- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I report TurboTax Software Errors?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Using Turbotax desktop Home and Business 2021. Form 2210 estimated tax penalty seems to be completely out of date, with references to the due dates for 2020 in Part III. As a result it calculates I owe a penalty when I don't.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Using Turbotax desktop Home and Business 2021. Form 2210 estimated tax penalty seems to be completely out of date, with references to the due dates for 2020 in Part III. As a result it calculates I owe a penalty when I don't.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@DeeDee47 wrote:

Using Turbotax desktop Home and Business 2021. Form 2210 estimated tax penalty seems to be completely out of date, with references to the due dates for 2020 in Part III. As a result it calculates I owe a penalty when I don't.

Form 2210, Underpayment of Estimated Tax for tax year 2021 is estimated to be available on 03/17/2022

Go to this TurboTax website for IRS forms availability -https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

UPDATE new error faq for it

The & in W2 box C is not showing correctly.

TurboTax CD/Download W-2 box C not showing ampersand(&) correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

May I therefore suggest that if someone wants to file earlier than that in order to get a refund, they should check the box on Form 2210 for the IRS to calculate the penalty, in which case the problem goes away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Correct, the program is waiting on form 2210. The state and federal governments approve the most common forms first and work their way down the list. Please see the links for form availability. Once a date shows up, the reality should be close. Once released, Turbo Tax will work quickly to get it working in the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Hi,

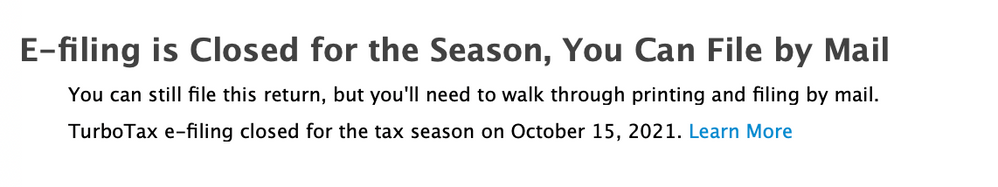

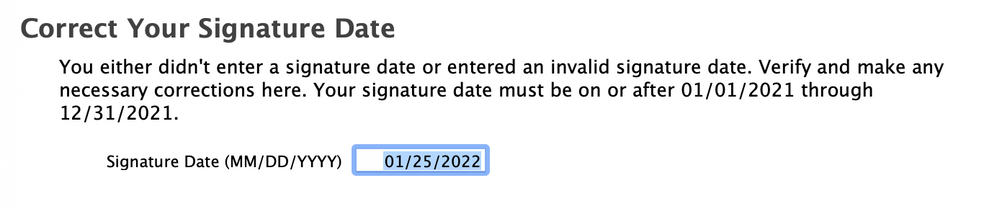

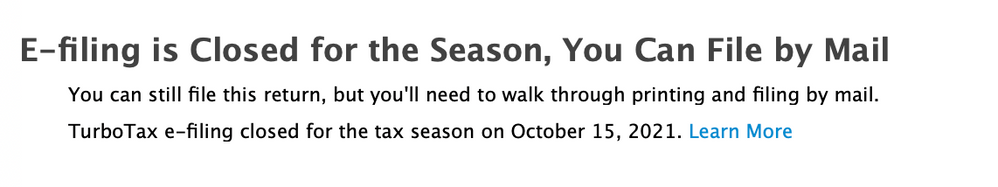

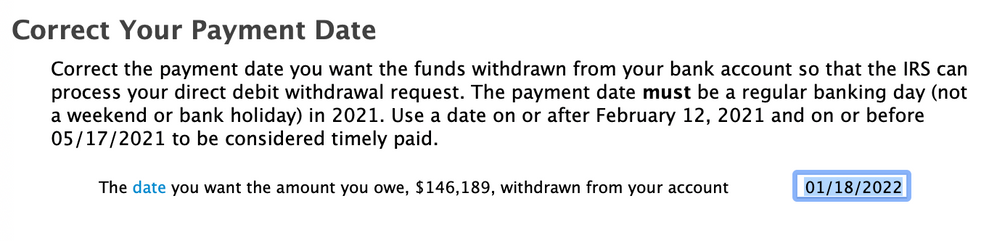

I tried efiling my amended 2020 tax return again today. I got the same errors from Turbo Tax and it failed to eFile:

