- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I use Mortgage Interest Credit Carryforward for Mortgage Credit Certificate (Form 8396 Mortgage Interest Credit)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use Mortgage Interest Credit Carryforward for Mortgage Credit Certificate (Form 8396 Mortgage Interest Credit)?

How do I use Mortgage Interest Credit Carryforward for Mortgage Credit Certificate (Form 8396 Mortgage Interest Credit)?

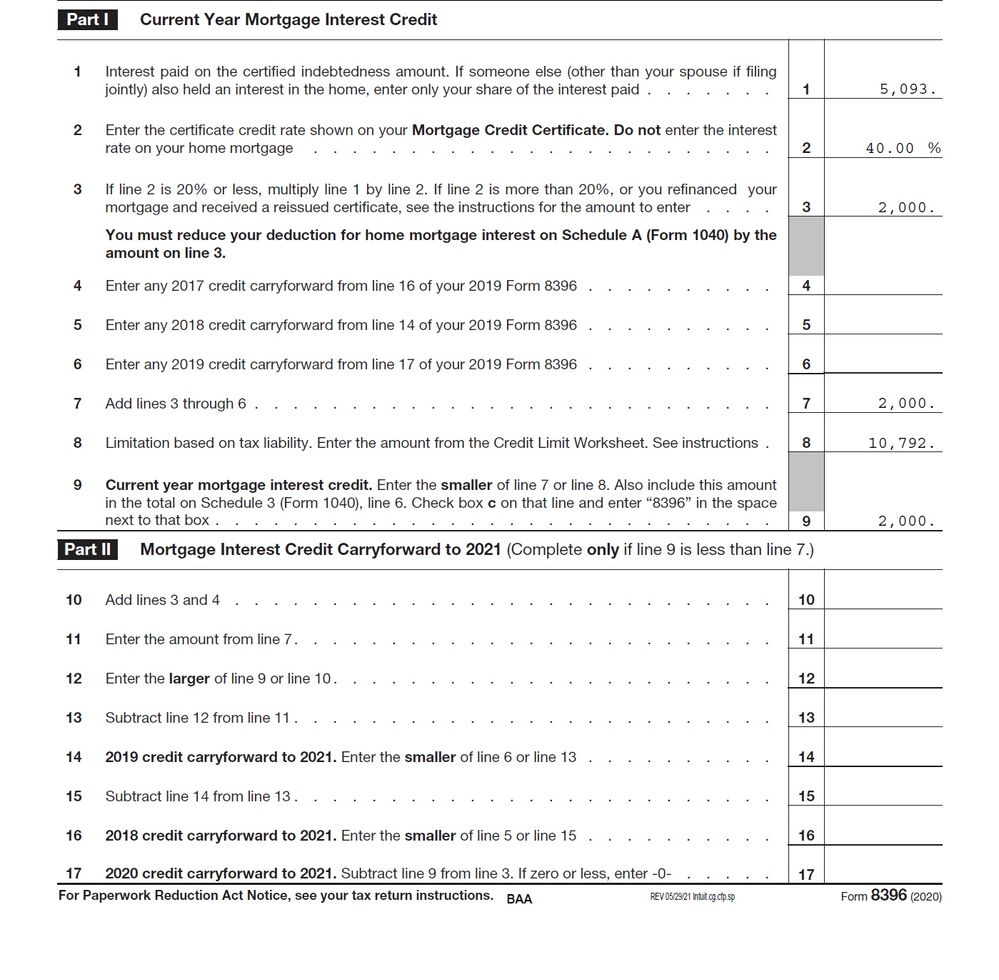

I've been filing my own taxes on TurboTax, but have never understood how Form 8396 Part II "Mortgage Interest Credit Carryforward to 2021 (or insert current year)" works.

I am currently entitled to deduct the certificate credit rate shown on my Mortgage Credit Certificate of 40%.

How do I use the Carryfoward part II when line 9 is less than line 7?

Thanks so much for your time and attention to my question!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use Mortgage Interest Credit Carryforward for Mortgage Credit Certificate (Form 8396 Mortgage Interest Credit)?

Line 7 is all the credit you have available to use and line 9 is the credit you are able to use based on your tax liability. If your tax liability was $1000 for example on the form you provided, then you would have a carryover of $1000 to the next year because line 9 is less than line 7.

Part II is used to figure that carryforward to 2022. TurboTax will complete the form and math based on your entries.

The next year you would need to find this form in your tax documents to see the carryforward when asked in the MCC interview.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use Mortgage Interest Credit Carryforward for Mortgage Credit Certificate (Form 8396 Mortgage Interest Credit)?

I suspect that your mortgage interest credit is being limited by some other credit in your tax return? That could explain why line 9 is greater than line 7?

I have had experience with taxpayers who are unable to use up all of the credit when other credits are available to the taxpayer.

Are you able to view the complete tax return and see whether there is a worksheet to limit the tax credit?

In TurboTax online the forms can be viewed at Tax Tools / Print Center / Print, save or preview this year's return.

To view these forms in TurboTax Desktop version, click on Forms in the upper right hand corner of the screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use Mortgage Interest Credit Carryforward for Mortgage Credit Certificate (Form 8396 Mortgage Interest Credit)?

Please see the attached Form 8396 Mortgage Interest Credit for further clarification on my question regarding the Mortgage Interest Credit Carryforward and how does it work:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use Mortgage Interest Credit Carryforward for Mortgage Credit Certificate (Form 8396 Mortgage Interest Credit)?

Line 7 is all the credit you have available to use and line 9 is the credit you are able to use based on your tax liability. If your tax liability was $1000 for example on the form you provided, then you would have a carryover of $1000 to the next year because line 9 is less than line 7.

Part II is used to figure that carryforward to 2022. TurboTax will complete the form and math based on your entries.

The next year you would need to find this form in your tax documents to see the carryforward when asked in the MCC interview.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

42Chunga

New Member

bjw5017

New Member

4md

New Member

RCarlos

New Member

in Education

sam992116

Level 4