- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Help needed with K-1 and 1099-B for a Publicly Traded Partnership ETF sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help needed with K-1 and 1099-B for a Publicly Traded Partnership ETF sale

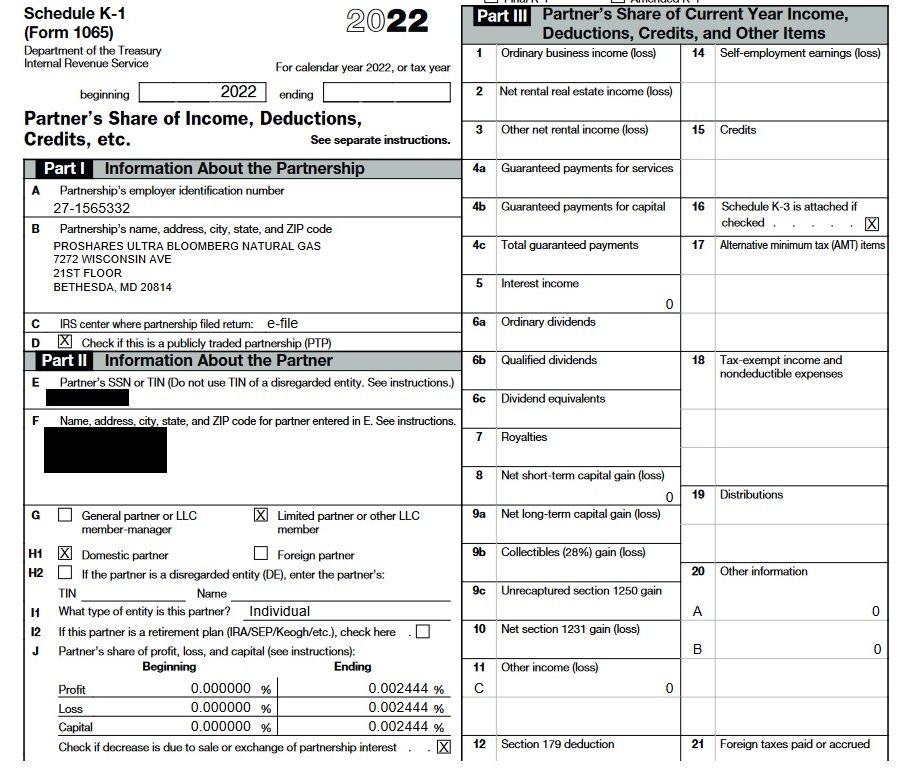

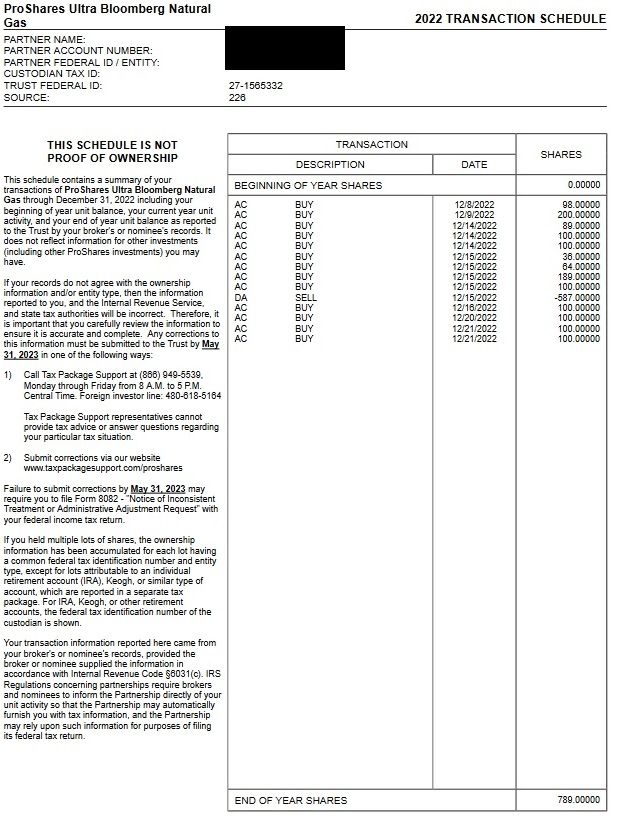

I have been procrastinating on doing my taxes with the extended deadline because of this K-1 stuff. I would appreciate if someone can help me figure this out and make sure I'm doing it correctly. Last year, I bought multiple lots of an ETF (BOIL) on different days and sometimes on the same day. I then had one sale of 587 shares, but still owned 789 shares at the end of the year. All the relevant documents are attached.

