- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

If you are getting an error by entering 0 (meaning you do not want to defer any self-employment tax), make sure you answered no on the TurboTax screen in which you are asked if you want more time to pay self-employment taxes.

Please follow these steps in TurboTax to check and/or change your election:

- Open your return.

- Click Federal on the left hand side.

- Click Deductions and Credits on the top of the page.

- On the page Tax Breaks, scroll down until you see Tax relief related to Covid-19.

- Click Revisit next to Self-employment tax deferral.

- Answer no to the question Do you want more time to pay self-employment taxes?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

I have done this, it has not changed. I'm suspicious the problem is line 10 is a negative number. I'm not even eligible for the deferred tax, but it keeps asking for a number larger than 0... Thoughts on next steps?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

I'm having the same problem and errors. It appears the software is still trying to defer some of the taxes owed even though I've checked no, been told by the software that we don't qualify to defer and have a refund coming. Also cannot link schedule C to the filing, saying that the income and expenses info was incomplete (which it is not).

Very frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

Technical is working on the 1099-NEC as it relates to sch C. The IRS does not open until February 12. They work on forms from most common to least common. See Federal form availability for expected release dates. Once released, we work to incorporate them quickly and accurately. We are working on it!

@JHerrington

New this year:

The 1099-NEC is for each person to whom the taxpayer has paid at least $600 during the course of a business for the following.

•Services performed by someone who is not an employee, including parts and materials (box 1),

•Cash payments for fish (or other aquatic life) purchased from anyone engaged in the trade or business of catching fish (box 1), or

•Payments to an attorney for legal services (box 1).

The Form 1099-MISC is for each person to whom the taxpayer has paid the following during the course of a trade or business.

•At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest,

•At least $600 in rents (box 1), prizes and awards (box 3), other income payments (box 3), the cash paid from a notional principal contract to an individual, partnership, or estate (box 3), any fishing boat proceeds (box 5), medical and health care payments (box 6), crop insurance proceeds (box 9), payments to an attorney (box 10), IRC section 409A deferrals (box 12), or nonqualified deferred compensation (box 14).

•Any payment from which federal income tax has been withheld (box 4) under the backup withholding rules

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

Same problem - TurboTax not letting me submit my returns due to this self-employment deferral error. It states that I don't qualify for a deferral (probably because the deferral amount is a negative number). But it's not accepting "0" for a response - keeps kicking me back from transmitting my returns to correct the response because "0" is "too large". I've tried inserting the negative number, inserting a positive number, etc. Nothing works. It's not accepting any number. Keeps producing an error that prevents me from e-filing my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

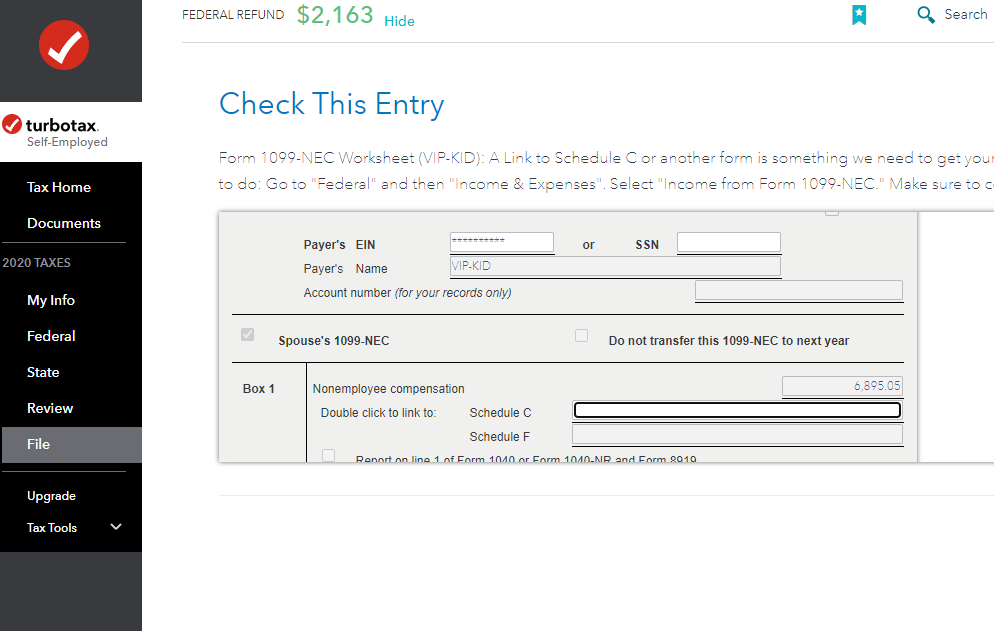

Some TurboTax Online customers are getting the error below when attempting to link their Form 1099-NEC.

