- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How To Avoid Double Counting Crypto, if already listed as Income on Schedule C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Avoid Double Counting Crypto, if already listed as Income on Schedule C

I have added income as cash on my schedule C in TurboTax.

I've also brought a P&Linto TurboTax, of all my crypto transactions from 2023, which includes the deposits that I've included as income in the Schedule C.

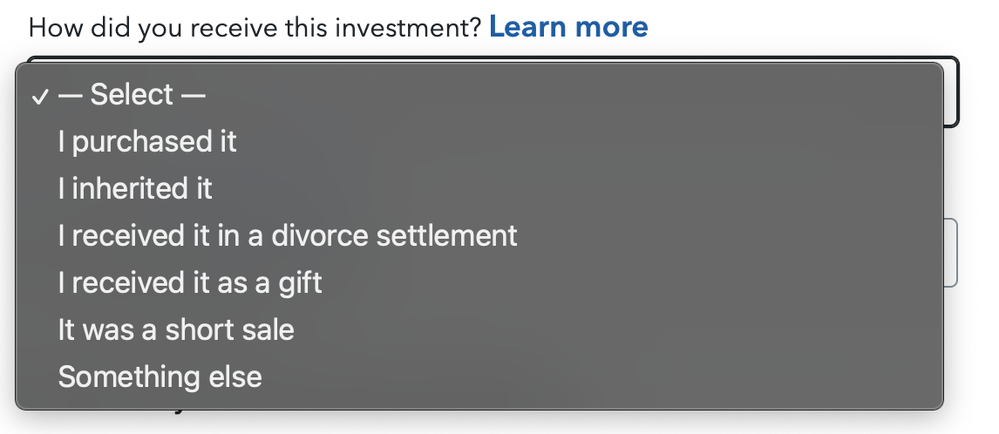

I've tried to edit the transaction within TurboTax, thinking that the 'how did you receive this investment' box might allow me to signal that it's already been processed, but the options don't include 'as income'.

Does anyone have a solve for this? I would think that just removing the transactions from the P&L would also be the wrong approach, as it should be listed, but maybe that's just the solution?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Avoid Double Counting Crypto, if already listed as Income on Schedule C

Is your intent to record your crypto investments as a trader and self-employment income? Please clarify.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jane-Jerzak

New Member

fataxkc

New Member

alex400

Returning Member

boyrpiep

New Member

user17724914922

New Member