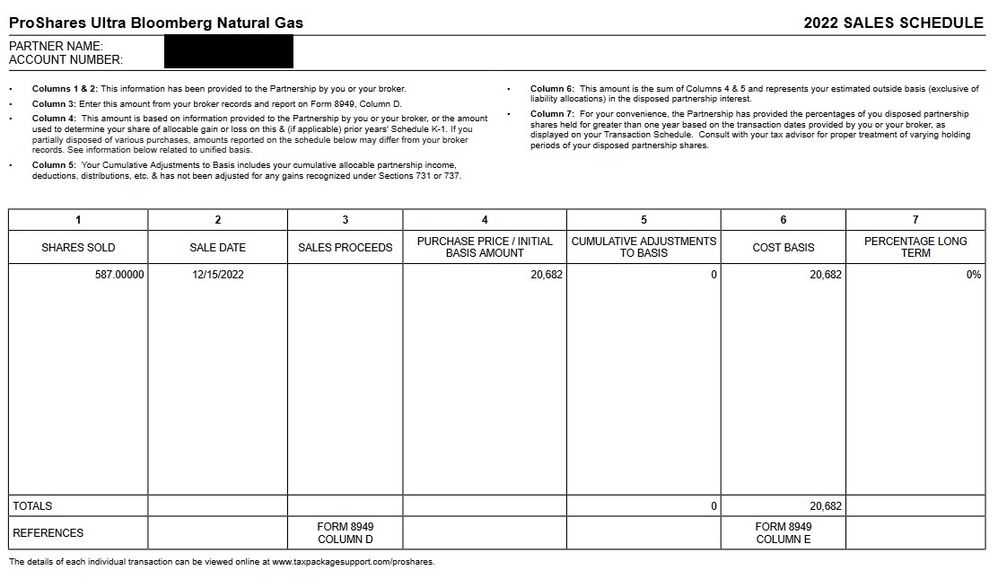

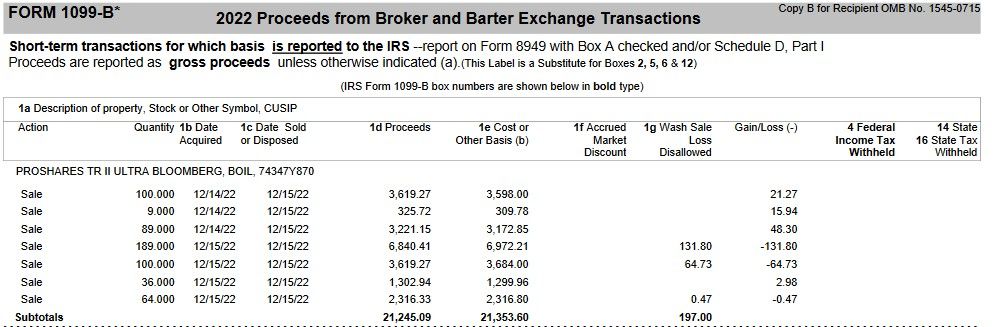

1. What cost basis should I use? So far, I just imported the 1099-B data into Turbotax. The 1099-B identifies which lots were sold off for the sale of the 587 shares. It seems like the broker is using last-in, first-out. The total cost basis is 21,353 (ignoring the disallowed wash sale loss).

