- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help needed with K-1 and 1099-B for a Publicly Traded Partnership ETF sale

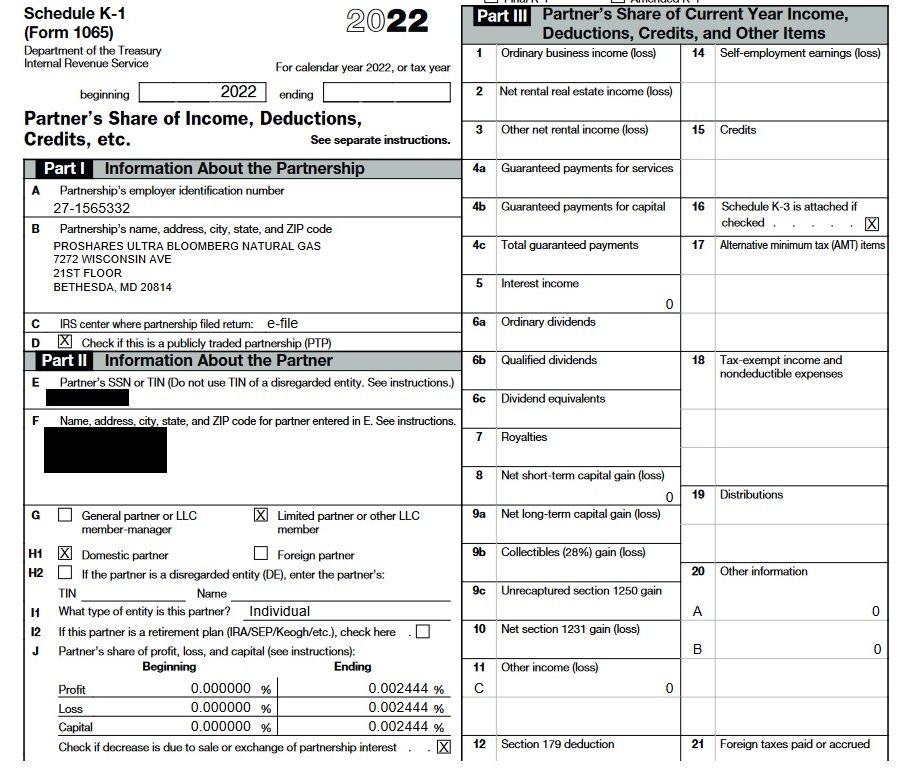

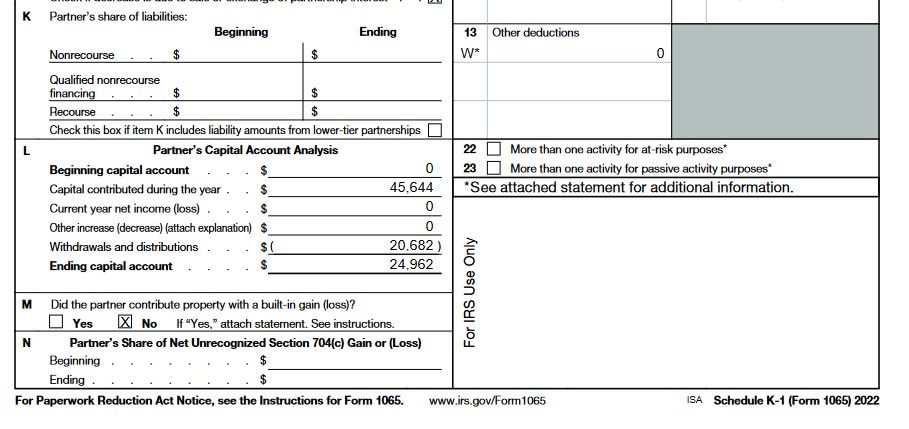

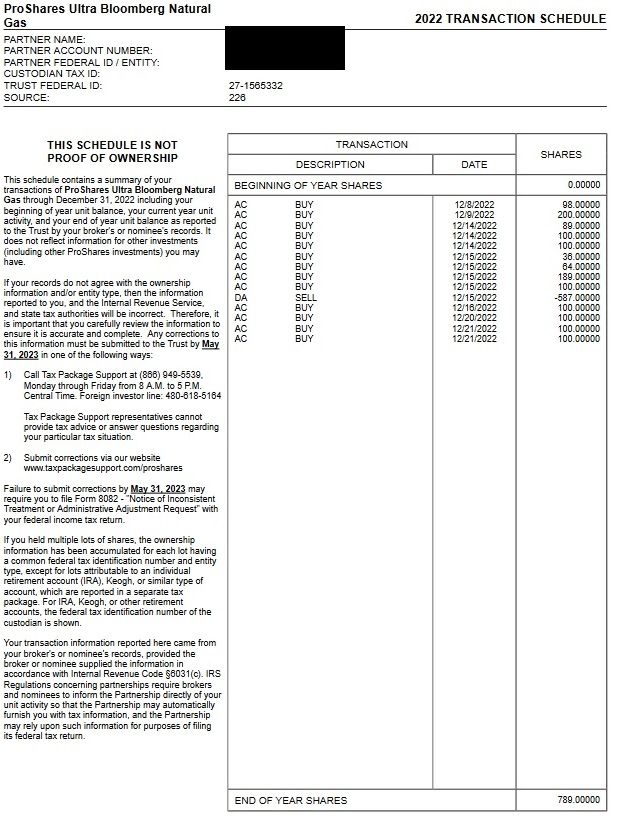

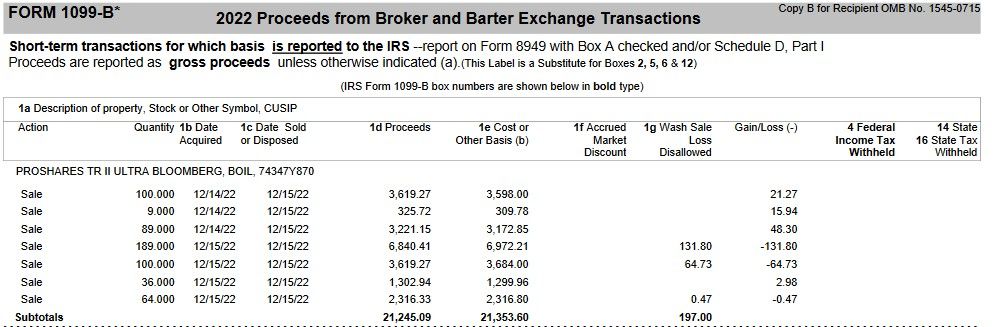

I have been procrastinating on doing my taxes with the extended deadline because of this K-1 stuff. I would appreciate if someone can help me figure this out and make sure I'm doing it correctly. Last year, I bought multiple lots of an ETF (BOIL) on different days and sometimes on the same day. I then had one sale of 587 shares, but still owned 789 shares at the end of the year. All the relevant documents are attached.

