- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@TaxOverpayment wrote:

I have 3 different EIN numbers for three W-2s. They are all assigned to me within Turbo Tax and not my spouse. I paid an excess of over $2000 in social security tax and it is not showing up on any of the forms in the places that you and I have both identified it should be. Please let me know if I should look somewhere else within turbo tax. I have even gone as far as looking at the Smart Worksheets where Turbotax shows you the calculations and background info and I am not seeing anything there either.

If the calculation is being done, but the numbers is not showing in Schedule 3, please let me know another place to look. I've seen others say they've experienced this same issue. Has Turbo Tax made an update the to the online tool to ensure that the numbers are showing in the correct forms? Are you able to run a mock situation on Turbotax with either 2 or 3 EINs and see if the numbers show up for you?

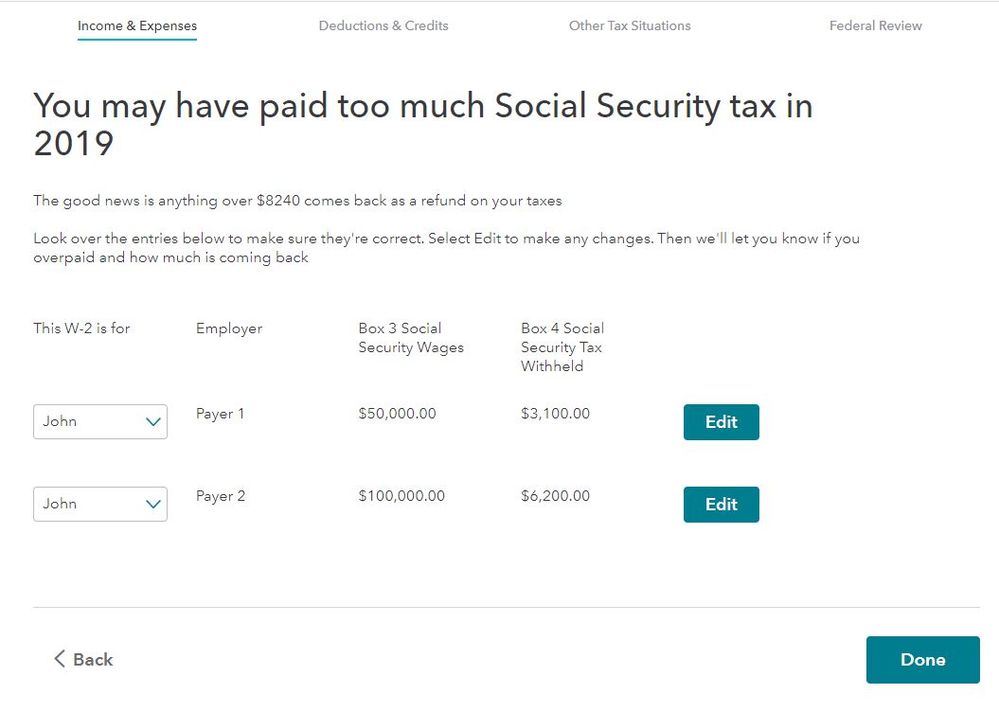

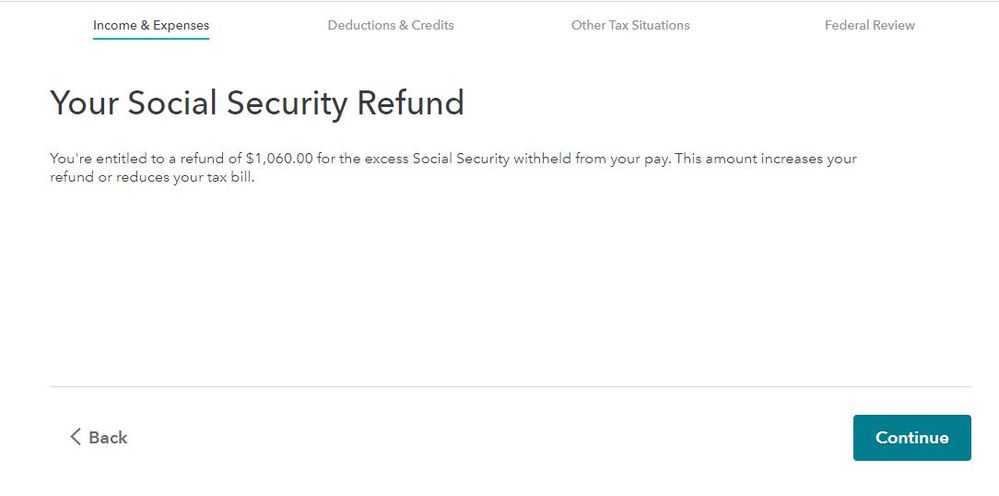

After entering the 3 W-2's did you get a TurboTax page telling you that you had excess SS taxes withheld and then another page showing you the amount of excess?

