- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Here is how you can report your income from the Form 1042-S and exclude it from tax (solution from @ThomasM125:(

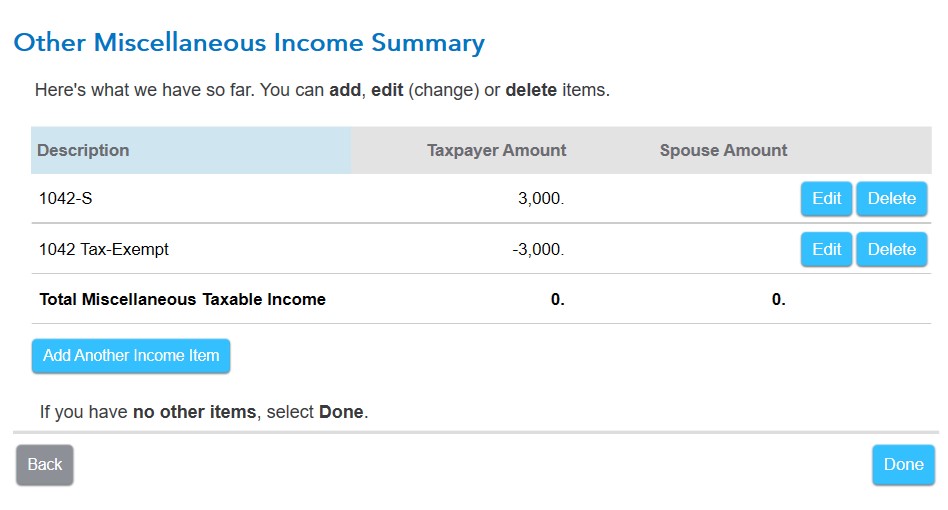

You should enter the form in TurboTax in the Income and Expenses section, and then Less Common Income and then Miscellaneous Income and finally Other Reportable Income.

First, enter the form 1042-S as income, then make an additional entry as a negative amount for the amount of income excluded by the treaty. Thus, both amounts will cancel themselves out, so the net tax will be zero, but it will still show on your tax return that you reported both amounts.

February 18, 2021

11:35 AM