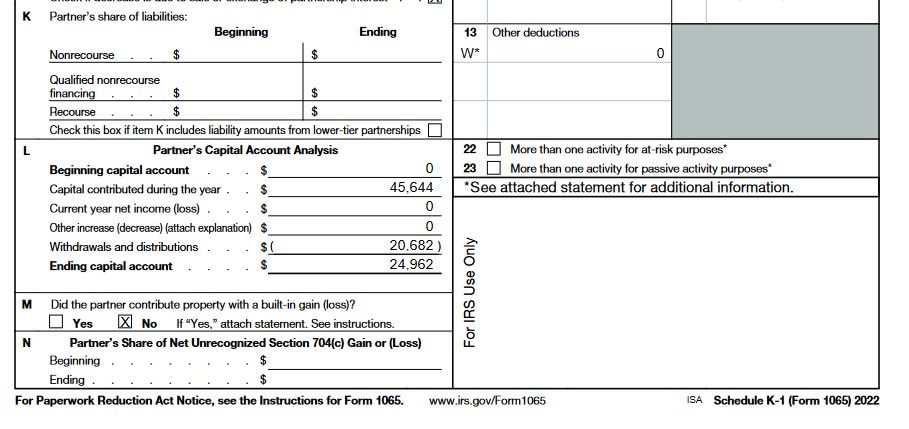

However, on the K-1 package sales schedule, the cost basis in column 6 shows 20,682. I figured out that this amount is based on the pro-rated cost basis for all the shares purchased on or before 12/15/2022. The pro-ration factor is 587/976, which is the number of shares sold divided by the number of shares owned on 12/15/2022. I think this is equivalent to the weighted average cost basis of all the lots owned prior to the sale.

So it seems that the cost basis from the broker was based on the cost of the last-in, first-out shares, but the ETF K-1 cost basis used the weighted cost average.

2. On K-1, box L, the capital account withdrawals and distributions amount is (20,682), which is identical to the cost basis shown in box 6 in the sales schedule. Is this always true? If the answer to my first question is use the 1099-B cost basis 21,353, will this cause a problem if the figure that I enter in my tax return doesn't match the withdrawals and distribution amount?

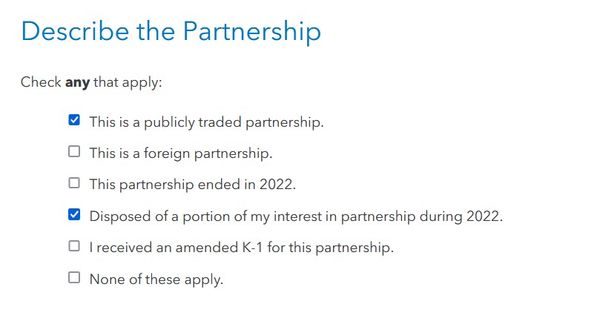

3. During the K-1 interview, are these selections below correct?

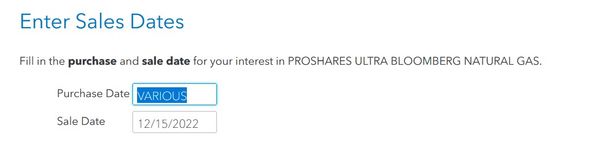

4. I had only one sale, but that sale consisted of lots purchased on multiple dates. The K-1 interview doesn't allow me to enter the different purchase dates, so do I enter "VARIOUS"?

5. I saw some threads about Turbotax could duplicate the ETF sales transactions. Importing the 1099-B added the transactions, but entering this sale during the K-1 interview will also add a duplicate sale transaction. How do I check for duplication in TT?