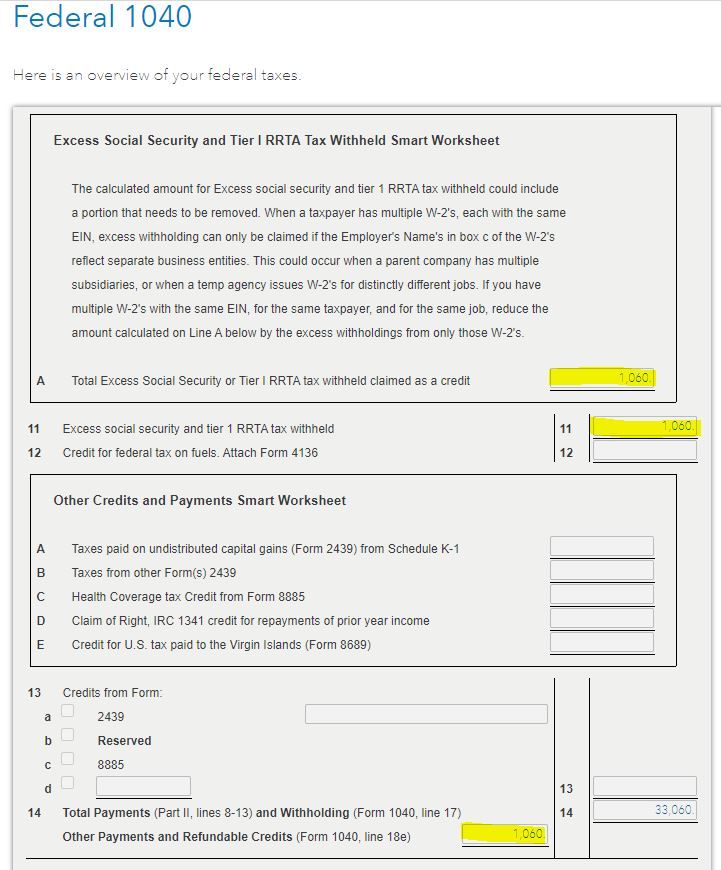

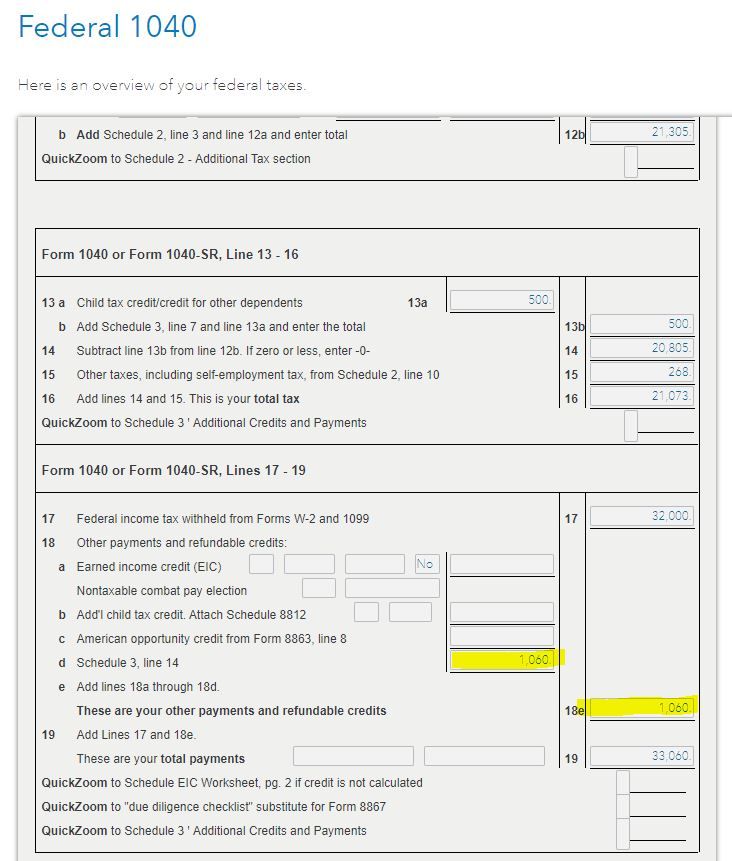

The following screenshots are from the Self-Employed online editions with two employers with separate EIN's. The program correctly calculated the excess SS taxes paid and entered the excess on Schedule 3 Part II Line 11 and that amount flowed to the Form 1040 Line 18d