- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 8812 calculating incorrectly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

I have gone through the worksheet and the calculations and it appears at though TT is calculating incorrectly. I've gotten notice from the IRS that the calculations are in error. I would really like someone to take 10 min to review and either affirm TT's calculations or help me understand why they can't calculate correctly.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

@prkammann wrote:

I have a zero there. We do not recall getting advance child tax credits.

Best to check your IRS tax account to make sure that the IRS does not show you receiving the advance CTC. Go to this IRS website for your tax account - https://www.irs.gov/payments/your-online-account

The IRS would have mailed you a Letter 6419 for the credit - https://www.irs.gov/individuals/understanding-your-letter-6419

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

" I would really like someone to take 10 min to review..."

No one in the user forum has access to your tax return, nor can anyone else here "review" it for you.

You do not provide any details of what the IRS says is incorrect or what you think might be wrong with your form 8812 for the child tax credit.

For tax year 2022, the child tax credit maximum is $2000 per child for children younger than 17 years old. That credit is applied toward your tax liability; if your tax liability is at zero, then you may receive the refundable "additional child tax credit" based on how much you earned by working.

If your child was older than 16 at the end of 2022, but can still be claimed as your dependent, then you can get the $500 credit for other dependents for the child instead of the child tax credit.

https://ttlc.intuit.com/questions/1900923-what-is-the-child-tax-credit

We could be more helpful if you provide some details as to what is lines 19 and 28 of your Form 1040, as well as some details as to what the IRS letter says.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

The tax laws changed for child-related credits and are much less generous for 2022.

Make sure you have entered your child as a dependent in My Info, and that you have entered the child's Social Security number. Careful— do not say that your child’s SSN is not valid for employment. If your child was born in 2022 make sure you said he lived with you the whole year. There is an oddly worded question that asks if the child paid over half their own support. Say NO to that question.

Have you entered income from working in 2022? If not, you will not receive an income tax refund based on having dependent children.

The rules for getting the child tax credit on a 2021 tax return and now on a 2022 return are very different. For 2021 you could get $3600 for a child under 6 or $3000 for a child between 6 and 17 even if you had no income/did not work. That is NOT the way it will work for your 2022 tax return. The “old” rules are back.

The maximum amount of the child tax credit is now $2000 per child; the refundable “additional child tax credit” amount is $1500. In order to get that credit, you have to have income from working. The credit is calculated based on the amount you earned above $2500 multiplied by 15%, up to the full $1500 per child. If the amount you earned was too low, you will not get the full $1500.

If your child is older than 16 at the end of 2022, you do not get the CTC. But you may still get the non-refundable $500 credit for other dependents instead.

https://ttlc.intuit.com/questions/1900923-what-is-the-child-tax-credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

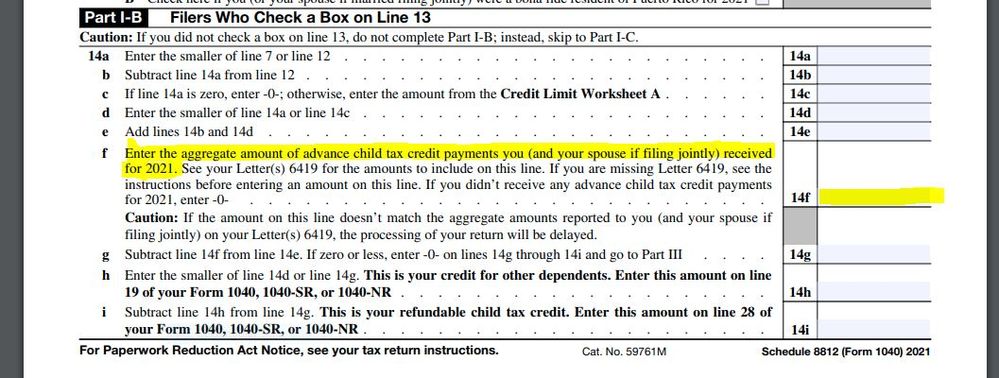

@prkammann Another thought: You did not mention which tax year your IRS letter is referring to. If they are saying you have something incorrect on a 2021 tax return, it is possible that you entered the amount of the advance tax credit payments incorrectly. For tax year 2021, if you received advance child tax credit payments between July 2021 and December 2021, you had to enter the amounts you received so that when your child tax credit payment for line 28 was calculated, you received only the "other half" of the 2021 refundable child tax credit. When you prepared your tax return, and entered information for the CTC, did you correctly enter the amount from letter 6419 that the IRS sent to you (and perhaps to your spouse if you filed a joint return)? If you made a mistake with that, then the IRS adjusted your refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

