- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Excess Real Estate Taxes

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Real Estate Taxes

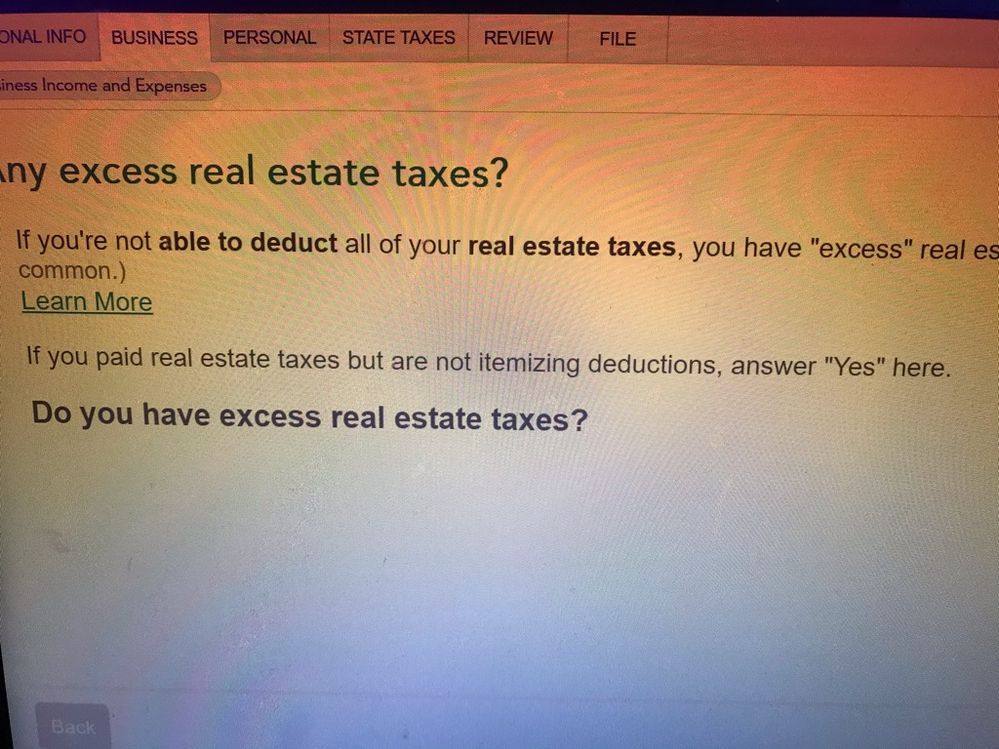

I’m thoroughly confused here

I paid over 11k in RE property taxes. What am I supposed to do here?

Topics:

posted

July 15, 2020

8:19 PM

last updated

July 15, 2020

8:21 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

3 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Real Estate Taxes

Hope this helps:

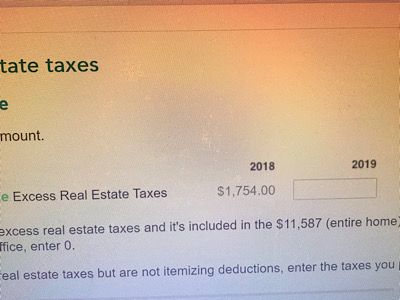

Beginning in 2018, the total amount of deductible state and local income taxes, including property taxes, is limited t $10,000 per year.

July 15, 2020

8:29 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Real Estate Taxes

So what do I put?

July 15, 2020

8:33 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Real Estate Taxes

If this is form 8829 then it would be the excess over $10,000. So it looks like in your case that would be $1,587.

July 15, 2020

8:42 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

j_pgoode

New Member

x9redhill

Level 2

Liv2luv

New Member

in Education

dllundgren

Level 1

Tax_right

New Member