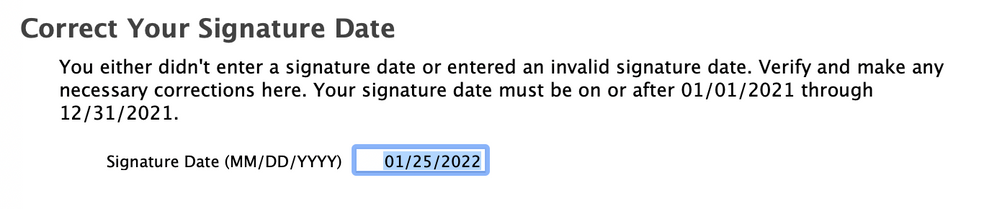

When I started the whole efile process it started by saying that e-Filing is closed for the Season, You can File by Mail. When I ignored that message and went through the process of trying to e-File it complained about the signature and payment date and would not let me file. I have attached snapshots of the error messages.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

I am preparing tax returns for my son and my daughter. One files joint and the other married/separate. TURBO tax rates are not matching the ones indicated on IRS.gov. A discrepancy of $1611. My daughter's is even more. The discrepancy for her is $4460. Why are the tax rates on TURBO tax not matching the ones on IRS.gov? In each case they would be paying a lot more in taxes they should.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Are you comparing the tax on line 16? And the taxable income on line 15? There may be other taxes or penalties added in. and there are several different way to figure the tax. Not just the tax table. Or you aren't getting the same credits.

If you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all worksheets to see it.

For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Click Forms in the upper right (upper left for Mac) and look through the list and open the Qualified Dividends and Capital Gain Tax Worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

And for Married filing Separate

Unless you have a specific reason to file separate returns,

It is usually better to file Joint. Joint has the lowest tax rates and the highest Standard Deduction. And if you are in a Community Property state MFS gets tricky to figure out. Here's some things to consider about filing separately……

In the first place you each have to file a separate return, so that's two returns. And if you are using the Online version that means using 2 accounts and paying the fees twice.

Many people think they come out better when filing Married Filing Separate but they are probably doing it wrong. If one person itemizes deductions then the other one must itemize too, even if it's less than the standard deduction, even if it is ZERO!

And there are several credits you can't take when filing separately, like the

EITC Earned Income Tax Credit

Child Care Credit

Educational Deductions and Credits

And contributions to IRA and ROTH IRA are limited when you file MFS.

Also if you file Married Filing Separately up to 85`% of your Social Security becomes taxable right away even with zero other income.

See …….

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

One TurboTax home and business, windows version, Turbo Tax appears to be calculating a penalty on form 2210 based on estimated taxes paid in 2020 instead of 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Hi DanielV01,

I'm not sure if you saw my reply:

I tried efiling my amended 2020 tax return again on January 25th. I got the same errors from Turbo Tax which would not allow me to eFile the amended tax return.

When I started the whole efile process it said that e-Filing is closed for the Season, You can File by Mail. When I ignored that message and went through the process of trying to e-File it complained about the signature and payment date and would not let me file. (The payment amount listed is also incorrect, but that is a separate issue). I have attached snapshots of the error messages. Any help would be much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@slawso I am just now seeing your post. If you need to reach out to me specifically, you can put the @ symbol before my username so that I am notified.

Having said that, I will look into what you are seeing. As was provided in the TurboTax Tax Tips Article, it is supposed to be possible to e-file your amended return, but it is something that is still new. Let me do some further research, and if we can provide more information we certainly will do so. In the meantime, thank you for your patience.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

I notice the software has added gobly **bleep** to my employer name. It was imported from last year and it was correct then. I even tried to delete it and I redid it. There is an & in the employer name and it is adding amp; amp;amp;amp;. Instructions say if the employer name is not the exact same as the w2 it could delay processing. How to handle.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@slawso We want to take a deeper look into why you are getting the message you are receiving. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:”

TurboTax Online:

1. Sign into your online account.

2. Locate the Tax Tools on the left-hand side of the screen.

3. A drop-down will appear. Select Tools

4. On the pop-up screen, click on “Share my file with agent.”

5. This will generate a message that a diagnostic file gets sanitized and transmitted to us.

6. Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

1. Open your return.

2. Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent”

3. This will generate a message that a diagnostic copy will be created.

4. Click on OK and the tax file will be sanitized and transmitted to us.

5. Please provide the Token Number that was generated in the response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kaefreeman1

New Member

Celtlaw71

New Member

wattw2015

New Member

sambb

Level 2

tomd514

New Member