- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

You will need to enter the information from Form 1095-A. You will indicate that the policy is shared with someone who is not on your return. You may enter any allocation percentage you agree upon, even 0% & 100%, as long as the total between all covered taxpayers is not greater than 100%.

If you purchased insurance through the marketplace and received a 1095-A, that must still be reported on your return.This will calculate the Net Premium Tax Credit on Form 8962. This form reconciles the amount of the credit available to you with the amount already received as an Advance Premium Tax Credit. The result could be additional credit owed to you, or you may have to repay any amount already received in advance. Because of either of these results, it is important for taxpayers to include the information from Form 1095-A on their return.

Follow these steps:

- Click on Deductions & Credits under Federal

- Under the menu for Medical, click Start/Revisit next to Affordable Care Act (Form 1095-A)

- Answer Yes indicating that you have the form to enter

- Complete the information on the next screen to match your form and click continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

I know my SLCSP percentages, but I have three taxpayers on my plan that were on and off for different time periords. How do I allocate the SLCSP percentages within Turbotax for my return, as well as that of two additional tax returns (individuals).

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

If I understand correctly, you have one form 1095-A and want to know what to allocate to the other individuals covered on your insurance who are filing their own tax returns.

I suggest you assign a number of "1" to each covered individual for each month of the year they had coverage. Then add all the numbers together and divide the total by each individual's number total. That will give you a percentage for each, the total of which is 100%.

Use your percentage to enter on your tax return and the other's percentage to enter on their tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

If we choose to do a 0 and 100 allocation between myself and my parent, do I still need to input the 1095-A information in? What would be the repercussions of this? Some say to divide 1 (myself) by the total number of people which would give me a 50/50 allocation in my case.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

The IRS only requires that both of you agree on the percentage that you are claiming and that the percentages for each field add up to 100%. Since your mother claimed 100%, you will claim zero and the percentages will be correct.

To enter your 1095-A follow these steps:

- Federal

- Deductions and Credits

- Medical

- 1095-A

- Fill in the first page exactly as it is on the 1095-A

- The next page will say: Let us know if these situations apply to you

- Check I shared this policy with another taxpayer who is not on my taxes

- On the next page put your parent's social security number

- Use zero for your Premium Percentage, SLCP Percentage, and PTC Percentage

Form 1095-A is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier. The form does not have to be returned to the government but serves as a record of the individual's coverage.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

