- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Does receiving tax treaty benefit affect my residency status? can I still file as resident alien and do not claim the treaty?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does receiving tax treaty benefit affect my residency status? can I still file as resident alien and do not claim the treaty?

I am on F1 visa since 2015. In 2020, I meet the substantial presence test and become resident alien. I am full time employed and have a w2. However, I received 1042s form with 3000 income ( treaty benefit US and egypt , article 23(1), saving clause 6(3), saving clause exception 6(4)). Does that affect my residency for tax purposes? I still want to file as resident alien to benefit from the standard deduction and I do not care that much about the tax treaty benefit. Can I just add the 3000 income on the 1042s as other income and do not claim any benefit in order to be able to e file as resident alien? I also have medicare taxes and fica replacement plan deducted from my paycheck, do i need to pay anything else if i am resident alien?

Thank you so much in advance and really appreciate your response!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does receiving tax treaty benefit affect my residency status? can I still file as resident alien and do not claim the treaty?

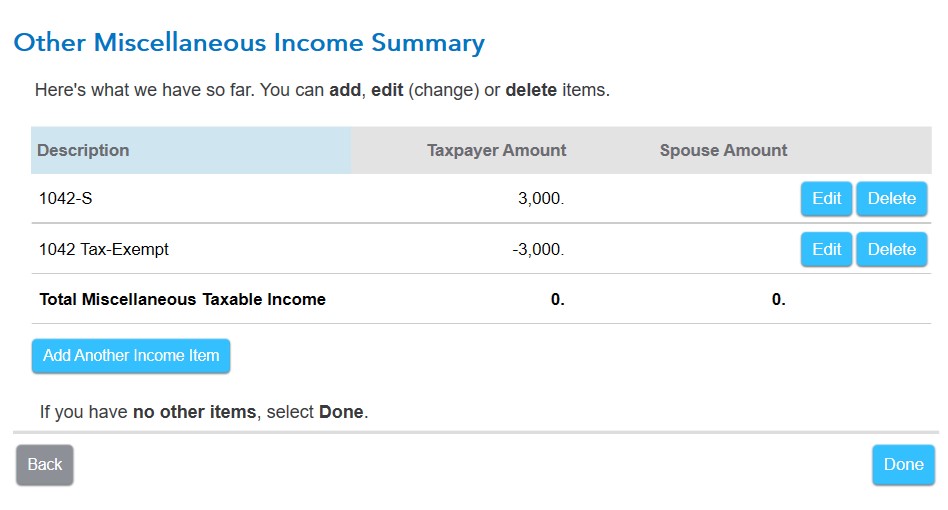

Here is how you can report your income from the Form 1042-S and exclude it from tax (solution from @ThomasM125:(

You should enter the form in TurboTax in the Income and Expenses section, and then Less Common Income and then Miscellaneous Income and finally Other Reportable Income.

First, enter the form 1042-S as income, then make an additional entry as a negative amount for the amount of income excluded by the treaty. Thus, both amounts will cancel themselves out, so the net tax will be zero, but it will still show on your tax return that you reported both amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does receiving tax treaty benefit affect my residency status? can I still file as resident alien and do not claim the treaty?

You will pay income tax on your total income less your credits and deductions. The amount of Federal tax you had withheld during the year will be applied to the tax on your taxable income and you'll be refunded the difference plus any refundable credits.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dominibopula

New Member

aashish98432

Returning Member

MummyatLilliput

New Member

dennison-jenna

New Member

davel-parr

New Member