- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Excess Social Security Tax Refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

I completed my taxes and filed. I had two employers during the year and paid excess social security tax. I also had a federal tax excess paid in my return. When I received my federal return, it was only for the excess federal tax and not for the excess social security tax, although this amount was include in my TurboTax summary of taxes. Do I submit to get this excess social security tax differently, will it come to me separately, please advise? The prior discussions seem to suggest this was done automatically by TurboTax.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

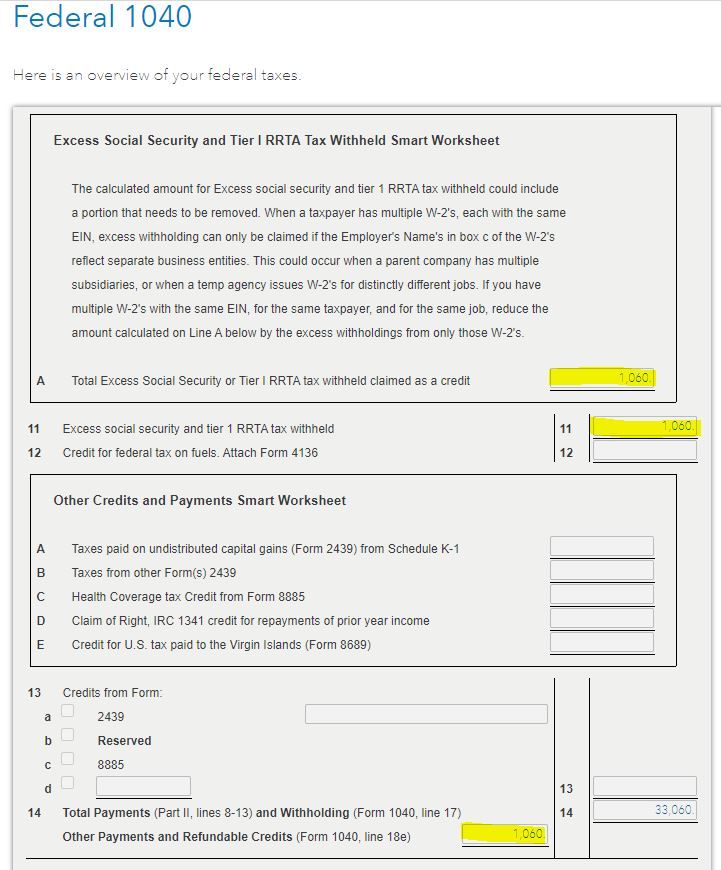

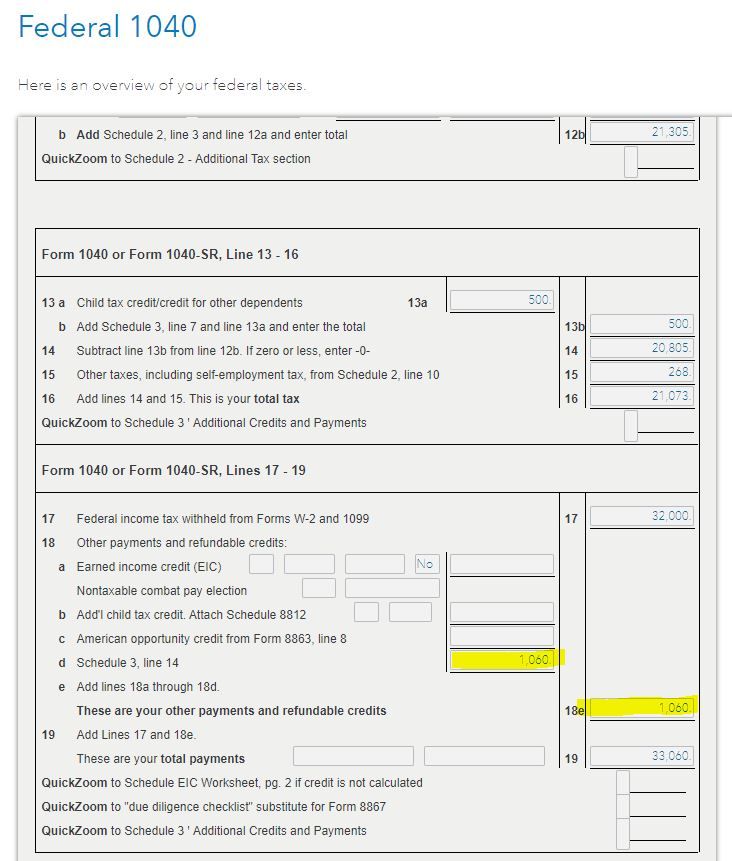

If you look at your Form 1040, Schedule 3, you will see excess Social Security withheld on line 11.

