- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@Mike9241 wrote:wrong place. what I'm seeing is the Turbotax section of the K-1 for reporting ordinary income on the sale. the K-1 sales schedule shows none

so sales price should be blank as should basis. if you leave it there you will be double reporting the sale because it's also on the 1099-B which was entered from the 1099-B

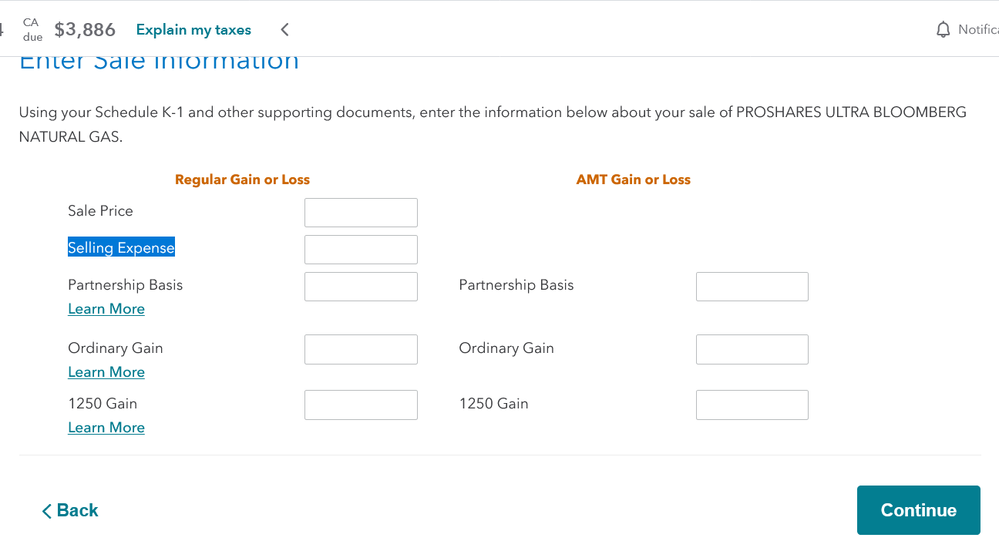

So are you saying that for the K-1 interview, I should leave these entries below blank?

in other words, I can't tell you what the correct number to use on the 1099-B for your tax basis. The broker uses type B which means it doesn't report your tax basis to the IRS.

This isn't correct. The broker's 1099-B listed the sale with Box A checked - short term transactions for which basis is reported to the IRS. Do I need to manually adjust the basis for this sale in TT in the investments section?