- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Federal Review Error Form 3468

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

When I run the Federal Review, I get several messages regarding missing data in Form 3468. The form is labeled "Investment Credit" and begins by asking for a "Description of the Facility" followed by the "IRS issued registration number for the facility." None of this seems applies to my taxes. Is this an error within TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

The incorrect identification of Box 20 Code AG/AJ will be addressed in a forthcoming update. We recommend signing up to be notified when the update is released: Why am I receiving an error in TurboTax for Schedule K-1 Box 20 when code AJ is selected?

However, since this information will be used only if your net losses from all businesses are more than $289,000 ($578,000 if filing a joint return), you have the option to omit the code and the amount(s) from Schedule K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

I have the same issue. Form 3468 keeps reappearing after I delete it. Nothing on the form applies and i want to remove it. The form is blank except for my name info. What could be triggering this to happen. I checked 'Do not link to any 3486' on my K1 additional info (Box 20) but that didn't help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

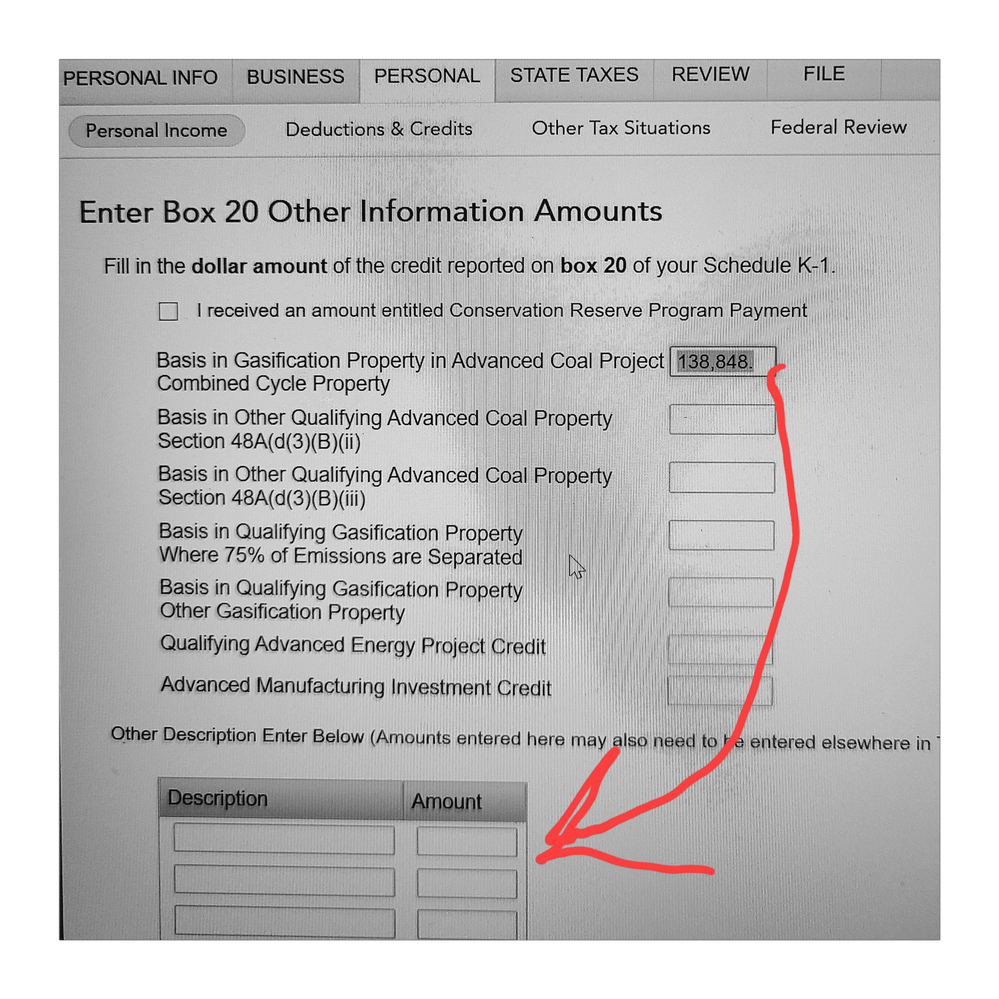

I figured it out. My K-1 had amounts for Box 20 Code AJ. After going back to step-by-step turbo tax there was a new screen asking about box 20 other information and it was placing this value into 'basis in gassification..coal project ' which added form 3468. To fix i changed $ amount in the field above to 0 and entered the amounts at the bottom to other.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