Check This Entry

Form 1099-NEC Worksheet (XXXXX): A link to Schedule C or another form is something we need to get your info in the right place.

If you are experiencing this issue, please sign up here for email updates as we are working on the issue.

Please click Why am I not able to link my 1099-NEC in TurboTax Online? to learn more.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

I have nothing to add other than I also get the same error on self-employment tax deferrals.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

Your self-employment income may be eligible for a portion of your self-employment tax to be deferred. See this TurboTax Help.

You may find it helpful to delete the form for the 1040 and 1040 Worksheet. Both forms will regenerate but you may have to add a couple items of data. Follow these steps:

- Down the left side of the screen, click on Tax Tools.

- Then click on Tools.

- Then in the center of the page, click on Delete a Form.

- Choose the form to be delete and click Delete to the right of the form(s).

In TurboTax Online Self-Employed, I was able to enter a self-employment tax deferral and pass Review. Then I was able to remove self-employment tax deferral and pass Review.

Follow these steps.

- Down the left side of the screen, click on Federal.

- Across the top of the screen, click on Deductions & credits.

- Under Your tax breaks, scroll down to Self-employment tax deferral.

- Click on Edit/Add to the right of Self-employment tax deferral.

- At the screen Do you want more time to pay your self-employment tax?, click Yes.

- At the screen Let's start by getting your eligible income, I have left the dollar amount that was previously entered, others change this amount to $0.

- Click on Continue.

- At the screen Tell us how much you'd like to defer, change the dollar amount to $0.

- Click Continue.

- Click through Federal Review to make sure than the Review issue has been removed.

- At the screen Some of your self-employment taxes may be eligible, click Skip.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

Thanks for the response. The program was recently updated and now allows me to enter the negative deferral number, which it accepted and transmitted my returns. It did not affect my tax refund amounts, which I was worried about. But we'll see in the next 24-48 hours if my return is accepted (crossing my fingers).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

I answered no to the deferral but the form doesn't seem to hold that response and continues to give me an error. How can I correct this? Are you preparing a software update to fix it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

This doesnt work for me. It tells me since you are getting a refund you dont qualify for the tax deferral. I have tried everything I know to try. I updated the software and still nothing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

This question is associated with the option to defer paying some of your self-employment tax due to Covid-19. If you are getting a refund for your tax return, then deferring some of the self-employment tax is not an option for you.

If you do not want to defer any of the self-employment tax, then enter '0' for line 18 when you see the review question in the error check.

If you do wish to defer paying the self-employment tax, then line 18 is asking for the portion of your Schedule C and/or Schedule F profit that is attributed to March 27, 2020 through December 31, 2020.

To go back to the input screens related to deferring Self-Employment tax if you qualify, look in the Deductions and Credits section of your return. Then find the Tax Relief related to Covid-19 section, then Self-employment tax deferral.

When you click Start or Update beside this section you may see a message that you do not qualify to defer the self-employment tax. If this is the case and you did enter a number during the error check process, then be aware that nothing is being calculated as part of your return as a deferral.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

Line 18 on what form? The error I receive shows this number on Line 11 of the Deferral for Certain Schedule H or SE Filers Smart Worksheet. I enter zero and it tells me this number is too large. I try entering a negative number and it tells me the number must be zero or greater. I do not see a line 18 on the form being flagged with an error.

Turbotax will not let me transmit my return with this error being flagged.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting an error by entering 0 for deferred self employed tax on schedule H or SE worksheet

AnnetteB6 writes: "This question is associated with the option to defer paying some of your self-employment tax due to Covid-19. If you are getting a refund for your tax return, then deferring some of the self-employment tax is not an option for you."

I don't think that is right. If you look at the deferral worksheet in the instructions for form 1040 (Page 101), the test is not whether you are getting a refund, but instead whether your Total Tax (1040 Line 24) exceeds your Total Payments. Your Total Tax can exceed your Total Payments and you may still be entitled to a refund if you have refundable credits. It is NOT correct to say that if you are getting a refund then you cannot defer SS taxes. This problem in TT really needs to be fixed and is the source of a lot of confusion in this thread and others.

The fix to the zero problem is easy: Go to Forms, go to the 1040/1040SR Wks, go to line 11 in the "Deferral for Certain Schedule H...Worksheet" and change the amount to $0. This is not an override, just an entry. Save your return. Go back to Step by Step and go to Review. You won't get any more errors.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

apollocoulis

New Member

user17631449562

Level 1

adm

Level 2

jeff7

Level 3

kkarnes

Level 2