- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

You can choose to enter this as a cash payment of business income by selecting Income from farming activities (if you choose this, delete the 1099-NEC). Continue through the screens until you can enter the amount of income received on your Form 1099-NEC. The form is an information document and is not required to be specifically entered in the form itself. Be sure to keep this with your tax records.

This will allow you to move forward to complete your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

This worked!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

Diane, I really, really appreciate your prompt help with this. Unfortunately, deleting my 1099-NEC didn't remedy the issue. I still get the prompt, and I can tell from the prompt that TurboTax didn't really delete my 1099-NEC...the application references the old name of the payer from the 1099-NEC in the prompt. (The payer's name was "Casey County Conservation District".) Any more ideas? I deleted the 1099-NEC and clicked all the way through the Federal wizard again, but the delete didn't seem to take. If I click back into the 1099-NEC wizard there is not one listed there, so nothing for me to re-delete.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

There is a known issue when using TurboTax Online that is related to the program asking you to double-click to link to Schedule C. Take a look at the TurboTax article below and use the link in the article to enter your email address to be notified once this is resolved.

Why can't I link my 1099-NEC in TurboTax Online?

Alternatively, take a look at the additional information below for a possible series of steps to solve the issue.

Since income reported on Form 1099-NEC needs to be reported on Schedule C, the program is trying to tie these two forms together to be sure that it is reported correctly and on the right form.

You have already tried deleting the Form 1099-NEC, but now you need to add it back to your return through a Schedule C. This will insure that the income is reported directly as part of your Business Income and Expenses and within the correct form and section of your return.

Use these steps to go to the Schedule C section of your return.

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “schedule c” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to schedule c”

- Click on the blue “Jump to schedule c” link

If you already have a Schedule C in your return, edit it and go to the section to Add Income. This is where you will re-enter the Form 1099-NEC.

If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099-NEC. Then continue through that section to Add Income and enter the Form 1099-NEC plus any other income you received for that self-employed business.

Don't forget you can also claim expenses related to your business.

After you are finished, the error condition should be eliminated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

I appreciate this response, but as I mentioned earlier, I don't have a schedule C, I have a schedule F, so I can't follow those steps. I did enter my email to be notified of the bug fix.

I have to wonder if my problem isn't the fact that I am not able to delete my 1099-NEC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

You want to make sure you clear the cache and cookies from your browser once you delete the 1099-NEC. This can be a life saver when your computer remembers things you want it to forget.

As far as entering the cash income, because it belongs to the Farm, it must be entered on Schedule F, not Schedule C as you noted.

I didn't specifically list the steps, so they are here for you now.

- Open your TurboTax account > Business tab or Wages and Income > Scroll to Farm Income and Expense or Rentals, Royalties, and Farm > Update or Revisit (depends on the version you are using).

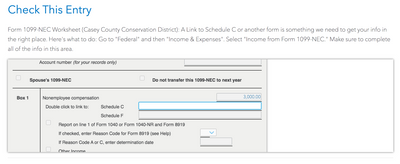

- Continue through the screens until you have the screen to enter the income (see the image below)

- Enter your farm income and complete the rest of the farm information to complete your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

@DianeW777 Thank you so much for your continued attention. I cleared my cache and cookies, tried e-filing again. Still no luck. Same issue. Please advise. I appreciate the instructions for entering cash income, but I know how to do that. I already did that. The problem is the application is referring to a 1099-NEC that I deleted. I have no way to "re-delete" it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

Well I am digging myself deeper into a hole here. I thought creating a "dummy" schedule C and then deleting it might flush the pipes out somehow and get me past this, but instead I have doubled my issues. Now when I try the Review "completecheck" I get TWO errors, both associated with 1099-NEC/schedule C's that have been deleted. I have no way to go back and "re-delete" them. Please advise. If it matters, I was using an "incognito" window to try and eliminate any errors associated with cookies/cache.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

If you have not already deleted it from the left menu, try these steps in a Chrome web browser:

- From the left menu, select Tax Tools.

- Select Tools.

- Scroll to Delete a form and scroll for Form 1099-NEC.

- Follow these steps for the Schedule C, also.

- Delete it and confirm the deletion.

Otherwise, check your entries that you have now included to make sure it is only reported once for your Schedule F.

For your reference for other details about Farm income and expenses, see the IRS Agriculture Tax Center.

[Edited 02/08/2021 | 1:07 PM PST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

@KathrynG3 Bless you! That did it! Thank you so much. My taxes are done and filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I link to Schedule C on my 1099-MISC for Box 7? I am told to double-click to select, but there is not option to do so.

Hooray! You're welcome - We are happy to help!

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Edandaudrey

Level 1

GAHannon

New Member

aoclba

Returning Member

bartzda67

Level 2

in Education

Mcb050032

Level 2