- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How are mutual funds taxed every year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

I have Vanguard's VTSAX mutual fund which is doing quite well. It's been quite a while since I had money in a mutual fund but I recall that changes to the tax code sometime in the early 2000's I think, required me to pay taxes even though I did not sell any shares. If I recall correctly since shares in a MF are constantly being sold and bought the Feds decided to tax based on this buying and selling. Is this the case? Will I be required to pay tax on my MF even though I didn't sell a single share?

If this is true will I get a statement from the IRS in January telling me what is taxable? It's hard to plan for a potential tax payment when I don't really know what's going on behind the scenes. If you need more info about my MF let me know and I can post it here.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

@streetwolf wrote:

.....since shares in a MF are constantly being sold and bought the Feds decided to tax based on this buying and selling. Is this the case?

Yes, that is the case with many mutual funds; the underlying assets are bought and sold potentially creating gains for the holders of shares in the funds (typically referred to as capital gains distributions, which are long term capital gains).

You should receive a tax reporting statement, such as a 1099-B, from your broker or direct from Vanguard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

If you own mutual fund shares there are 3 ways to be taxed... all of these will be reported on the year end consolidated statement issued in mid to late February or March...

1) dividends are paid

2) cap gains are paid at the end of the year for any net gains the funds made even if you don't sell your shares or use the DIV or Cap gains to buy more stock ... any losses incurred are netted against the gains before they are issued.

3) you sell the mutual funds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

You will get a capital gain and/or a dividend usually in December. typically this is reinvested (recommended) because that's how you make money in mutual funds over the long term.

If you have a cash flow issue with taxes you may be forced to sell some of your fund to pay the tax.

Then you will pay tax again on any gain from what you sold to pay tax.

This is call confiscation from the middle class to transfer benefits to the poor.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

The broker should keep track for you.

I'm invested in several mutual funds and I left them alone after the original purchase. At the end of the year I had:

- some taxable dividends (got re-invested so I pay income tax but it increases my cost basis)

- some tax-free dividends (re-invested but does not increase the cost basis)

- some taxable short term capital gains (taxable now, but the new stock that was purchased has the higher cost basis)

- some unrealized capital gains (will be taxed if and when I cash out)

The broker will keep track and you will most likely get a combined 1099-INT/1099-DIV/1099-B at the end of the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

Since you specifically mentioned VTSAX, you do not have to guess at the tax treatment you will receive.

The dividend and capital gains distributions are listed at the site below (as well as other fund information).

https://investor.vanguard.com/mutual-funds/profile/distributions/vtsax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

One thing nobody mentioned.....are these in a personal account? If you have funds or stocks in a IRA or 401K or retirement kind of account you do not pay tax on any dividends, interest or sales. You pay ordinary income tax when you take a distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

@Anonymous_ I sent you the output of the Vanguard link you posted for me for you to look at?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

you won't be getting statements from the IRS at year-end. those 1099's come from the fund. you'll receive a 1099-DIV if either ordinary and/or capital gain dividends are paid. you'll receive a 1099-B if you personally sell shares. some funds send out a consolidated 1099 to report both types of 1099's.

every fund has an investors relations website that might contain projected tax info for the year. also most if not all send out quarterly reports of what occurred in an investor's account. this would include dividends paid - broken down between ordinary and capital, dividends reinvested and report of gain/loss onyour own sales.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

The IRS had to muck up MF. Why couldn't they just treat them like individual stock as in the past. Oh yeah I know, they want to squeeze more money out of the taxpayer sooner than later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

@streetwolf Huh? What do you mean? The mutual fund 1099 statements usually come out in Feb each year. Here's mine from Vanguard. It was issued on Feb 12. You enter each line into Turbo Tax 1099Div form, the box numbers go across the top. Or you can import directly from Vanguard into Turbo Tax. But you have to wait to file until the 1099 statements come out, which might be late February and they may send corrected 1099 forms later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

@streetwolf aren't you getting quarterly statements from the MF? if not contact the fund to see if it issues them. I have several and receive a quarterly statement from each if there's activity. it includes dividends and also reports gain/loss on any shares I sell. maybe you have to access your a/c online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

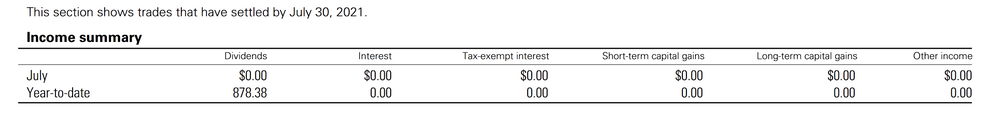

This is my latest statement. Does this tell me that the only tax liability I have, so far, is from dividends?

Btw.. I have two other VG accounts both IRA. I assume I have no tax liability until I start taking money out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

Yep. You only have some dividends to add to your income tax return so far. Most funds do make more dividends and capital gains distributions in Dec at the the end of the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are mutual funds taxed every year.

Oh by the way, are you reinvesting the dividends? So they buy more shares? When you eventually sell the shares don't forget to increase your cost by the dividend amount. A reinvested dividend is really 2 transactions....a dividend and then buy more shares.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BaliAgnes

New Member

peteysue07

New Member

tidwell-monique74

New Member

Bruno_Mesquita

New Member

Lukas1994

Level 2