- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Entering points for a rental property purchase

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

Hello! I tried to enter points on rental but it is not calculating.

Here's what I did:

Add asset

Amortizable intangibles

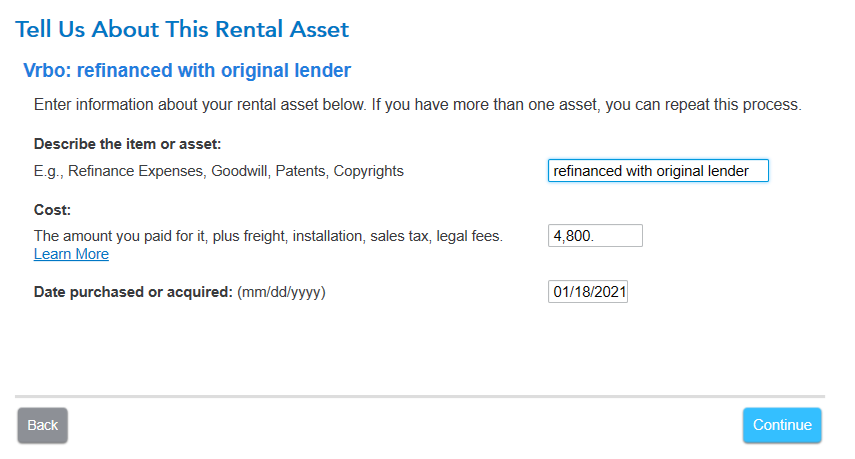

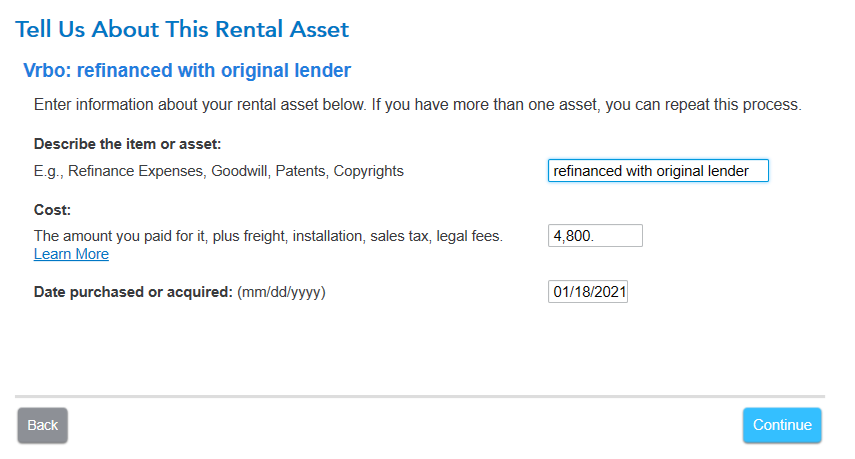

Described asset - added cost and closing date of loan

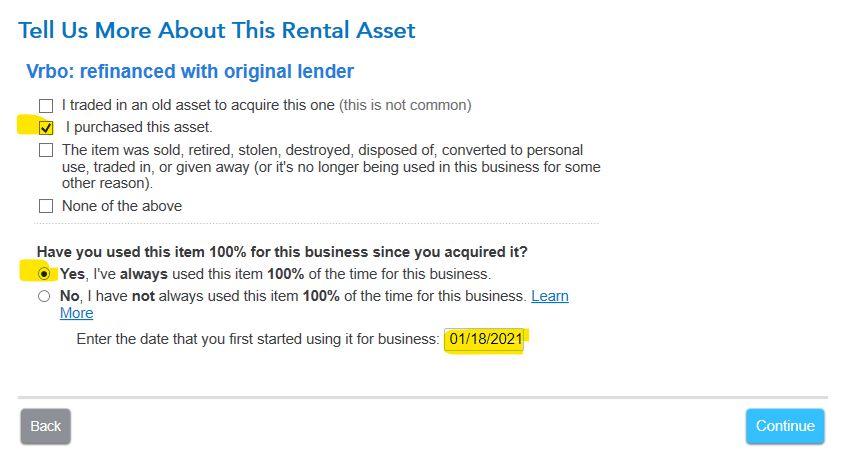

Selected purchased new asset

Clicked used for 100% of business and entered closing date of loan

Selected code section 163:Loan fees

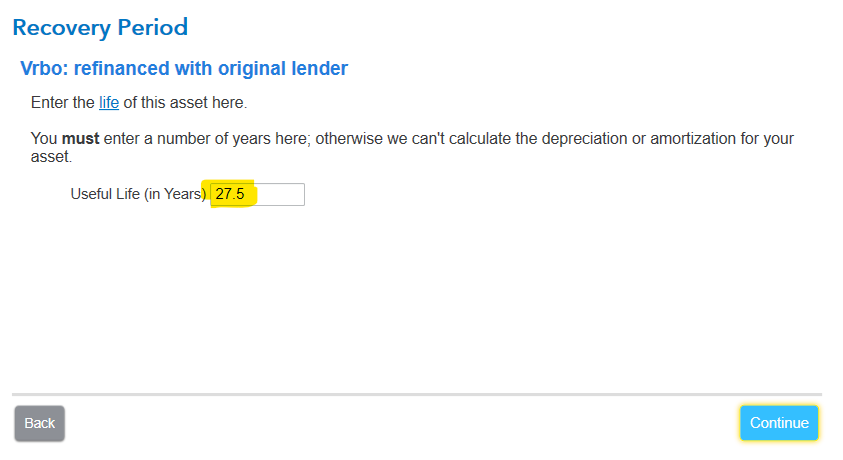

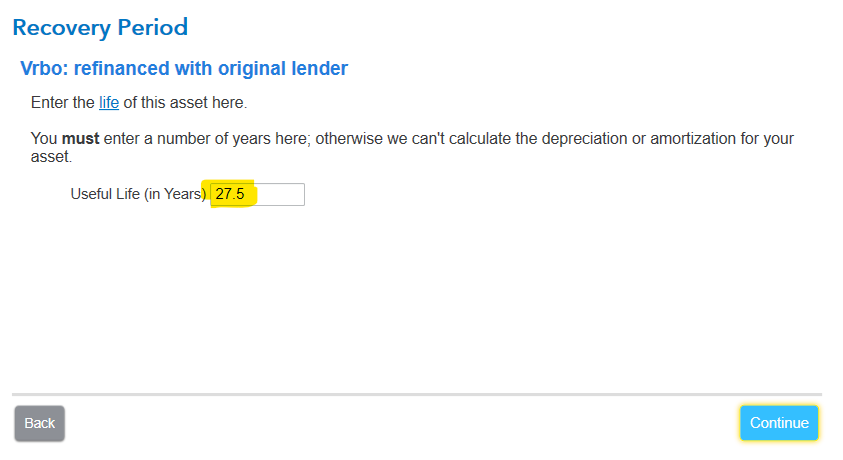

Entered in useful life of 30 years

Asked if I wanted to take special depreciation allowance (clicked no because I don't think it applies)

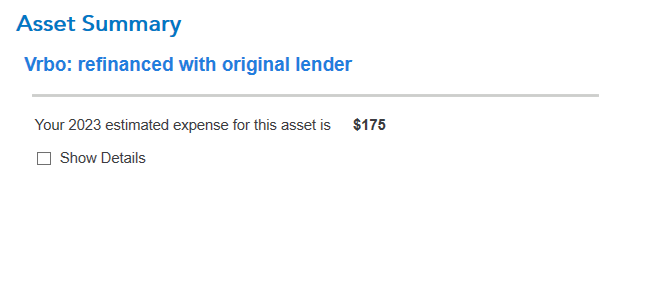

Calculates $0 for the amortization

Can you please let me know what I did wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

When you refinance with the same lender, you are required to amortize the points. Otherwise, the points are deductible for purchase and refinance.

I am following your steps and can only tell one mistake so far (rental is 27.5 years for mortgage), here are mine:

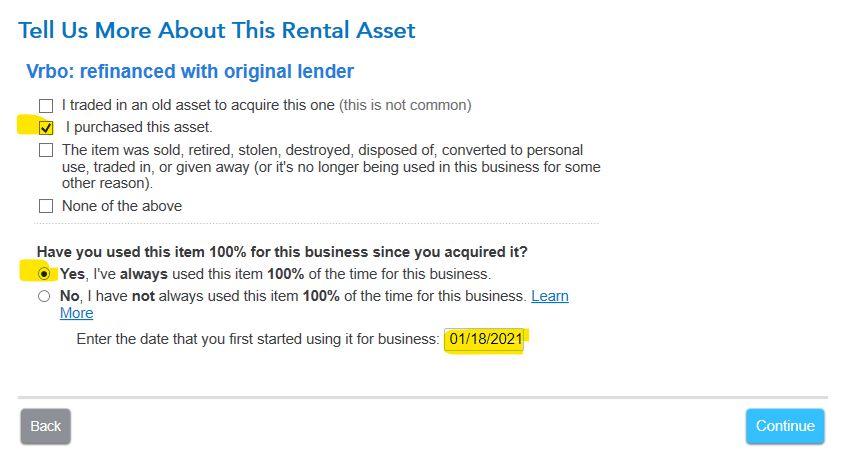