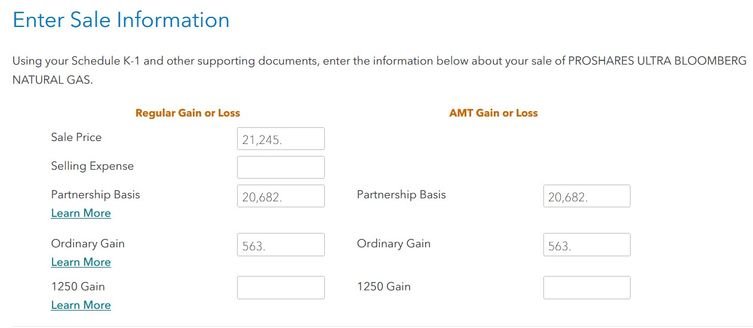

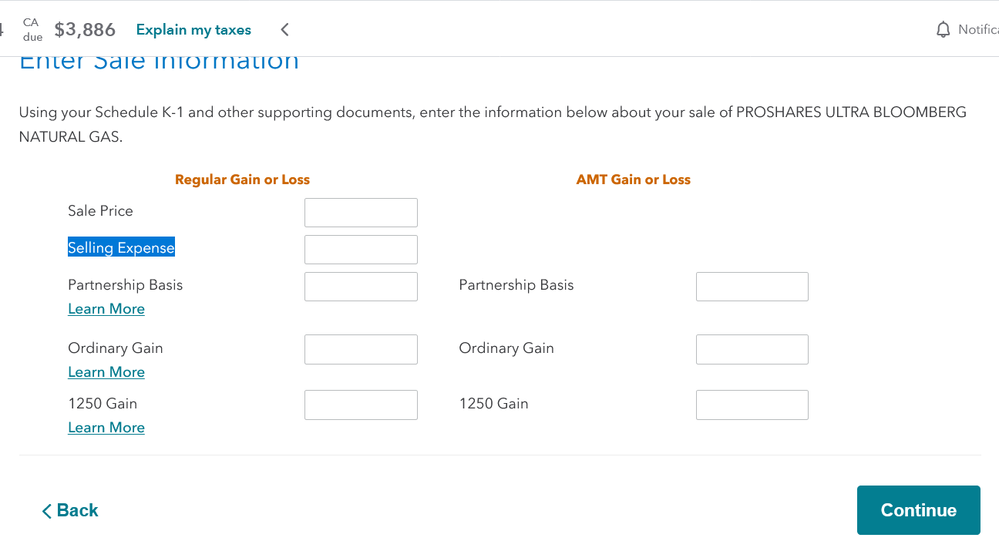

6. What do I enter for the Partnership Basis for regular and AMT gain or loss?

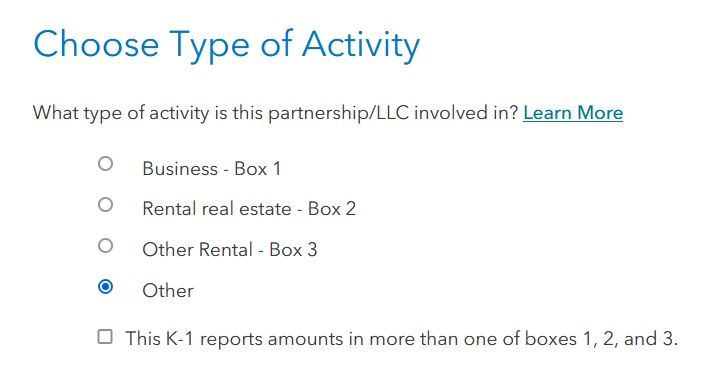

7. This ETF trades in natural gas futures. I'm guess that its activity type is "Other". Is that correct?

Thank you for your help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help needed with K-1 and 1099-B for a Publicly Traded Partnership ETF sale

wrong place. what I'm seeing is the Turbotax section of the K-1 for reporting ordinary income on the sale. the K-1 sales schedule shows none

so sales price should be blank as should basis. if you leave it there you will be double reporting the sale because it's also on the 1099-B which was entered from the 1099-B

what i can't help you with is the wash sale

the k-1 sales schedule uses FIFO but I don't know if it takes wash sales into account. you can check by adding up the purchase price you paid for the first 587 shares. If it's the same as what is shown, then no it doesn't. if it does take into account wash sales then that's what I would use for the 1099-B. you would have to change what's currently on the 8949 as cost just so future sales and reporting doesn't get messed up. The broker is reporting original cost + wash sales adjustments which can be different than your actual tax basis because the broker's 1099-B does not and never will reflect any K-1 activity. You're lucky in 2022 because the k-1 reports nothing on lines 1 to 20

if the k-1 schedule does not take into account wash sales for cost basis this will create future problems because the PTP will continue to use FIFO and the broker LIFO

I also don't know how different tax basis will affect the calculation of any profit or loss allocated to your shares should you hold them long enough.

in other words, I can't tell you what the correct number to use on the 1099-B for your tax basis. The broker uses type B which means it doesn't report your tax basis to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help needed with K-1 and 1099-B for a Publicly Traded Partnership ETF sale

@Mike9241 wrote:wrong place. what I'm seeing is the Turbotax section of the K-1 for reporting ordinary income on the sale. the K-1 sales schedule shows none

so sales price should be blank as should basis. if you leave it there you will be double reporting the sale because it's also on the 1099-B which was entered from the 1099-B

So are you saying that for the K-1 interview, I should leave these entries below blank?

in other words, I can't tell you what the correct number to use on the 1099-B for your tax basis. The broker uses type B which means it doesn't report your tax basis to the IRS.

