- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Expat: where to add foreign tax paid

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expat: where to add foreign tax paid

Hello all,

I am an expat. I have lived and worked as a permanent resident in Germany this entire year. I was able to enter how much I made, but where to I add how much tax Germany took away? Additionally, it is telling me I need to file by paper does anyone know why that might be? Thank you for any support.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expat: where to add foreign tax paid

The foreign tax credit topic is found in "Deductions & Credits" and "Estimates and other taxes paid" dropdown list. Be advised you can't take the credit for taxes paid if you use the "Foreign Earned Income Exclusion". In other words you can't take a credit for taxes paid on income that you exclude from taxation.

Some forms are not supported as e-filed forms. You should view which forms are in your filing using the print center in the left-hand menu of your interview. You can then compare that to the forms available for e-file in this link.

Additionally, TurboTax typically details why you will not be able to e-file when completing the tax returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expat: where to add foreign tax paid

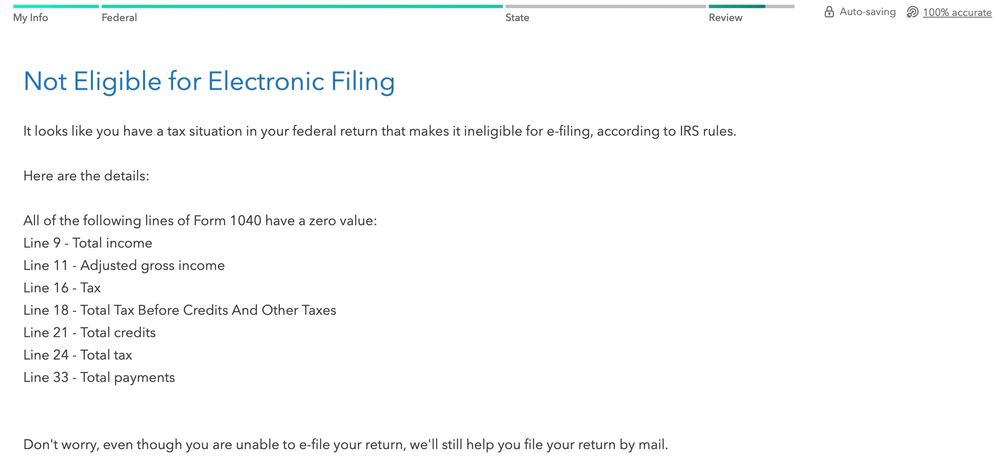

Thank you for your detailed answer. I already added the foreign tax credit. I noticed nowhere was I asked how much tax I paid, but only how much I made. As I do not have a W2 where would I go to add the adjusted gross income, tax, etc. As seen below, I believe these are my issues with e-filing. Thank you for any additional help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expat: where to add foreign tax paid

It looks like you have not entered any income yet based upon the screenshot your provided.

Make sure you enter any applicable income in the Income & Expenses section of the program as well as in the foreign income section.

As far as the foreign tax credit, please see this link for guidance to ensure you have entered everything correctly in order to claim a credit for any taxes paid in the foreign country. Your entries would be entered in the Deductions & Credits section of the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

patamelia

Level 2

Lewlew

Level 2

cosmobello

New Member

VicG2

Returning Member

shanesnh

Level 3