You must mark purchased as well as enter your date

Sec 163 loan fees is correct

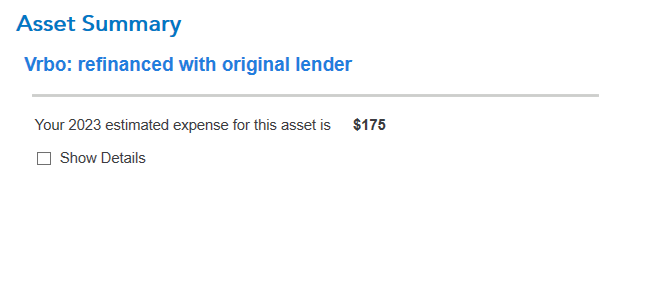

depreciation allowance, no is good and then asset summary

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

When you refinance with the same lender, you are required to amortize the points. Otherwise, the points are deductible for purchase and refinance.

I am following your steps and can only tell one mistake so far (rental is 27.5 years for mortgage), here are mine:

You must mark purchased as well as enter your date

Sec 163 loan fees is correct

depreciation allowance, no is good and then asset summary

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

Thank you for the detailed reply! I closed out the program, deleted that asset I was working on, and created a new asset and all worked! I wonder if I somehow messed something up when I went to look at the individual forms. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

The program wouldn't have asked about Special Depreciation for points, so chances are it was in the wrong place the first time.

Thank you for choosing TurboTax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Eddie Glastname

Level 1

elliott1917

New Member

jackkgan

Level 5

stvbreed

New Member

supecoadventures

New Member