Where is "Federal" on Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

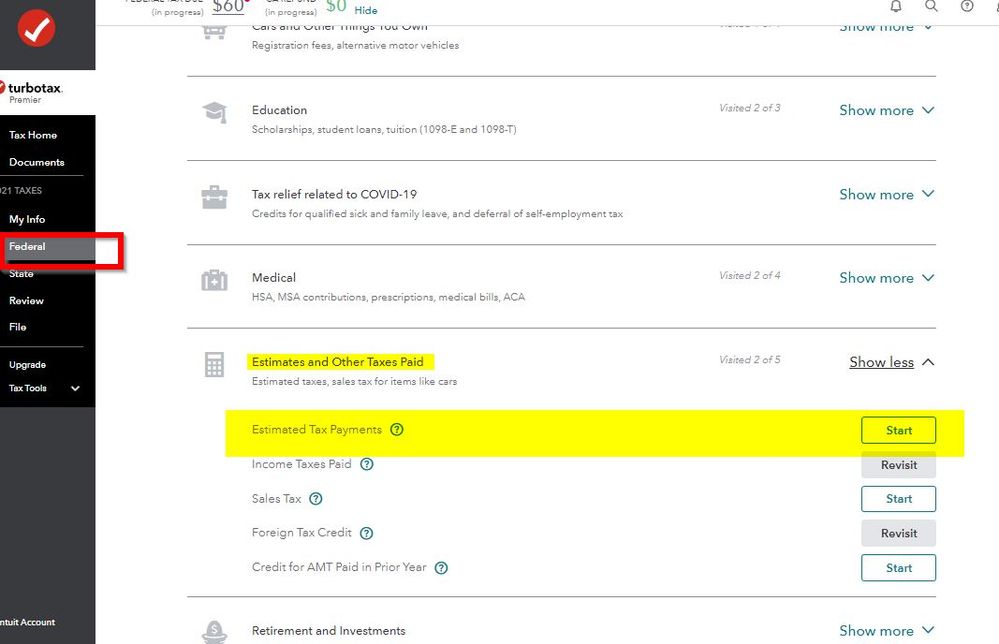

@michellereese2806 What version are you using? In the Desktop Home & Business version you don't have a Federal tab but Personal Income.

In the Online versions Federal is on the left side menu bar. Here's a screen shot. You have to log into your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

Hello, I am having trouble figuring out the premium percentage and slcsp percentage. Is there a written out mathematical example that could be provided. I am not claimed by my parents but share a marketplace health policy in which the monthly premium, slcsp and monthly premium advance tax credit was the same each month for all 12 months in 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

There actually are some examples that would be useful to you. You can find them in the text below Allocation Situation 4 - Other situations where a policy is shared between two tax families in the Instructions for Form 8962.

According to Allocation Situation 4,

… you and the other taxpayer may agree on any allocation of the policy amounts between the two of you. You may use the percentage you agreed on for every month for which this allocation rule applies, or you may agree on different percentages for different months. However, you must use the same allocation percentage for all policy amounts (enrollment premiums, applicable SLCSP premiums, and APTC) in a month. If you cannot agree on an allocation percentage, each taxpayer’s allocation percentage is equal to the number of individuals enrolled by one taxpayer who are included in the tax family of the other taxpayer for the tax year divided by the total number of individuals enrolled in the same policy as the individual(s). The allocation percentage you use and that you put on line 30 of Form 8962 is the percentage of the policy amounts for the coverage that you will use to compute your PTC and reconcile APTC.

Please see the section cited above in the link to review the full text.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

I HAVE APOLICY FOR MARKETPLACE MY DAUGHTER IS FILLING HER TAXES NOW BY HERSELF HOW DO I FIGURE HER POSENTAGE SHE WAS ONLY 3 MONTHS IN THE POLICY

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

You get to do fun math. Look at the three months that she was in the policy and then divide the numbers for those three months by the number of people you had on the policy. She puts her share on her return and you put the remainder on your return.

For example, if you look at January and the numbers in columns A, B and C are $200, $160, and $100 for that month and you had four people on your policy then your daughter's share is one fourth of each column total. So on her return for January she would enter $50, $40 and $25. You would enter the rest on your return - $150, $120 and $75.

The total of both of your entries on the form should add up to what the total on the form is.

She will only need to enter information into the three months that she had coverage. The rest of her months get left blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

So, I have 6 people on my 1095-A 2 are independent adult children that don't make very much money. If the 2 adult children each take 50% of premium percentage, SLCSP percentage and PTC, and I take 0% we would get the best tax advantage. Is this an acceptable way to handle it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

Yes, if you have two persons on your 1095-A Health Insurance Plan that you are not claiming as your Dependents (and they are filing their own returns), you can Allocate a % of Premiums between you any way you choose, as long as the Allocations add up to 100%.

Here's more info on how to enter amounts in TurboTax when Allocating Form 1095-A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure out the Premium Percentage,SLCSP Percentage and Advanced Payment of PTC Percentage if I share health insurance marketplace with my parents?

So My Dad is a "Recipient" and I am in "Covered Individuals." We are filing separately. My question is can my dad set "your premium", "your SLCSP Percentage", and "Your advanced payment of PTC Percentage" to 0%? And I set to 100%? Also, every covered individuals have to add 1095A? because I do not see to add another person in a shared policy option.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 2

Kenn

Level 3

Aleriom

New Member

nirbhee

Level 3

donnapb75

New Member