- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

Wow, Dawn... seems like a viable option. Question though... I have already filed my S-Corp return and Health Insurance has never been expensed through the S-Corp because my understanding is that if I got paid for Health Insurance, that my 2 other part-time employees have to be paid for it too? So I have never done it. I used my Distributions and W2 salary to buy my own Marketplace Insurance. Will the solution you offered entail my having to refile my S-Corp or amend the W2 since it wasn't entered as an expense? The same has always been true with the HSA. I' had entered that on box 12 with W as advised through TurboTax which is non-taxable income for me. So this year, for some reason, it's not appearing as an HSA deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

DawnC and VolvoGirl, 😍 thank you BOTH for coming to my rescue. It sure takes a village!!

For those who are in a similar situation where you're self-employed, bought 1095-A Marketplace Health Insurance AND would like to take the Self-Employed Health Insurance (SEHI) Deduction on Schedule 1, line 17 but it wouldn't auto-fill... OR when it auto-fills, the numbers are duplicated on Schedule A and Schedule 1. Here's WHY and the SOLUTION.

As mentioned by Dawn C, IF your business is a LOSS, you can't take the SEHI, that is why it won't populate. THEREFORE (with Form 1095-A), if you have multiple businesses, make sure you FIRST (THIS IS KEY) link to a business income that has a PROFIT. In my case, it's my K-1 S-Corp business. I didn't know (have Schedule C and Schedule E businesses, and both were LOSSES) and I had linked to them first (as I wasn't aware it mattered). It wouldn't autofill on Schedule 1 to take the SEHI. When I later tried to link to my K-1 profitable business, it still wouldn't auto-fill Schedule 1, Line 17. There's probably a bug in the TurboTax software (boo!), so that if you made a mistake and clicked on a business loss (in my case Schedule C or E), it is unable to undo itself, as much as I tried linking the 1095-A to the K-1 business. It kept showing up on Schedule A as a Medical Expense (which you won't get the full deduction as there is a threshold to meet) and I was unable to OVERRIDE on Schedule 1, Line 17.

I followed DawnC's instructions, except in my case Sch K-1 business, for Box 17, I entered V, then clicked CONTINUE (there wasn't an AD option in my dropdown) and in my previous year, I had a "V" so I kept the same. Click on the box that says "I personally paid for health insurance...." and CONTINUE. Then enter the Medicare Wages (box 5 of W2) and Health Insurance Premiums you paid boxes (in my case, the monthly premiums I paid x 12, plus the return of premium credit). Disregard the footnote that tells you not to enter Marketplace Health Premiums. This is the ONLY easiest workaround that will get you your deduction AND be able to enter your 1095-A data to properly calculate if your Premium Credits were properly calculated and taken.

This is ultimately a TurboTax bug which they have clearly NOT FIXED over the last 2 years as I've read too many posts expressing similar frustrations. When 1095-A is linked to a business, it populates on Schedule A as well as Schedule 1, which should NOT be the case. I share the same sentiment, that I have paid for TurboTax for ease of a tax return, only to have wasted my whole day (as of this writing, 14 hours) working around and testing, so that I can file. Hope this helps people so they don't have to troll the internet for 7 hours before help came. Thank you ALL for helping!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

I just spent 3+ hours with Turbo Tax plus countless of my own hours trying to get 1095-A reporting, Premium Tax Credit, Schedule 1 of 1040 and Schedule A to work (Desktop version). It STILL didn't work even after over 1 1/2 hours with a TT CPA trying to get it to work. I too have used TT for many many years, and I have been a tax preparer myself. I followed the TT instructions for self-employed health insurance premium payments through the marketplace. TT created a phantom number and footnote on Form 7206, the SE Health Insurance Deduction worksheet. Also form 7206 did not appear in my side menu, it was invisible. it was by seeing a reference to that form on this forum that I found it. Short version of story: TT CPA did some research on her own, contacted her contacts at TT to tell them what is going on. Her colleagues didn't believe her when she told them the calculation was simply not working and that there was a mystery number that was included in the calculations. There was no way to override, or even right click on fields to find source of calculations like there used to be. TT CPA could not convince her colleagues that that is what was happening even though she saw it by viewing my screen. TT CPA was wonderful, sticking it out until we found a workaround that appeared to work correctly, at least for 1040 Schedule I (unlink 1095-A from business, enter health insurance premiums on C, zero out 7206), That deduction was correct and the Premium Tax credit calc and Schedule C all appeared correct (total deductions on C ignored health ins premiums which is correct). That was late last night, so I put it aside until this morning to double-check before filing. it's good that I did because although everything else is correct, the health insurance premiums now show up on Schedule A too! There is something wrong with these calculations. The fact that TT knew about this last year and didn't fix it is very concerning. I just happened to know what to look for. (Oh, and running a review always showed "no errors.") I ended up entering a negative number equal to my insurance premiums on Schedule A on a line in the worksheet that is for "additional medical expenses." That zeroed out TT's error and made my Schedule A correct. Wish I could tell the TT CPA I worked with about this. She said she was going to run my scenario on her desktop and show her colleagues what is going on. She doesn't know about the Schedule A issue though since I discovered that after we hung up. Hope she sees it and that everything is fixed for next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

Having the same issue. Completing the 1095A information is NOT populating the Self employed information at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

Did you put a check mark in the box that says you are self employed and then select your business? This is the way to get it to transfer to become a self-employed health insurance deduction.

