- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Filling out fafsa - states the Income is on line 11 for 1040 but there is 11A and a 11B ??? no plain line 11 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out fafsa - states the Income is on line 11 for 1040 but there is 11A and a 11B ??? no plain line 11 ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out fafsa - states the Income is on line 11 for 1040 but there is 11A and a 11B ??? no plain line 11 ?

Don't know what 1040 you may be looking at. But my 1040 along with the one identical to it at https://www.irs.gov/pub/irs-pdf/f1040.pdf only has a single line 11 labeled "Subtract line 10 from line 9. This is your adjusted gross income"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out fafsa - states the Income is on line 11 for 1040 but there is 11A and a 11B ??? no plain line 11 ?

@Carl wrote:

Don't know what 1040 you may be looking at. But my 1040 along with the one identical to it at https://www.irs.gov/pub/irs-pdf/f1040.pdf only has a single line 11.......

I am going to take a wild guess that the 1040 is for the 2019 tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out fafsa - states the Income is on line 11 for 1040 but there is 11A and a 11B ??? no plain line 11 ?

for tax years 2020, 2021 Line 11 is the "adjusted gross income". for 2022, it will again be line 22 based on the draft form for next year

in 2019, Line 8a is the 'adjusted gross income".

What year is FAFSA asking you for? is it really asking for 2019??????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out fafsa - states the Income is on line 11 for 1040 but there is 11A and a 11B ??? no plain line 11 ?

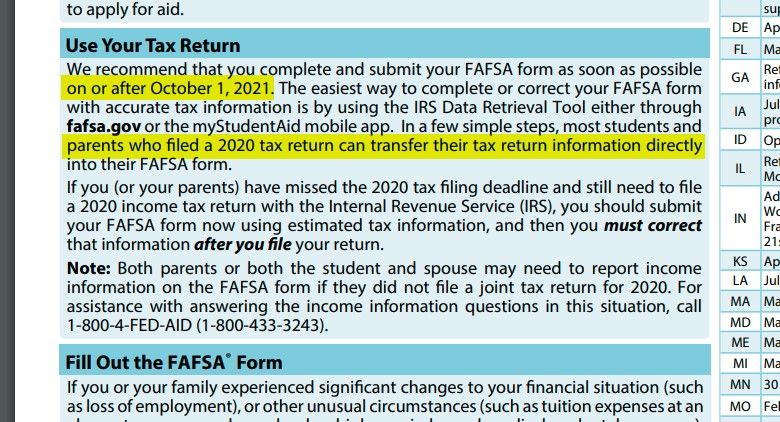

A current FASFA form will want info from the 2020 or 2021 return ... I cannot believe they want anything off a 2019 return in 2022. Read that form again ... do you have the correct current form or one that is 2 -3 years old ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out fafsa - states the Income is on line 11 for 1040 but there is 11A and a 11B ??? no plain line 11 ?

@Critter-3 wrote:

A current FASFA form will want info from the 2020 or 2021 return ... I cannot believe they want anything off a 2019 return in 2022.

I believe that is absolutely correct; the base year for 2021-2022 is the 2019 tax year.

Somehow, @cerrajane must have done an internet search and got ahold of the 2021-2022 FAFSA application (PDF probably).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out fafsa - states the Income is on line 11 for 1040 but there is 11A and a 11B ??? no plain line 11 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out fafsa - states the Income is on line 11 for 1040 but there is 11A and a 11B ??? no plain line 11 ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

4md

New Member

test5831

Returning Member

user17555332003

New Member

Inychole12

New Member

Danielvaneker93

New Member