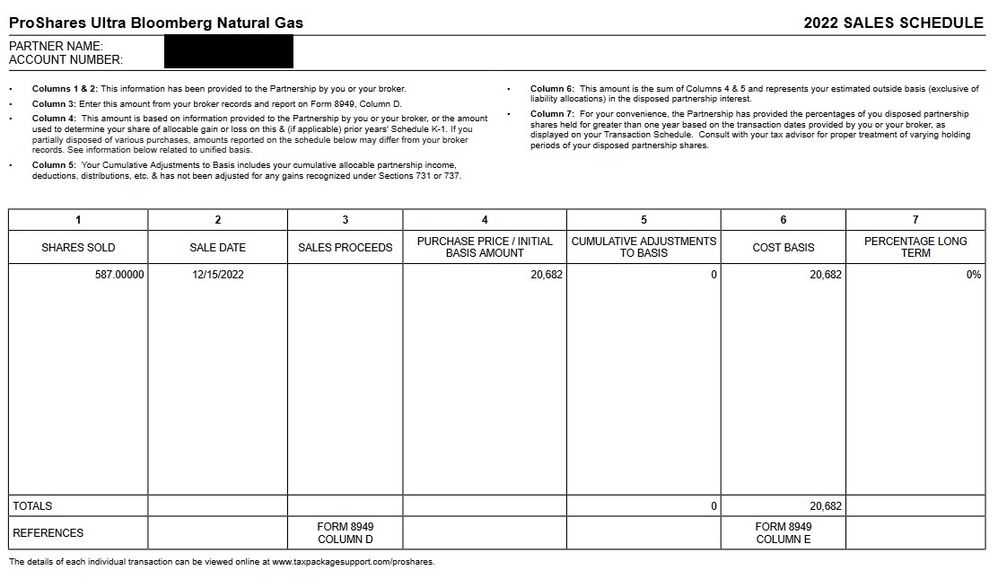

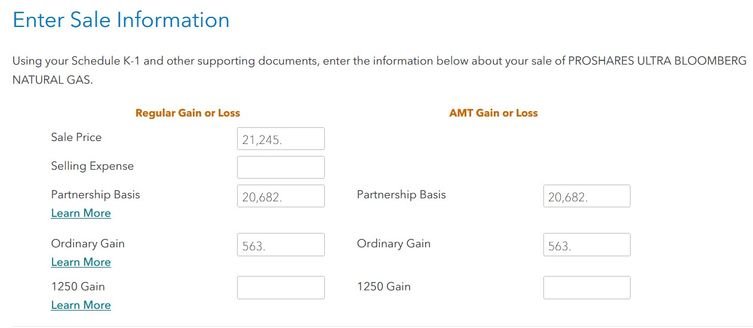

1. What cost basis should I use? So far, I just imported the 1099-B data into Turbotax. The 1099-B identifies which lots were sold off for the sale of the 587 shares. It seems like the broker is using last-in, first-out. The total cost basis is 21,353 (ignoring the disallowed wash sale loss).

However, on the K-1 package sales schedule, the cost basis in column 6 shows 20,682. I figured out that this amount is based on the pro-rated cost basis for all the shares purchased on or before 12/15/2022. The pro-ration factor is 587/976, which is the number of shares sold divided by the number of shares owned on 12/15/2022. I think this is equivalent to the weighted average cost basis of all the lots owned prior to the sale.

So it seems that the cost basis from the broker was based on the cost of the last-in, first-out shares, but the ETF K-1 cost basis used the weighted cost average.

2. On K-1, box L, the capital account withdrawals and distributions amount is (20,682), which is identical to the cost basis shown in box 6 in the sales schedule. Is this always true? If the answer to my first question is use the 1099-B cost basis 21,353, will this cause a problem if the figure that I enter in my tax return doesn't match the withdrawals and distribution amount?

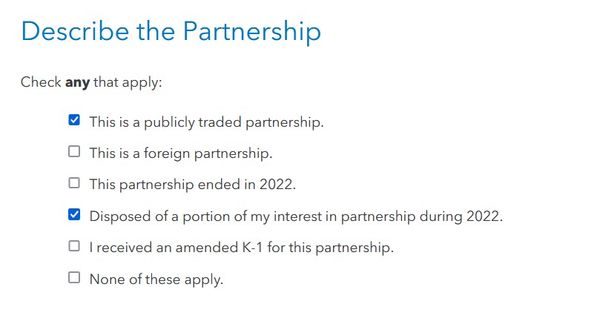

3. During the K-1 interview, are these selections below correct?

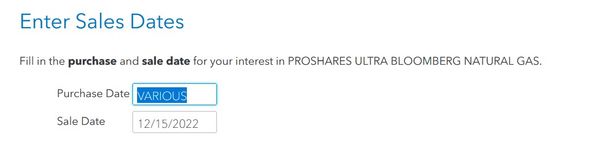

4. I had only one sale, but that sale consisted of lots purchased on multiple dates. The K-1 interview doesn't allow me to enter the different purchase dates, so do I enter "VARIOUS"?

5. I saw some threads about Turbotax could duplicate the ETF sales transactions. Importing the 1099-B added the transactions, but entering this sale during the K-1 interview will also add a duplicate sale transaction. How do I check for duplication in TT?

6. What do I enter for the Partnership Basis for regular and AMT gain or loss?

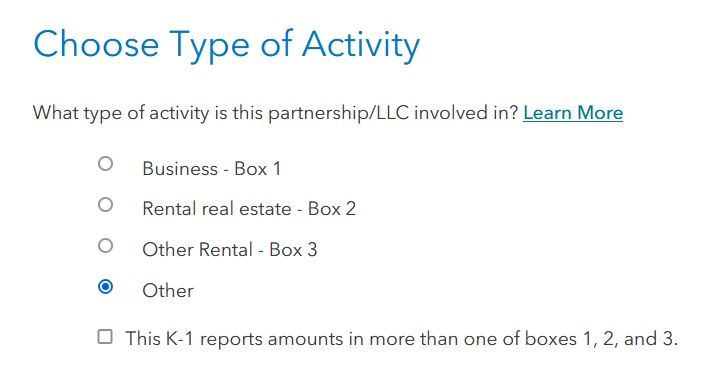

7. This ETF trades in natural gas futures. I'm guess that its activity type is "Other". Is that correct?

Thank you for your help.