This number flows through to your Form 1040 Line 13b, where it is treated as a tax payment.

Your refund includes your excess Social Security withheld.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

Turbo Tax Online is not doing the actual calculation for excess social security tax payment. The software makes the comment that you "may have overpaid" but it never confirms or calculates the amount. Additionally, the excess amount is not showing up on Schedule 3, line 11 nor is it showing up on Form 1040, line 18d. There have been discussion in the community space, but the problem still exists today. What does TurboTax recommend.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

"Turbo Tax Online is not doing the actual calculation for excess social security tax payment."

This is not correct.

TurboTax will calculate the excess Social Security tax withheld and add it to Schedule 3, when the IRS allows it.

The issue that has come up this year is that the taxpayer submitted multiple W-2s with the same EIN on them. This can be the result of a taxpayer working for a PEO,

Normally, a PEO (Professional Employer Organization) handles the personnel as their own employees. Since that is the case, the IRS (correctly) considers that you have only one employer - your PEO.

In this case, the IRS will not accept the request to refund the excess SS tax through your tax return, and neither will TurboTax. In the past, the IRS has sent letters to taxpayers who claimed the refund of excess Social Security taxes on their return when the "two" employers had the same EIN; these letters told the taxpayers to go back to their employer(s) and get the refund from them.

The same thing happens when a company changes divisions internally and moves an employee from one to the other. If both divisions have the same EIN, then the IRS policy is that since this is really one employer, you must ask the employer for the refund.

This a change from prior years where TurboTax had a workaround for this second situation, but that workaround has been removed, based on IRS guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

I have 3 different EIN numbers for three W-2s. They are all assigned to me within Turbo Tax and not my spouse. I paid an excess of over $2000 in social security tax and it is not showing up on any of the forms in the places that you and I have both identified it should be. Please let me know if I should look somewhere else within turbo tax. I have even gone as far as looking at the Smart Worksheets where Turbotax shows you the calculations and background info and I am not seeing anything there either.

If the calculation is being done, but the numbers is not showing in Schedule 3, please let me know another place to look. I've seen others say they've experienced this same issue. Has Turbo Tax made an update the to the online tool to ensure that the numbers are showing in the correct forms? Are you able to run a mock situation on Turbotax with either 2 or 3 EINs and see if the numbers show up for you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

@TaxOverpayment wrote:

I have 3 different EIN numbers for three W-2s. They are all assigned to me within Turbo Tax and not my spouse. I paid an excess of over $2000 in social security tax and it is not showing up on any of the forms in the places that you and I have both identified it should be. Please let me know if I should look somewhere else within turbo tax. I have even gone as far as looking at the Smart Worksheets where Turbotax shows you the calculations and background info and I am not seeing anything there either.

If the calculation is being done, but the numbers is not showing in Schedule 3, please let me know another place to look. I've seen others say they've experienced this same issue. Has Turbo Tax made an update the to the online tool to ensure that the numbers are showing in the correct forms? Are you able to run a mock situation on Turbotax with either 2 or 3 EINs and see if the numbers show up for you?

