- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No, you would have to enter the loss as a carryover from the previous year, it wouldn't be allowed as a current year deduction if it came from a previous year.

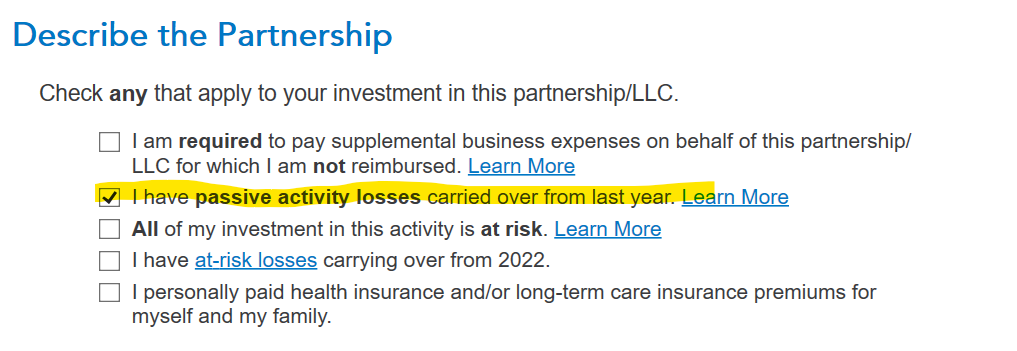

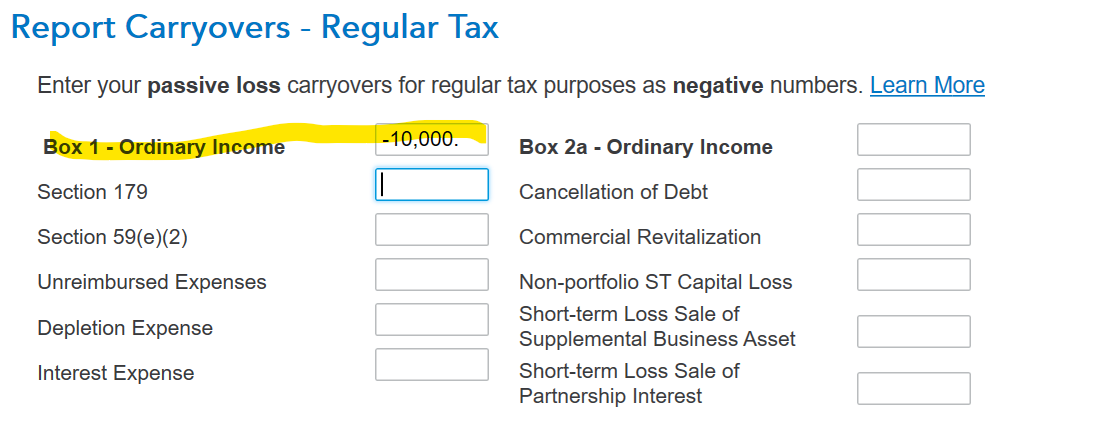

You would enter the unused loss on the entry screen for the same activity in the current year. For instance, if you had unused passive losses relating to a rental activity reported on a partnership schedule K-1, you would enter the loss on the current year K-1 entry for the same partnership:

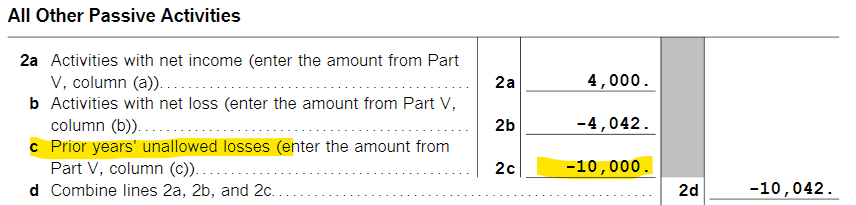

The loss will show up on Form 8582 Passive Activity Loss Limitations where it will be matched with income from other passive activities so it can be deducted from them as is allowed:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 3, 2024

5:49 PM