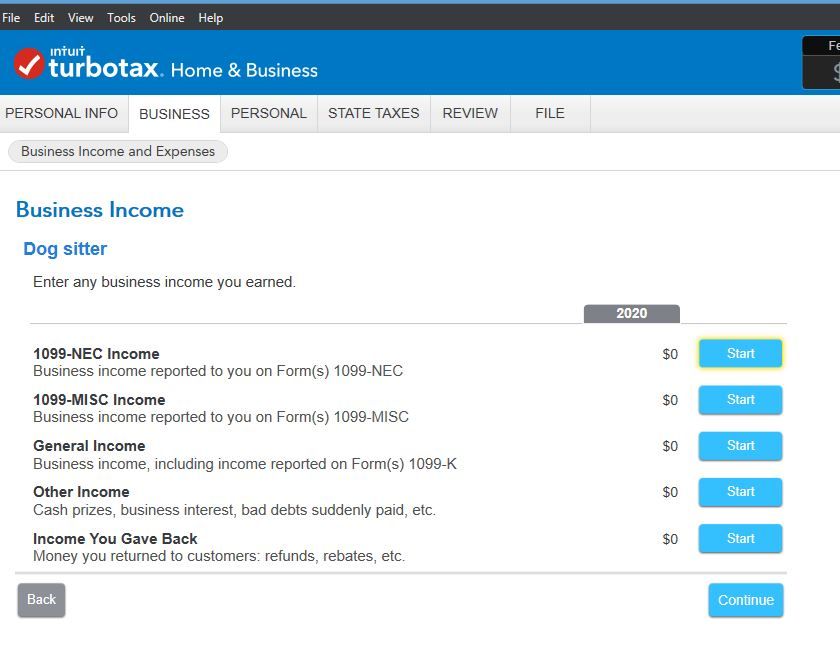

Go to Business tab-Continue

Business Income and Expenses

Profit or Loss from Business, click Start or Update.

You use your own name, address and ssn or business name and EIN if you have one. You should say you use the Cash Accounting Method and all income is At Risk.

After it asks if you received any 1099NEC it will ask if you had any income not reported on a 1099. You should be keeping your own records. Just go through the interview and answer the questions. Then you will enter your expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill out schedule C

When I am going through it, one of the prompts is 'this business is owned by'...I do not own the business, I am essentially an independent contractor for someone else who owns the business. Do I still put my name under 'Business is owned by'...and the address listed, should it be my home address or the place of business? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill out schedule C

Yes you are the owner of your own self employment business. You are in business for yourself. Use your own info. The people or company that pays you is your customer or client. You need to fill out schedule C for self employment business income. You are considered to have your own business for it. YOU are the business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill out schedule C

Thank you. I completed the business section, but I am a little confused as to where I enter the actual income. Again, I never received a 1099-MISC/NEC or W2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill out schedule C

Enter it under General Income. Hmmm, I thought it said Cash in there too. But General is where it goes. Even if you got a 1099 you can just enter the total as General. Only the total goes to schedule C line 1.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

remohoson

New Member

remohoson

New Member

remohoson

New Member

remohoson

New Member

remohoson

New Member