- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Excess social security miscalculated - again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security miscalculated - again

When we filed our 2022 return with Turbotax, we received our refund many months later, was significantly lower than claimed, and came with a letter from the IRS that we claimed an excess social security contribution that was not valid. Thinking the IRS had made a mistake, I contested in a letter that our total contributions exceeded the 2022 limit of $9,114. They responded at the end of the year that there was no excess because that limit applies to each spouse, not a total when filing married jointly.

I have our 2023 return prepared but haven't filed yet. I see that again that a substantial excess is claimed on1040 line 11, even though my wife's three W2s do not go over the 2023 limit of $9932.40, individually or collectively. My W2 does not exceed that limit either. The excess claimed happens to be the entire amount contributed to social security (W2 line 4) for her teacher job W2. I haven't been able to figure out why Turbotax is calculating this as an excess. Help is greatly appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security miscalculated - again

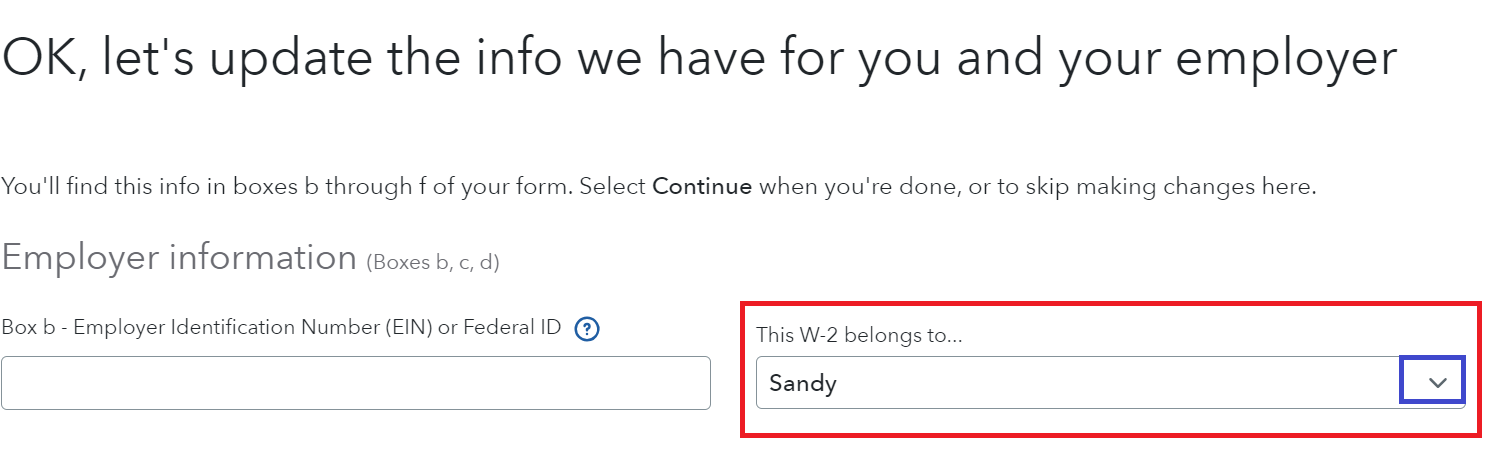

It depends. This can happen if the W-2s are not associated with the correct spouse. This should eliminate any excess social security tax payment when you are below the threshold.

- Search > Type w2 > Click the Jump to...link > Edit each W-2 > Check the box labeled 'This W-2 belongs to > Make sure the W-2s are assigned to the correct spouse.

- See the image below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

berms

New Member

Nance59

Level 1

daveshacho

New Member

hughesjohnl

New Member

thompsam

Level 2