Do you have a profit? The Self-Employed Health Insurance deduction is limited to your earnings. Meaning, you cannot deduct more than you earned.

Look at Schedule 1 line 17 to see if you did or did not receive the deduction.

On the menu bar on the left that shows.

- Select Tax Tools

- On the drop-down select Tools

- On the pop-up menu

- Select View Tax Summary

- On the left sidebar, select Preview my 1040

If you are using the desktop version, you can just switch to forms mode.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

When I do what you suggest, it creates a Schedule K-1 and I'm getting an error because it wants a Partership EIN and name. The business is a sole proprietor. Why is it doing this now?

Does Intuit have any intention of fixing this mess before 4/15????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

Delete the K-1 if you don't have one. Linking your 1095-A to your Schedule C does not require entering a K-1. I think you are in the wrong spot. After you enter the 1095-A, there is a box you can check to link to your business. This assumes you have a profitable Schedule C business entered into TurboTax. @CheeseHead12 After you enter the 1095-A, mark the self-employed box and then choose your Schedule C. In the example below - all the premiums from my 1095-A went to Schedule 1, Line 17.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

Did you read the post from the individual who said the only way he was able to get TT to do the right thing was to UNLINK the 1095-A from the business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

Where is the Line 17 on the 1040/1040SR supposed to be populating from? It's empty and I cannot override and if I select Data Sourse, it shows the Schedule C and the correct amount. Why isn't that amount populating this box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

Yes, I did see that, and we told him to unlink his 1095-A because he had multiple self-employment sources and a Schedule C with a loss (you have to have positive net income). To get the deduction on Line 17, you must have self-employment income in your return. Do you have self-employment income on Schedule C? If not, what is the source of your self-employment income?

Line 17 comes from insurance premiums entries, either from your 1095-A or business expenses, or an S-corp. There is a section for Insurance Payments in Common Business expenses in the Schedule C entry. @CheeseHead12

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

You are not alone. I'm having issues with self-employed health insurance. I input info on 1095-A and see a random $1,800 self-employed health insurance deduction in Schedule C (where it says not to input it)? I did not put in there because we purchased insurance thru a healthcare plan. Please help, Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

I don't know where on Schedule C you would see a health insurance deduction, as there is no line reserved for that on the form. Maybe it is listed on a worksheet that will not be filed with your return.

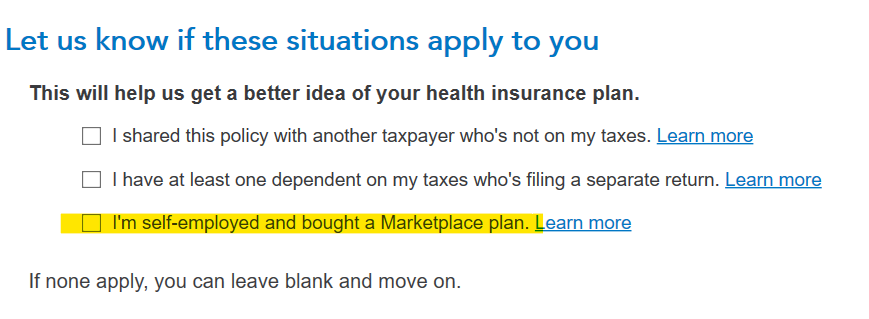

When you complete your Form 1095-A entry you need to indicate that you are self-employed and bought a Marketplace plan:

Then you assign the plan to your business:

You will see the allowable self-employed health insurance deduction on line 17 of Form 1040 schedule 1. It may be less than your premiums paid as it is affected by your premium tax credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

This is so frustrating. Unfortunately, I didn't catch this error until after I filed. I wonder if this is happening to me because I had a loss on rental property. I paid hundreds of dollars for this online software and I'm finding out this bug has been affecting people for years.😡 Turbo Tax told me to take it up with the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

UPDATE - NEVERMIND! I FOUND IT!!

Nowhere on the 1095-A page do I see that question. I have Home & Business 2024. Can anyone please tell me where i can find that question or how else I can link my self-employment to my 1095-A to get the deduction????

I'm SO frustrated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP!!! Self-Employed health insurance deduction with 1095-A NOT populating on Schedule 1!!!

Thank you for participating and for your update.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

botin_bo

New Member

cbdoran28

Level 1

itskristy

Level 1

barbara-stefl

Level 1

AviationFlyer2626

New Member