- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

Did you select that it was a long term gain? Go back and double check your entries to see if you have it listed as a C or an F. If it is an F, then it would be long term. If it is a C, then it would be short term. You can do this by going to the income summary screen and clicking edit next to the investment you sold.

Double check your dates. Make sure you entered the correct year for purchase and sales.

Also, what is it that you sold? If they were collectibles, the rates do not apply. Collectibles are an exception to the capital gains tax limit. They can be taxed at a rate of up to 28% even if your income is below the threshold to have the rest of your capital gains taxed at 0%.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

Hi thank you so much for your reply! I'm simply entering Box D,

Long Term basis reported to IRS (Covered), for a stock helo for 3 years net proceeds about 23,000. So that should be 0% but its included in my income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

The $$ do get added into your AGI, but the tax on those $$ will be calculated on a separate worksheet...where the LT Gains (and qualified dividends) are split out from ordinary income to be dealt with separately.

Usually, it is the "Qualified Dividends and Capital Gain Tax Worksheet"

But there are a couple different tax worksheets that could be used depending on your overall tax situation.

______

IF you are using the Desktop software, you can see that worksheet in Forms Mode.

With then Online software you would have to pay for the software when using the Print Center to create a PDF with all forms and worksheets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

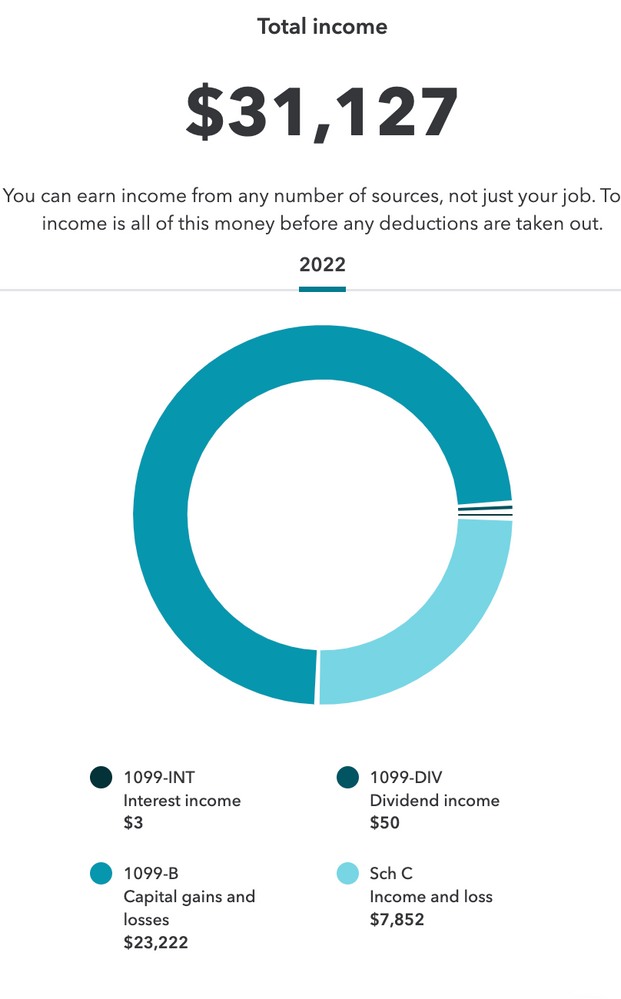

as you can see, by long term capital gains i reported are being included in income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

ALSO... I hope you realize that the $83k exclusion is based on your total income, NOT just your L/T capital gain.

So, for example, if you have $100k of other income, you're gonna be taxed on this gain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

that capital gain is added to your other taxable income and then $83350 is subtracted. the excess is taxed at 15%. so in the most simple situation if you had taxable income of $106350 including the capital gain the $23000 would be taxed at 15%. if you had taxable income of $83350 including the capital gain the $23000 would be taxed at zero

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

So...on the Qual DIVs & Cap Gains Tax Worksheet

Yoru LT cap gains + Qual dividends will show on line 4 of that worksheet

The amount being taxed at 0% will be on line 9......

.....and I suspect that line 4 will = line 9 for your posted income situation...so likely all of it is being taxed at 0%.

For you, the rest of the form is likely just chaff.....meant to deal with folks with much higher incomes.

But the situation might change if you have not yet entered ALL your income from everywhere yet..1099-R forms, SS income, W-2 income ..etc..etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

yes i will download the worksheet, hopefully, it sheds some light. my total income other than the 23,000 LT cap gains is about 9,000 net profit from my business, so total income is well under 83K, and with 0% LT cap gains tax i should be well under standard deduction as well. however it's saying I owe around $1300 on my ~33,000 total income since its including the cap gains

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

exactly, my total income is being listed at ~33k with the 23K cap gains and 10k from my business. maybe the standard deduction is including my LT cap gains?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

Correct, the LT gains is included in total income before subtracting the Std Deduction...leaving you with some taxable income.....as well as SS and Medcare taxes on your business net income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

I also had my long term capital gains listed as part of my AGI. I had imported the stock sales from my brokerage, who check box E on my Form 8949 (inherited stocks). There was no dialogue box to manually report my basis, and as such it was treated as ordinary income. I need to know how to rectify this on an amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I added a 23,000 long term capital gain to my taxes which should be taxed at 0% up to the $83,350 limit for married filing jointly. however, its adding tax

Per IRS Publication 551 page 10, the basis of property inherited from a decedent is one of the following.

- The FMV of the property at the date of the individual's death.

- The FMV on the alternate valuation date if the personal representative for the estate chooses to use alternate valuation.

- The value under the special-use valuation method for real property used in farming or a closely held business if chosen for estate tax purposes.

- The decedent's adjusted basis in land to the extent of the value excluded from the decedent's taxable estate as a qualified conservation easement.

You will be able to amend your 2022 Federal 1040 tax return after your tax return has been accepted by the IRS.

If you used TurboTax Online, log in to your account and select Amend a return that was filed and accepted.

If you used the CD/download product, sign back into your return and select Amend a filed return.

The stock sale basis may be entered by following these steps:

- Open or continue your return.

- Select Federal down the left side of the screen.

- Select Wages & Income down the left side of the screen.

- Select Show more to the right of Investments and Savings.

- Select Start / Revisit to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B).

- Select the entry to be corrected. Click Edit.

- At the screen Review, click the pencil to the right of the line to be corrected.

- Enter the correct cost basis in Box 1e Cost or other basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ammon626

New Member

dafeliks

New Member

RCarlos

New Member

in Education

user17558933183

Returning Member

sacap

Level 2