- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

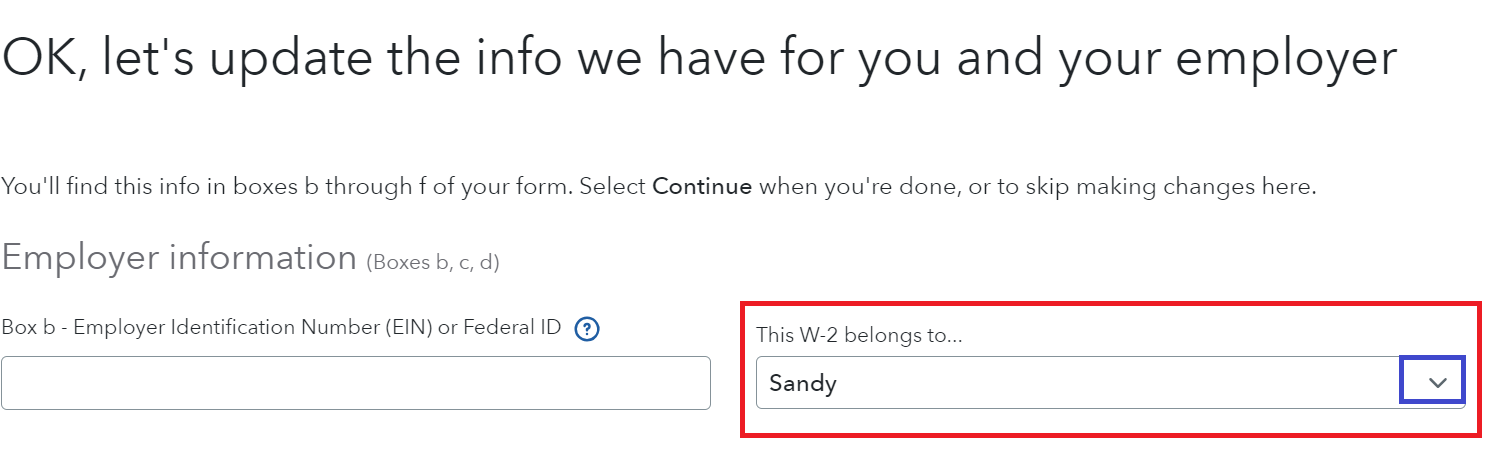

It depends. This can happen if the W-2s are not associated with the correct spouse. This should eliminate any excess social security tax payment when you are below the threshold.

- Search > Type w2 > Click the Jump to...link > Edit each W-2 > Check the box labeled 'This W-2 belongs to > Make sure the W-2s are assigned to the correct spouse.

- See the image below

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 20, 2024

7:08 AM