- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Have LLC carryforward loss from last year I want to write off this year against other (non-LLC ) income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have LLC carryforward loss from last year I want to write off this year against other (non-LLC ) income.

Where in TurboTax do you enter an LLC carryforward loss from last year in this year's return. I want to use the carryforward loss against other income, not LLC-income of which I have none this year. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have LLC carryforward loss from last year I want to write off this year against other (non-LLC ) income.

No, you would have to enter the loss as a carryover from the previous year, it wouldn't be allowed as a current year deduction if it came from a previous year.

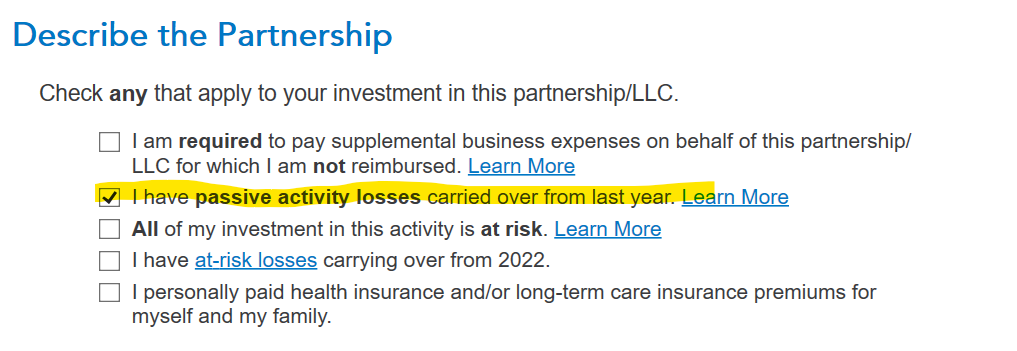

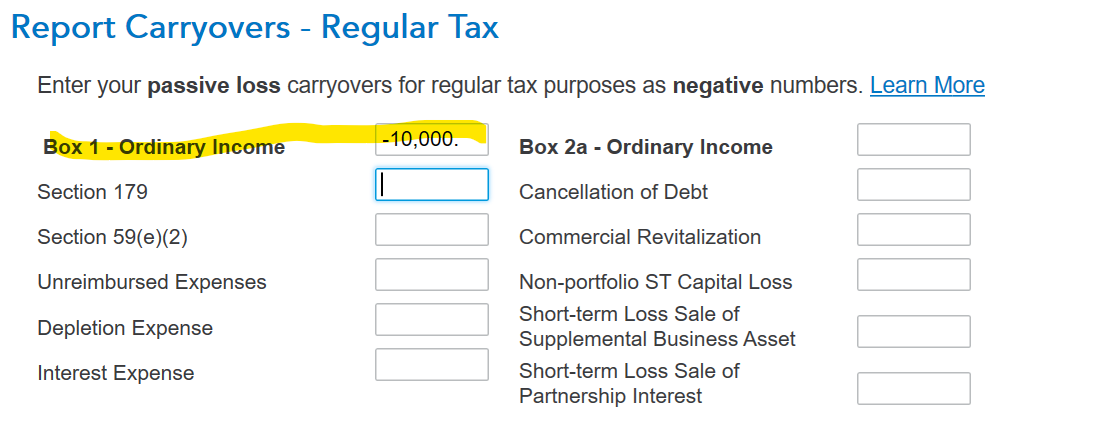

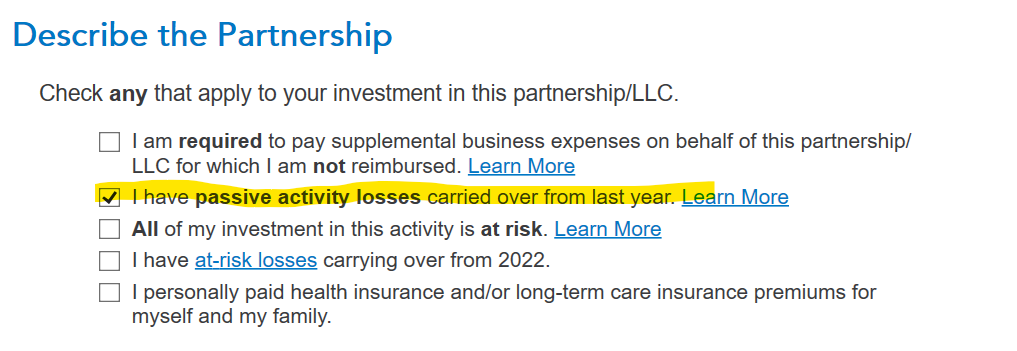

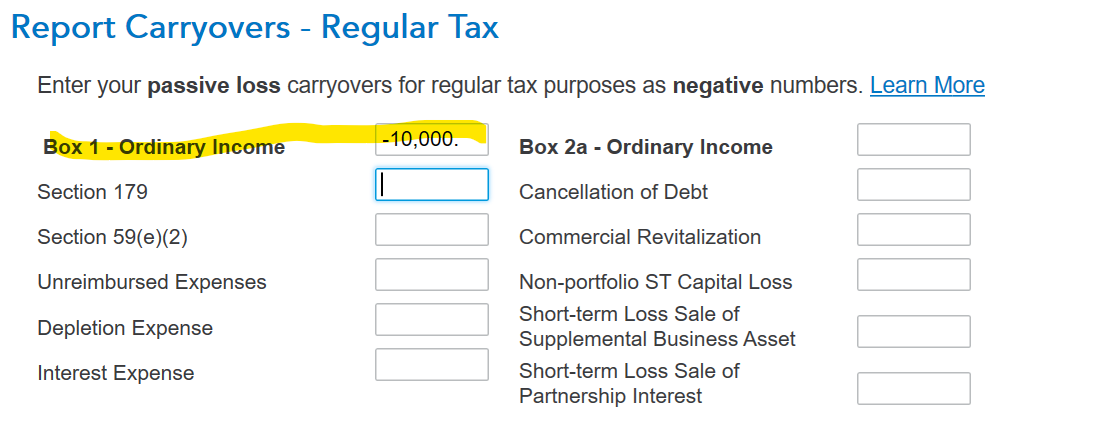

You would enter the unused loss on the entry screen for the same activity in the current year. For instance, if you had unused passive losses relating to a rental activity reported on a partnership schedule K-1, you would enter the loss on the current year K-1 entry for the same partnership:

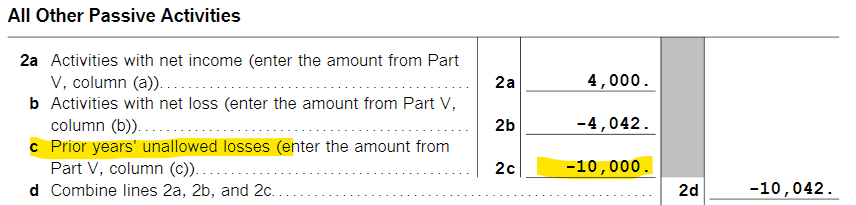

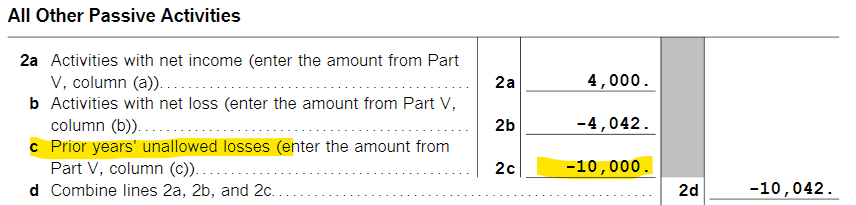

The loss will show up on Form 8582 Passive Activity Loss Limitations where it will be matched with income from other passive activities so it can be deducted from them as is allowed:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have LLC carryforward loss from last year I want to write off this year against other (non-LLC ) income.

Original poster here continuing with the question. For example, can I simply enter the carryforward loss and enter it as expenses in the LLC his year and just not carryforward the loss again? And the expenses (loss) be automatically used in reducing my other non-LLC income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have LLC carryforward loss from last year I want to write off this year against other (non-LLC ) income.

No, you would have to enter the loss as a carryover from the previous year, it wouldn't be allowed as a current year deduction if it came from a previous year.

You would enter the unused loss on the entry screen for the same activity in the current year. For instance, if you had unused passive losses relating to a rental activity reported on a partnership schedule K-1, you would enter the loss on the current year K-1 entry for the same partnership:

The loss will show up on Form 8582 Passive Activity Loss Limitations where it will be matched with income from other passive activities so it can be deducted from them as is allowed:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have LLC carryforward loss from last year I want to write off this year against other (non-LLC ) income.

Well, OK, Thomas, and thanks. I'll try that.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kemashacoka

New Member

42Chunga

New Member

user26879

Level 1

fiorentino-mary

New Member

Agately

New Member