- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I enter Section 199A dividends reported on 1099-DIV?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

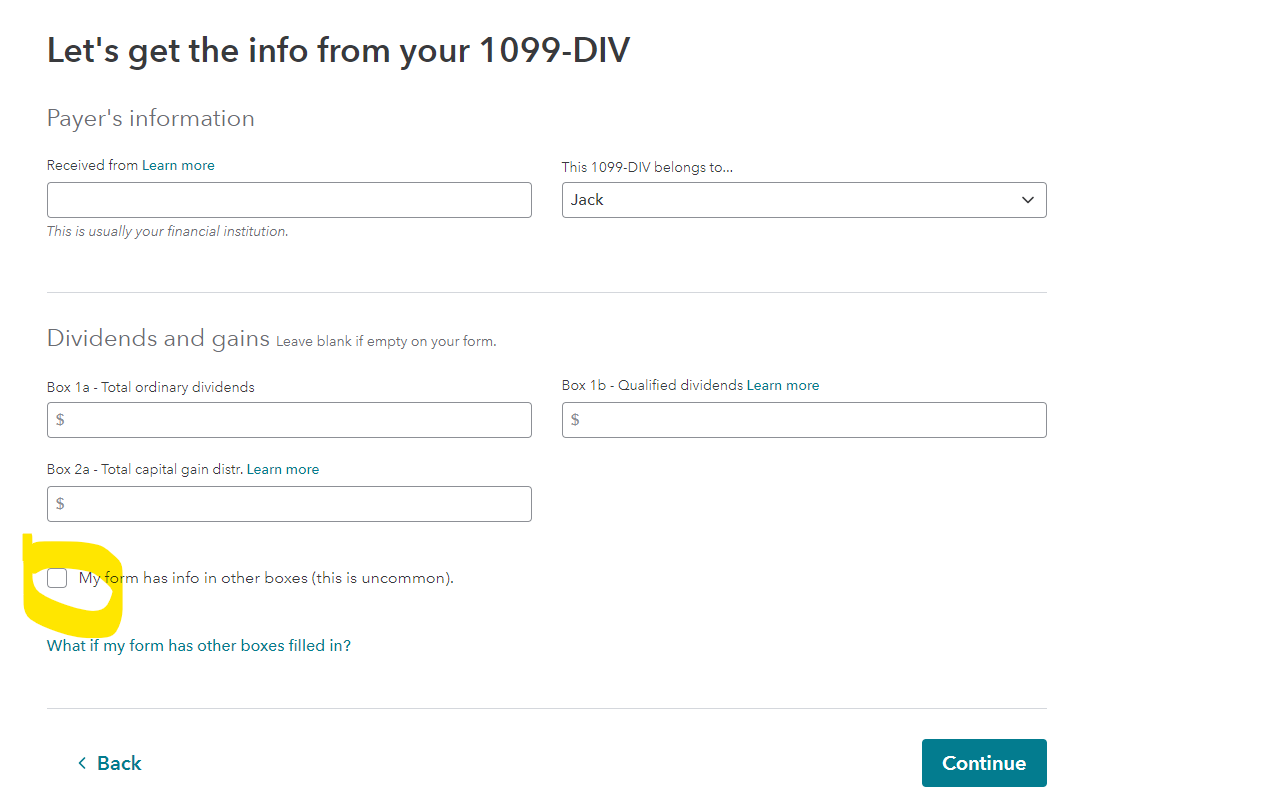

To enter the box 5 amount on your form 1099-DIV, you will see box below the box 1(b) entry for your 1099-DIV that says My form has more than just these boxes (this in uncommon), check that box and your will see where you can enter the amount in box 5, Section 199A dividends.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

To enter the box 5 amount on your form 1099-DIV, you will see box below the box 1(b) entry for your 1099-DIV that says My form has more than just these boxes (this in uncommon), check that box and your will see where you can enter the amount in box 5, Section 199A dividends.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

Can this be done in the Online version? I don't see this option. Do I need to buy the download version to input this information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

Yes, this can be done on TurboTax Online.

In the Dividend section, check the box My form has info in other boxes (this is uncommon). The other boxes will show up then.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

I should clarify that I'm trying to input this information for my child that who's Divided income I am trying to include on my return in the Child's Income section. I don't see a place here to input this information. Will I need to file a separate return for him because this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

You can enter those in the "Ordinary Dividends" box in the "Child Income" topic. On the 1099B, the 199A dividends are a subset of box 1A and taxed as ordinary income. However, the 199A dividends are separately identified to be eligible for the qualified business deduction (20% of amount deducted from income).

In order to get that qualified business deduction you would need file a separate return for him and enter the form 1099B.

The savings may be negligible. For example if your tax bracket is 10% and the 199A dividend amount is $1000 the tax will be $100 on your return. However on his return only $800 is taxed so the tax will be $80. This is a simplified example there may be other factors.

You can start a free return for him in TurboTax without filing to compare to your return with/without the dividends.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

My Turbotax lists box 5 as "Investment Expenses"; 199A Dividend is not an option on the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

TurboTax 1099-DIV input screen shows:

Box 4 - Federal income tax withheld Box 5 - Section 199A dividends

Box 6- Investment Expenses Box 7 - Foreign tax paid

The Section 199A dividends can be entered in Box 5 as shown below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

This reply is not correct: The list shows up but no boxes -- in particular, no blank for box 5.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

Are you able to click My form has info in other boxes (this is uncommon)?

See here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

I finally clicked in the right place to get the boxes to show. Before that, if they were there, the lines were so thin and faint that they did not show on my desktop machine (2022 iMac). I suggest the detail people make the lines thicker or have the boxes flash when the bold print numbered box titles are clicked on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

How do I enter Section 199A dividends reported on 1099-DIV that has amounts in Items Boxes Numbered 3; 7; and 8 that will eliminate the Red Flag Errors I am receiving on Turbo Tax Home & Business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

199A dividends are reported on line 5 and have nothing to do with line 3,7 ,8

the amount on line 1 of the 1099 gross dividends must be great than line 5

line 3 isn't used for anything and is not reported

don't know what you have on line 7 or 8 but if you are below the threshold for filing form 1116 ($600 for joint returns $300 for all other filing statuses) the only number to enter is the amount of the foreign tax credit. otherwise all other info is required including selecting a column, linking to form 1116 and completing that form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

What if the Sec 199a dividends were reported on a K-1 from a Trust? Where would this be entered (there is no box like there is if it were coming from a 1099)? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Section 199A dividends reported on 1099-DIV?

What if the Section 199a amount is reported on a K-1 from a trust and not from a 1099? I don't see how the number can be inputed other than on line 5 of a 1099. Thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pmichael5

New Member

rfisher71

Level 3

jtaxuser

Level 3

ronmckee15azcat

Level 2

CT311

Level 1