I have the same problem and I can't figure it out. I have looked over everything, spending hours. This has never happened before so I think it might be a Turbo problem. I am wondering what happens if I delete the form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

I hope it's as simple as removing Form 3468. I'm concerned that if the data from K-1 is triggering Form 3468, is it triggering something else we're not aware of? The last thing I want to do is send in my forms and they trigger an audit. Don't need that headache!

I have reported the issue to Intuit, but have not gotten a response as of yet. I'm hoping they'll release an update that fixes the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

I tried deleting it without success. I keeps coming back asking for information. there must be a way to permanently delete it so I can e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

This was my case. Go back to step-by-step and look to see if TT put info here. If yes move it to other using the description on the k1. Continue.Save file. See if it's gone. If not, delete the form, then save file. It should go away. I wouldnt worry about it affecting any other areas.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

How do I get rid of this form 3468 - it does not apply to my taxes but keeps pushing an error on my return. Can anyone help?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

The incorrect identification of Box 20 Code AG/AJ will be addressed in a forthcoming update. We recommend signing up to be notified when the update is released: Why am I receiving an error in TurboTax for Schedule K-1 Box 20 when code AJ is selected?

However, since this information will be used only if your net losses from all businesses are more than $289,000 ($578,000 if filing a joint return), you have the option to omit the code and the amount(s) from Schedule K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

I removed the AG code and still received the 3468 form error.

I then deleted the entire K-1 form and re-added it, this time just to try things i removed all the ZZ information and still received the 3468 for error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

Here's a work-around for 1120S Schedule K-1 that might allow you to delete Form 3468:

In the Schedule K-1 interview, choose Box 17 Code ZZ instead of AG. Continue until you see "Enter Other Information Detail." Enter two lines: Label one line "AG - Aggregate Business Income" with the number from Box 17 additional information and the second "AG - Aggregate Business Deductions" (usually a negative number).

Your entries appear on the K-1 worksheet under Box 17 Code AJ to ZZ Line 6.

If you are using TurboTax for Desktop and can use Forms Mode:

Check K-1 S-Corp for this entity. Make sure there are no entries for Form 3468 under Box 13 Credits.

Then delete Form 3468 if it is still on the forms list.

You can use the same work-around for a 1065 K-1 with Box 20 Code AJ

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

I'm having this 3468 error issue after having added a new K-1. I had included A, B, & N from line 20. I have not been able to resolve the issue at all. I have completely removed the added K-1 and requested deletion of the 3468 form, but the form error continues, and the form 3468 seems to never go away. I need help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

I received the following reply from Intuit:

"The incorrect identification of Box 20 Code AG/AJ will be addressed in a forthcoming update. We recommend signing up to be notified when the update is released."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

I did this to fix it and it still didn't work. I've been trying to file my taxes since the beginning of February and have been running into delay after delay from turbo tax. Can you please fix this so that I can wrap up my taxes? It's frustrating that I pay all this money to turbotax and it's supposed to be the easier route. Guess I'll be going with a CPA next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Review Error Form 3468

You're lucky to get all your paperwork so early. I'm a TT user just like you and struggled a little bit until I figured out what was going on. I know you probably tried it a million times but go to step by step and check again that the screenshot I posted above has no values in any of those fields. That will trigger form 3468 investment credit. Once you remove the values you need to go back to forms, locate the form 3468, then click delete on the bottom of the page, then click save. That's what worked for me. If that doesn't work, create a backup, look around is it possible something else considered investment credit is also adding this form, start deleting things in step by step mode.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LionsTIgersBearsRavens

Level 2

user17714484965

New Member

Raptor2020

New Member

zinj

Level 3

in Education

Nagg

New Member