- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Homebyer Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Homebyer Credit

So I was doing my taxes on TurboTax and it asked me if I purchased a home in 2008 and took the homebuyer credit (2008 homebuyer credit needs to be repaid).

This made me remember that I purchased a house, and took the homebuyer credit, but I can't remember the exact year. It was sometime between December of 2008 and April 2009 (2009 homebuyer credit doesn't need to be repaid if lived in home for 36months). For some reason I lost my 2008-2010 taxes so I can't go back and check them to see when I got those credits.

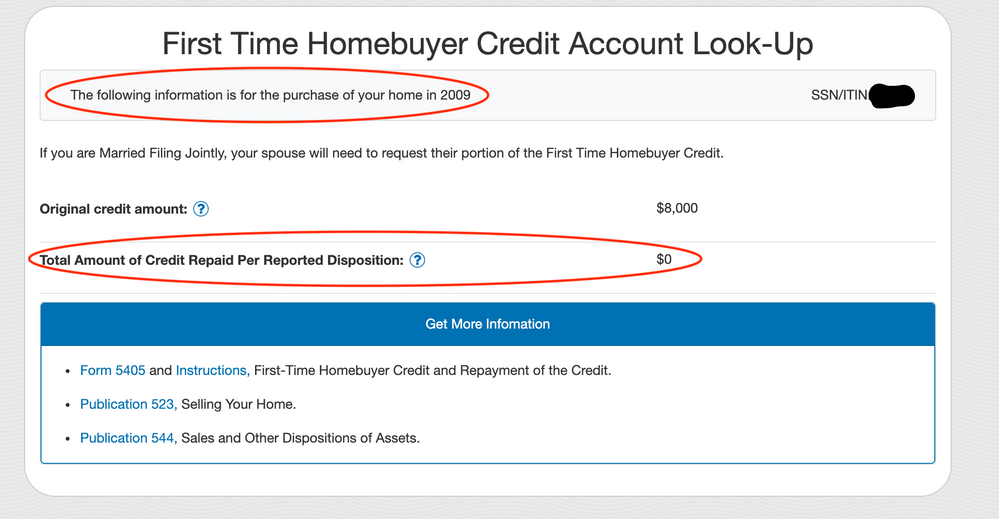

I found an IRS tool that shows the status of my homebuyer credit but it's confusing me: One of the fields says "The following information is for the purchase of your home in 2009" (so I'm assuming I don't owe the money since it confirms it was purchased in 2009) but then the "Total Amount of Credit Repaid Per Reported Disposition" field says 0. I'm interpreting this field as if I owe the money and haven't paid back.

Can someone familiar with this help me?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Homebyer Credit

There are a couple of important clues in the information you shared from your looking up your home buyer credit through the IRS. First, it states that you purchased the home in 2009. Second, it states that you received a credit of $8000.

Based on those two pieces of information, you do not need to worry about entering anything into your tax return with regard to the home buyer credit. Yours was claimed in 2009 instead of 2008. The maximum amount of the 2008 credit was $7500, not $8000.

The statement about the amount that was repaid due to reported disposition just means that you have not repaid any of the credit due to selling the house within the time frame that is would be required to be repaid. It does not mean that you need to repay the credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Homebyer Credit

There are a couple of important clues in the information you shared from your looking up your home buyer credit through the IRS. First, it states that you purchased the home in 2009. Second, it states that you received a credit of $8000.

Based on those two pieces of information, you do not need to worry about entering anything into your tax return with regard to the home buyer credit. Yours was claimed in 2009 instead of 2008. The maximum amount of the 2008 credit was $7500, not $8000.

The statement about the amount that was repaid due to reported disposition just means that you have not repaid any of the credit due to selling the house within the time frame that is would be required to be repaid. It does not mean that you need to repay the credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gaurav-amarpuri

New Member

choiscut

New Member

Marciasparks1

New Member

jlfesh

Level 1

leticiareneev

New Member