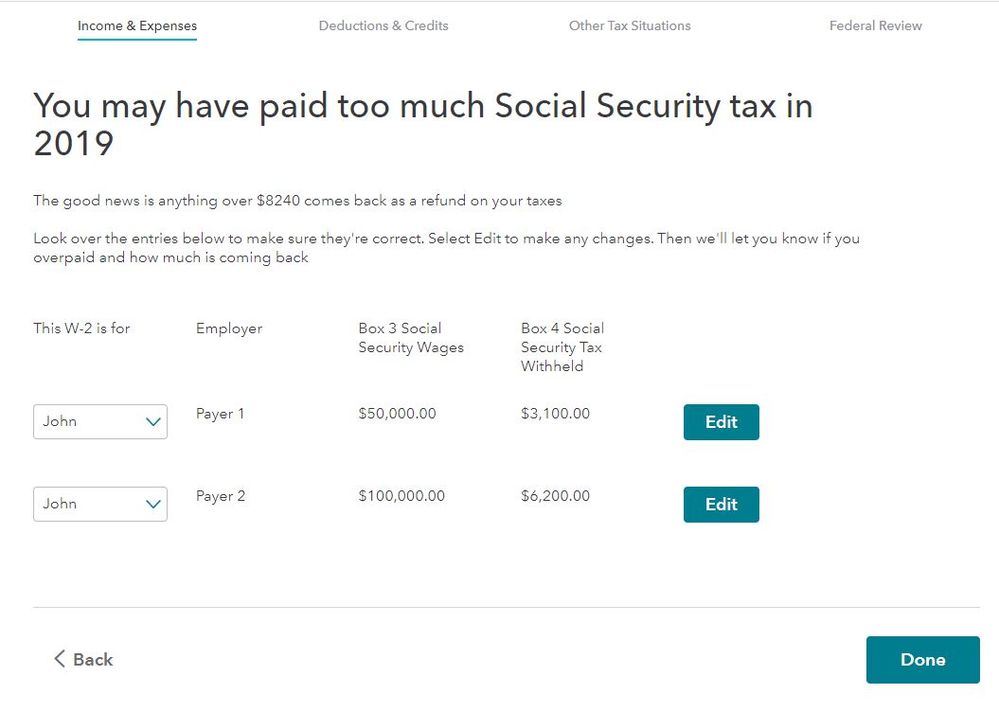

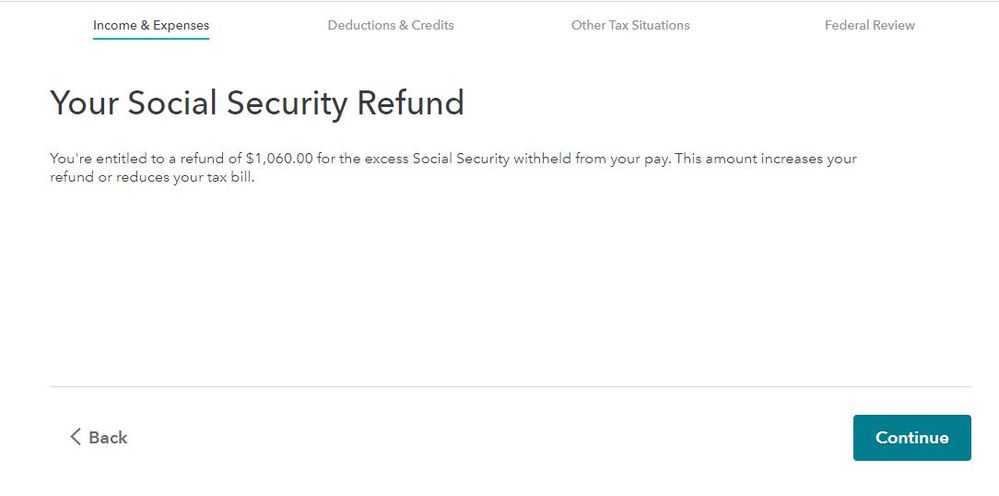

After entering the 3 W-2's did you get a TurboTax page telling you that you had excess SS taxes withheld and then another page showing you the amount of excess?

The following screenshots are from the Self-Employed online editions with two employers with separate EIN's. The program correctly calculated the excess SS taxes paid and entered the excess on Schedule 3 Part II Line 11 and that amount flowed to the Form 1040 Line 18d

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

I received the first page that stated "you may have paid too much...". I did not receive the page after it. And the numbers do not show in my Smart Worksheets nor in my 1040 form.

Is there some condition written into the programming where something else that I may have entered in another part of my taxes is blocking TT from doing the calculation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

@TaxOverpayment wrote:

I received the first page that stated "you may have paid too much...". I did not receive the page after it. And the numbers do not show in my Smart Worksheets nor in my 1040 form.

Is there some condition written into the programming where something else that I may have entered in another part of my taxes is blocking TT from doing the calculation?

The only thing that would cause the excess SS taxes not being entered would be if two or more of the W-2's that were entered had the exact same EIN (Employer Identification Number).

Go back to the W-2 section and verify each W-2 entered has a unique EIN that is not shared with any other W-2 entered.

Also verify that the amount of SS taxes withheld in box 4 of the W-2 is correctly entered.

If all looks good then suggest you delete the W-2's and re-enter each one manually, if you have not already done so.

If all else fails then contact TurboTax support for assistance.

See this TurboTax support FAQ on how to contact Support - https://ttlc.intuit.com/questions/3401489

Or -

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

I deleted and manually retyped the info on all three of my W-2s, I still only received the screen that said "you may have paid too much...". I will move forward with contacting a person with Turbo Tax Support.

Thank you for your quick responses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

Hello, opening this thread again.

I am in a similar but different situation, in my case I have 2 W2's for different employers but both employers use the same Paying Agent. I went back to the Paying Agent asking for the refund of the excess social security taken but they are telling me they are not the ones who are supposed to send me the check because they are representing two different employers.

What should I do in that case? TurboTax thinks is the same employer because both of them use the same Paying Agent, but they are two different employers.