The IRS calls any error a calculation error. It doesn't mean that the calculations on the form are wrong. It could mean that an amount or other information was entered incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

Well I was hoping someone who review the form and let me know what I'm missing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

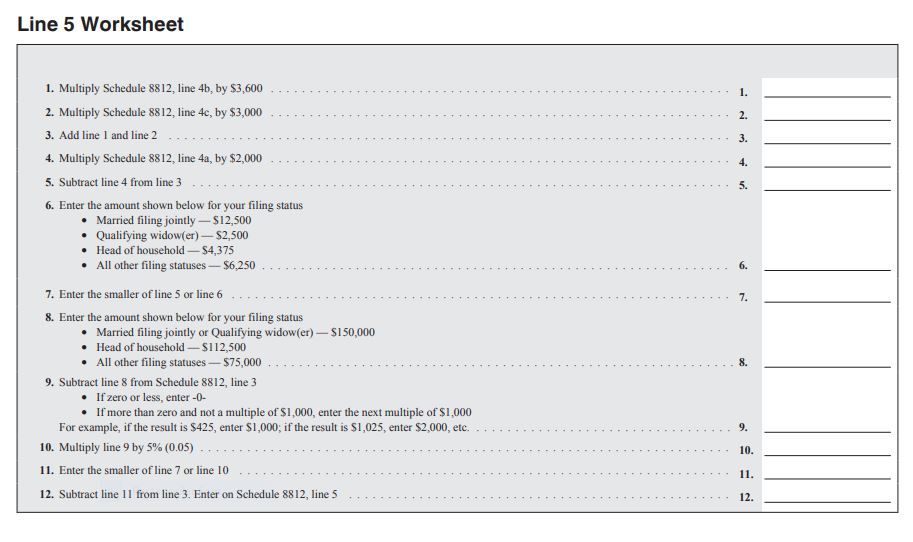

This is for '21 taxes and I'm looking at the worksheet that calculates line 5 on form 8812 and it doesn't say anything about the CTC. When TT calculates it they come up with $4650 which I cannot come up with when looking at the calculations for the worksheet. The worksheet just asked how many kids you have that I can see. It makes no sense to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

@prkammann This is the Line 5 Worksheet for Schedule 8812, tax year 2021 - https://www.irs.gov/pub/irs-prior/i1040s8--2021.pdf

The Advance CTC is asked on the Schedule 8812 for 2021 on Line 14f - https://www.irs.gov/pub/irs-prior/f1040s8--2021.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

I have a zero there. We do not recall getting advance child tax credits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

@prkammann wrote:

I have a zero there. We do not recall getting advance child tax credits.

Best to check your IRS tax account to make sure that the IRS does not show you receiving the advance CTC. Go to this IRS website for your tax account - https://www.irs.gov/payments/your-online-account

The IRS would have mailed you a Letter 6419 for the credit - https://www.irs.gov/individuals/understanding-your-letter-6419

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

"Well I was hoping someone who review the form and let me know what I'm missing. "

No one has access to your tax return or your account. We cannot review it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

The IRS has rejected most of our CTC for 2023 citing and unspecified "error" on Form 8812. This form, as prepared by TT does not comply with the IRS requirements or limitations for CTC or additional CTC. The IRS will not identify the error. TT is not reachable or accessible to discuss or correspond with regard to this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8812 calculating incorrectly

@Harrell7 You are posting to an older thread which has had questions related to errors made on past year returns with the child tax credit. We do not know what tax year you are having problems with--you have not told us--nor do we have any way to look at your return. Provide some details. What tax year are you asking about? How many children did you claim as dependents? How old were they at the end of the tax year in question? How much income from working did you enter on your tax return? Did someone else claim those same children as dependents?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LosRubios

Level 3

crazyforpizza

New Member

83490749707rn

New Member

user17621839383

New Member

markorec

Level 2