This isn't correct. The broker's 1099-B listed the sale with Box A checked - short term transactions for which basis is reported to the IRS. Do I need to manually adjust the basis for this sale in TT in the investments section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help needed with K-1 and 1099-B for a Publicly Traded Partnership ETF sale

So are you saying that for the K-1 interview, I should leave these entries below blank?

the section you are showing appears tp be where ordinary income on sale is reported. you have none .

in other words, I can't tell you what the correct number to use on the 1099-B for your tax basis. The broker uses type B which means it doesn't report your tax basis to the IRS.

This isn't correct. The broker's 1099-B listed the sale with Box A checked - short term transactions for which basis is reported to the IRS. Do I need to manually adjust the basis for this sale in TT in the investments section?

can't tell you why the broker uses A. they do not get the k-1's so if there was any adjustment to basis for say income/loss or distributions they would not know about them and would not adjust your purchase price

I would suggest you go to the Tax Package Support website for this entity and call to see if you can use LIFO costs so the numbers match the broker's statement. If so the corrected K-1 would not be out until after 10/15 so you would be filing after Turbotax closes e-filing for 2022 which would require you to mail in your return. if you file with the broker's numbers which are different than what the partnership reports then technically you are supposed to include with your return form 8082 Notice Of Inconsistent Treatment. even using the Partnership numbers may not be correct because of the wash sales.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help needed with K-1 and 1099-B for a Publicly Traded Partnership ETF sale

@pinguino I'm traveling, so may not be able to respond if you have follow-up questions, but wanted to offer a couple comments:

- The partnership is using average cost because of IRS Reg 84-53, which says "IRS Revenue Ruling 84-53 provides that a partner has a single unified basis in their Partnership interest". That means that picking which lots to sell to manage losses doesn't work. You may be able to find a tax advisor who will give you a rationale for ignoring this, but that's why the sales schedule will use average cost.

- Your broker should not be reporting cost basis on the 1099-B. They can't know it, because the cost basis changes with every K-1, and they don't see the K-1s. The fact that they did just means that you'll report a different basis on your tax return (there are codes to allow you to correct what the broker supplied). If the IRS ever asks, you'll have the K-1 to use as backup. In the future, you should only be using your own records for cost basis. The broker's will never be right.

- Because of unified basis, and any other adjustments that are made, partnerships are terrible vehicles for frequent trading and wash sales. Figuring out how to factor the wash sale into the calculation is way outside this forum. But when you figure it out, you'll probably be using a basis that differs from what the partnership provided. That's OK. You just need to keep good records and be prepared to justify them.

- If tracking all this seems like more than you want to take on, a possible answer is to just sell the entire position. As long as your 2022 + 2023 tax returns combined match what the 2022 + 2023 K-1s report, you've solved the wash sale and broker discrepancies. That's not investment advice: just a practical way to solve these headaches.

On some of your other questions:

- Withdrawals and Distributions will equal the cost basis of any shares sold + any dividends that the fund sent out.

- Q3 & 4: you've got it right

- Q5: As Mike said, all 0s and you avoid the duplication problem. The only reason you wouldn't use all 0s is if the partnership distributed 'Ordinary Gain', which yours did not.

Hope that helps!

-

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help needed with K-1 and 1099-B for a Publicly Traded Partnership ETF sale

My situation is that the my imported 1099-B had the incorrect cost basis than the one provided in K-1, which resulted in a much bigger gain.

What is the best way for me to input the correct basis provided by the Partnership's K-1?

Thanks very much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help needed with K-1 and 1099-B for a Publicly Traded Partnership ETF sale

@alaniboris When you get to the 1099-B section of the interview you'll be prompted to change the incorrect basis. Alternatively, just go into 'Forms' and make the change.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kegan

Level 1

Steph2024

Level 1

drkma

Returning Member

rodriguerex

Level 2

mrpuddington

Level 2