I also got a letter from the Paying Agent with the following:

As instructed by the IRS: a Common Pay Agent provides the following information in box C of form W-2:

Thank You

Line 1: ZZZZZZZ (Name of Agent) Line 2: Agent for: (name of each employer)

Line 3: Address of Employer

*As required each form W-2 reflects the EIN of the agent in box B.

Both W-2’s reflect the Common Pay Agent EIN of XXXXXXX for ZZZZZZ.

As an acting common pay agent it is generally not the responsibility of the agent for refunding excess social security tax on employees. If an employee worked for more than one employer during 2022 (as identified on Line 2 of box c) and had more than $9,114.00 in social security tax withheld, he or she should claim the excess on the appropriate line of Form 1040 or 1040A.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

If you worked for multiple companies, you can claim a refund of excess Social Security Tax on your 1040 return. The excess for 2022 is to exceed $9,114 per taxpayer. TurboTax will add the excess to your federal refund or subtract it from the taxes due. You can check Line 11 on your Form 1040, Schedule 3, to see if the credit was applied.

For the credit to be applied, you must be considered as working for two companies. This is determined by looking at your employer's EIN. Multiple companies would have separate EINs on the W-2.

So if your paying agent is only using one EIN, they would be responsible for refunding the excess Social Security Tax paid. The employer would be responsible for issuing the following:

- A refund for the excess amount, and

- A corrected W-2 (also called a W-2c) shows the correct Box 3 and 4 amounts.

If your employer is not being cooperative, you can follow these steps:

- correct the Box 4 amount yourself before filing. Multiply Box 3 by a factor of 0.062 and enter that amount or 9,114.00 (whichever is less) in Box 4.

- Fill out IRS Form 843: Claim for Refund and Request for Abatement according to the Form 843 Instructions and mail it in separately to get your refund. Make a copy to keep with your tax return paperwork.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

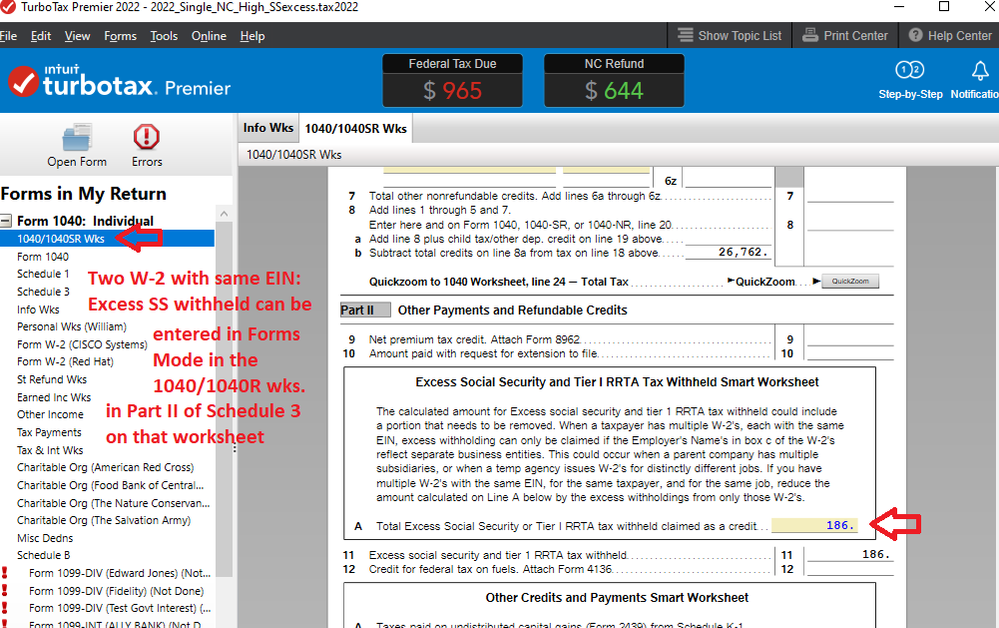

I'm in the same boat and the response from Turbo Tax does not follow their own information which states:

"Excess withholding can only be claimed if the Employer's name in box c of the W-2's reflect separate business entities"

This is exactly my situation, but Turbo Tax does not do what it says in their own instructions. I have spoken to several people at their support line, who made me upgrade and go to a Tax Advisor. She agreed that my situation qualified to enter a tax credit but couldn't help with why the program doesn't work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

The only way I've seen to fix your situation, is to use the Desktop/download software......and entering the excess SS withheld in Forms Mode on the Schedule 3.

___________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

Check your w-2 entries is one coded as spouse's w-2? not only must the employers be different but the employee must be the same.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Social Security Tax Refund

Filing as single, so definitely not this.....

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

simoncornell3592

New Member

jhph416

New Member

ebjensen

New Member

bvertrice

New Member

rjroth4

New Member