- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How does this tax liability make sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does this tax liability make sense?

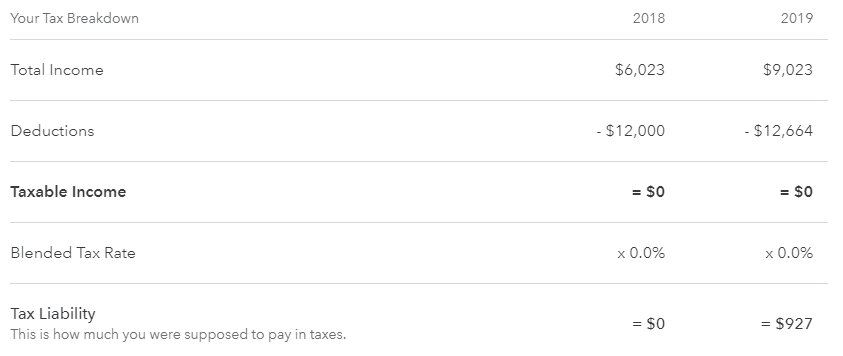

I would like to find the source of my tax liability in the federal tax calcution. In the review screen it shows the following

I'm interpreting this as $0 * 0.0% = $927 which obviously doesn't make sense. Is there a way for me to find the cause of this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does this tax liability make sense?

You should preview your 1040 to see where this tax liability is coming from:

- Click on "Tax Tools" in the left menu

- Click "Tools"

- Click "View Tax Summary" in the Tool Center window

- Click on "Preview my 1040" on the left

- Scroll down to "Tax Smart Worksheet"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does this tax liability make sense?

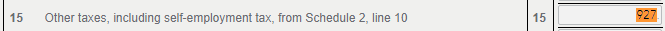

I've found this in the 1040

Is there a way for me to access this other form or find where this is calculated?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does this tax liability make sense?

If you continue to scroll down the "Preview my 1040" selection, you will see a preview of Schedule 2 - Additional Taxes almost at the end of the preview screen. (See message above from DanaB27 on how to access this.)

There are a few possible explanations for your tax liability since you do not have taxable income. Please see below for some common Other Taxes reported on Line 15 of your Form 1040:

- If some of the income you reported on your tax return was from self-employment, you may owe self-employment tax on this income. You would owe this tax regardless of whether the income was taxable for income tax purposes. (This would be reported on Line 4 of Schedule 2.)

- If you received a distribution from a retirement plan and you were under age 59 1/2, you may be subject to an early withdrawal penalty. (This would be reported on Line 6 of Schedule 2)

- If you received tips and had uncollected employee social security and medicare taxes (See Line 8 on Schedule 2)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dmertz

Level 15

bayssmsp

Returning Member

QRFMTOA

Level 5

in Education

Tina777

Returning Member

proper1420

Returning Member