- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Direct Deposit Information Filled with X in Amended Return with Refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Direct Deposit Information Filled with X in Amended Return with Refund

My original e-file return has to be amended and my refund amount has changed. As such, I need the direct deposit information to appear on my return. TurboTax is filling 33b and 33d with X so I cannot write my bank info in, and I cannot find any way to enter this information in the application. Please advise.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Direct Deposit Information Filled with X in Amended Return with Refund

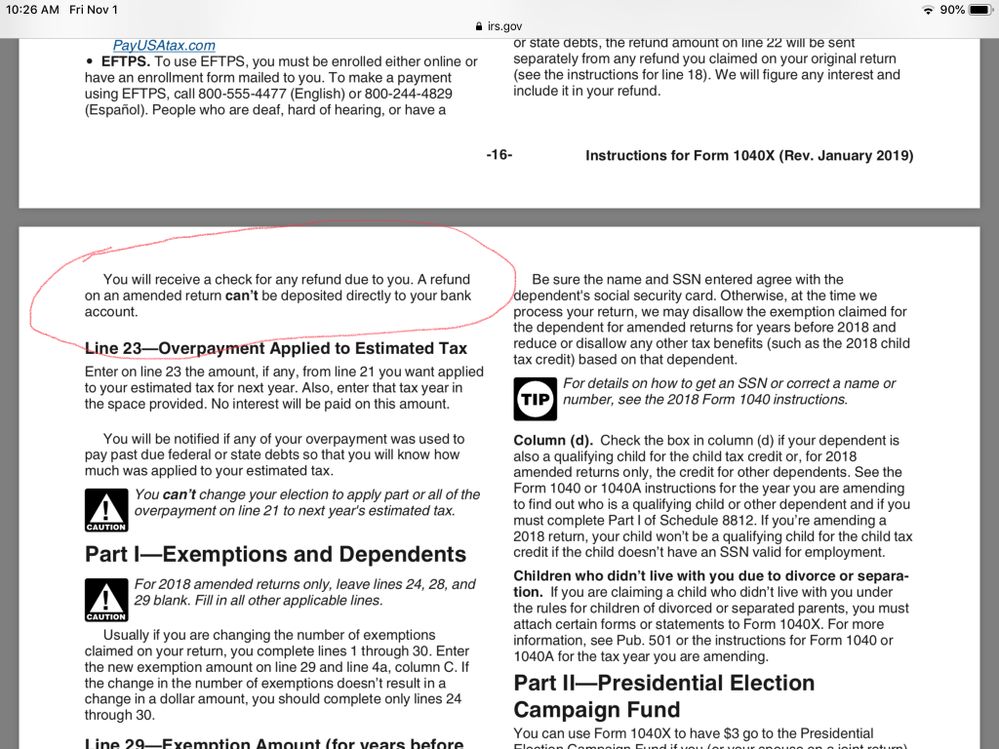

The IRS never makes a direct deposit for a refund based on an amended return. They will only mail a check to the address on your tax return, so you cannot enter banking information on an amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Direct Deposit Information Filled with X in Amended Return with Refund

I don't know what form you are looking at that has bank information on lines 33b and 33d. Did you mean lines 35b and 35d on a 2020 Form 1040? The revised Form 1040 is not your amended return. Form 1040-X is the amended return. There is no place for bank information on Form 1040-X because refunds for amended returns are not paid by direct deposit. It doesn't matter what's on the revised Form 1040 because that is not used for paying the refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Direct Deposit Information Filled with X in Amended Return with Refund

See 1040X Amended Instructions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Direct Deposit Information Filled with X in Amended Return with Refund

The IRS has updated 1040x and it will now do direct deposit for tax year 2021 and later. (this info is from the IRS website - Instructions for Form 1040-X (01/2023) | Internal Revenue Service (irs.gov)) There is room for the bank account info on lines 31-33. However, TurboTax has not updated its software, or its forms, and will not allow the bank account information to be inserted. Will TurboTax be updating its software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Direct Deposit Information Filled with X in Amended Return with Refund

Per IRS Direct deposit is not available on amended returns submitted on paper.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PCD21

Level 3

astan2450

New Member

lmh06420

New Member

Nicolecut67

New Member

Jarronharden6

New Member