- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do u know it on the way

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do u know it on the way

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do u know it on the way

Not sure what you are referring to. Can you post a specific question?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do u know it on the way

I file 4/10 and wen I check on here it’s said on its way but i have yet to receive either one

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do u know it on the way

Are you talking about your refund?

TurboTax does not get any information about refund status. You must check the status yourself using the IRS refund tracking web site: https://www.irs.gov/refunds

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do u know it on the way

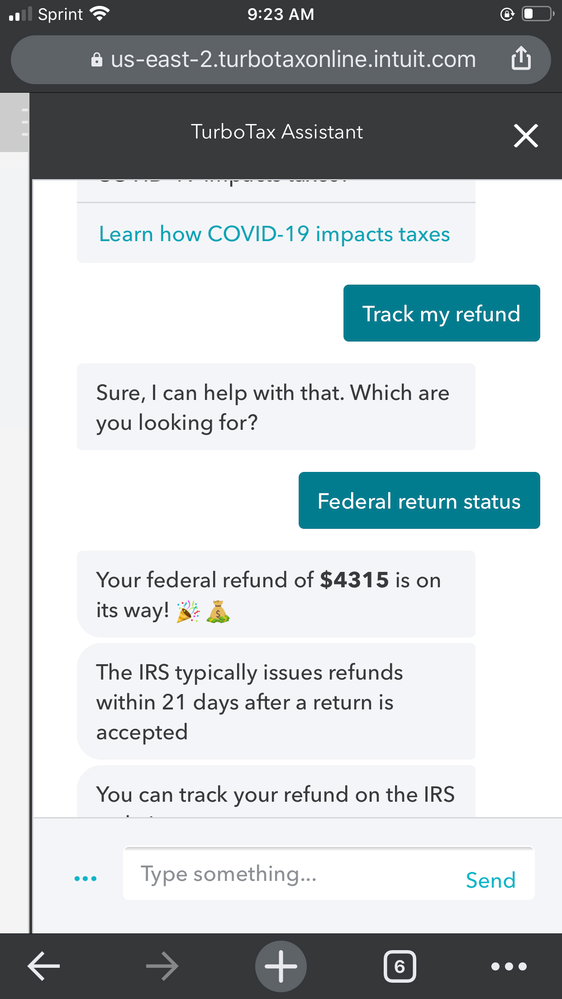

Then why do y’all keep saying it’s on the way

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do u know it on the way

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do u know it on the way

Because you filed and it was accepted by the IRS. It also says the IRS typically issues them within 21 and how to track it on the IRS website.

You are reading it literally when it is more of a comment, like 'Christmas is coming up'.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do u know it on the way

I still haven’t received my taxes now y’all tryan charged me wen I haven’t got paid yet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do u know it on the way

@ tommie2693 wrote:I still haven’t received my taxes now y’all tryan charged me wen I haven’t got paid yet

If you chose to pay your TurboTax fees out of your Federal refund, and if your Federal refund has been delayed unusually long at the IRS (or if it's been reduced), TurboTax will want to be paid. They likely started sending you emailed bills to pay. If you don't respond by either paying or asking for a deferment, they will ultimately debit your bank account. If you wish to ask for a deferment, you need to do so quickly.

See this FAQ that explains the process. The first paragraph of the FAQ has a special phone number if you have a question or have a hardship and need to ask for a deferment.

Hours are 5AM-5PM Pacific (8AM-8PM Eastern), Mon-Fri

If you need to ask for a deferment, you should call them as soon as possible. Once they actually start the debit process, they say they can't stop it.

FAQ: Why was my bank account auto-debited for the TurboTax fees?

The first paragraph there says:

If you’re in need of assistance, call us by the Tuesday prior to your debit date at 1-888-808-1723 to speak with a trained specialist and mention “auto-debit”, or visit TurboTax Support.

If for some reason you can't reach Support with that phone number in the FAQ, there may be one in your emailed bill. Otherwise, here's an alternate way to reach them, but try the one mentioned above first.

FAQ: What is the TurboTax phone number?

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jillwhite

New Member

user17724788612

New Member

cokaren17

New Member

Como1993

Returning Member

Cris

Level 3